Important milestones:

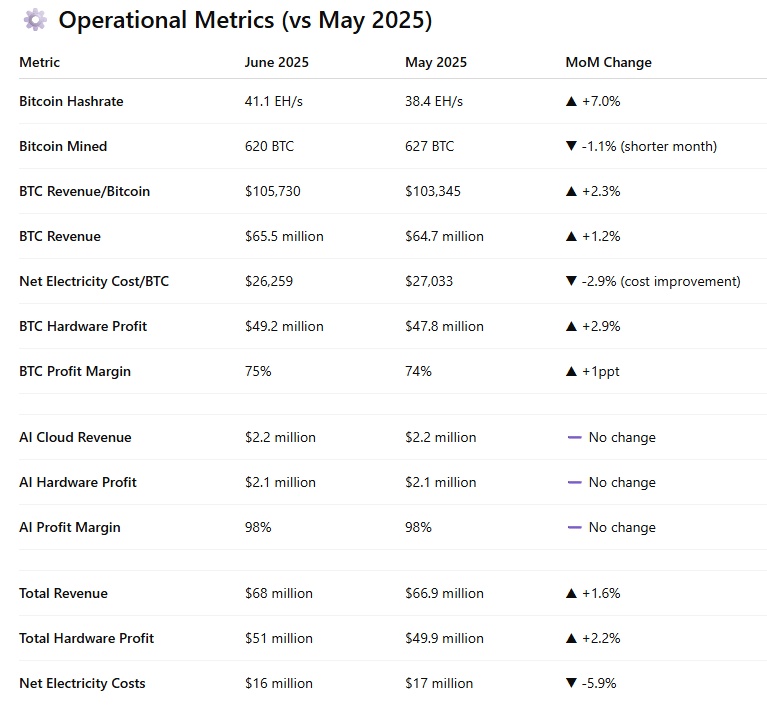

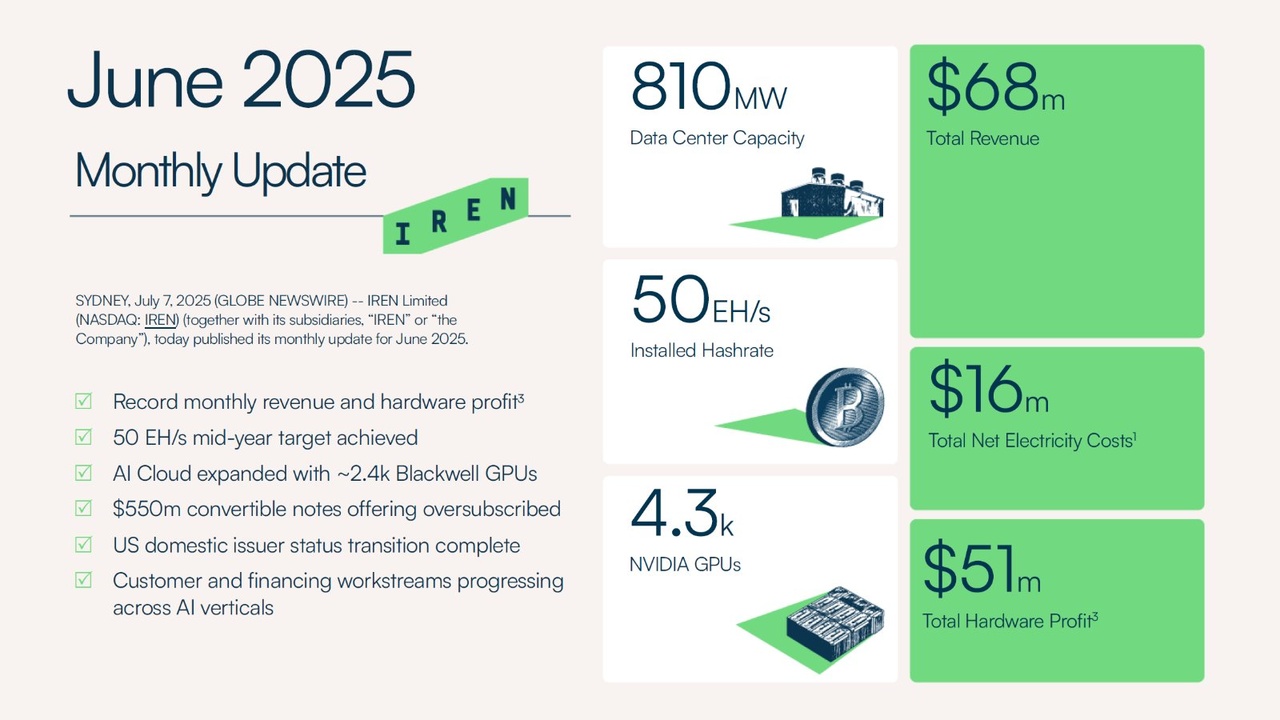

- Record total sales: 68 million US dollars

- Record profit in the hardware segment: 51

million US dollars

- Self-reduction target of 50 EH/s achieved

- AI Cloud expanded: ~2.4k NVIDIA Blackwell GPUs added (1.3k B200 + 1.1k B300)

- Convertible bond offering: 550 million US dollars, oversubscribed

🚀