Brief presentation of the company

- ISIN / Ticker: CH0010570759 (registered share with voting rights, very expensive) $LISN (-0,5%)

CH0010570767 (participation certificate without voting rights, significantly cheaper,

with the same dividend, my choice 😁) $LISP (-0,97%)

- Sector / Industry: Consumer staples - Food & Confectionery

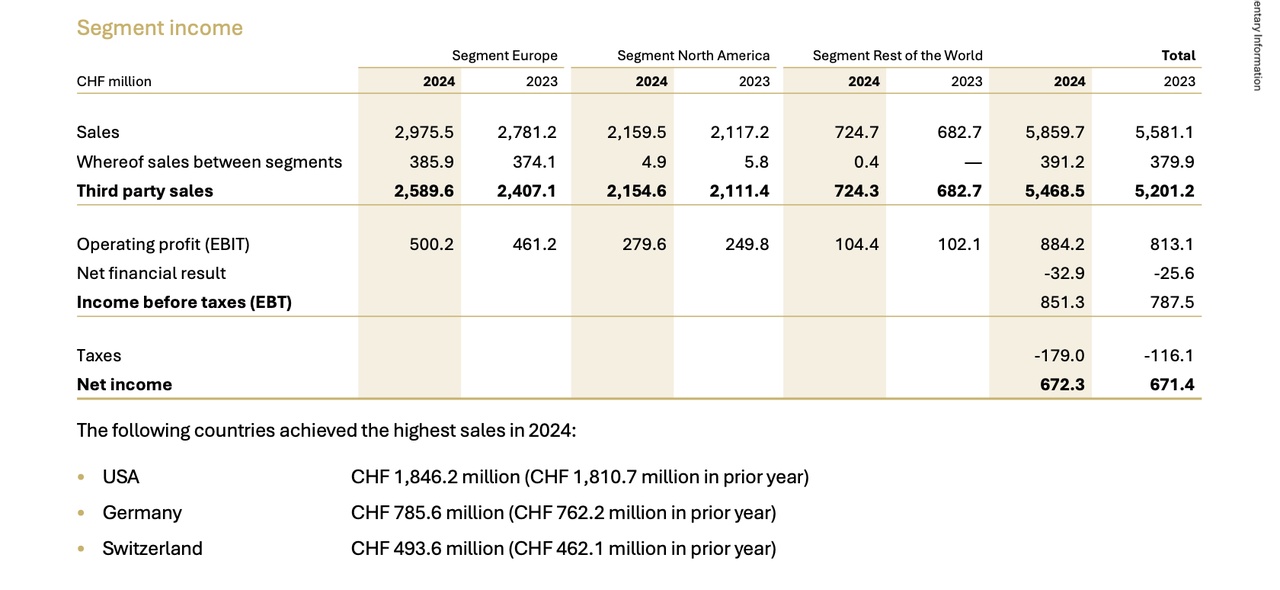

- Geographical positioning: Lindt sells its chocolate in over 120 countries, with a strong presence in Europe and a growing market share in North America and Asia. The highest sales are generated in the USA, Germany and Switzerland.

Brief profile & business model

Lindt & Sprüngli is a traditional Swiss company founded in Zurich in 1845.

Lindt is known worldwide for iconic products such as the Gold Bunny, Lindor balls and classic chocolate bars.

The company controls the entire value chain, from the cocoa bean to the point of sale, and relies on its own brand boutiques and online store in addition to a strong retail network.

Fundamental key figures

- Market capitalization: CHF 28.2 billion

- P/E ratio / forward P/E ratio: 41 / 39

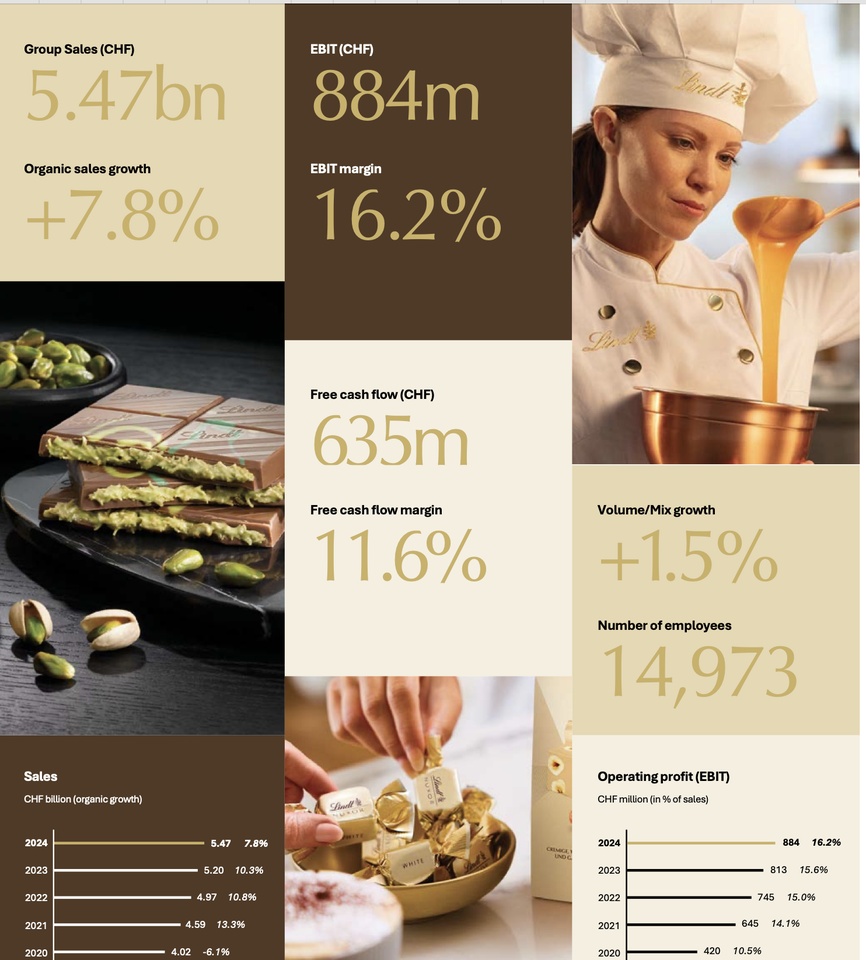

- Sales growth 2024: 5 %

- Profit growth: 8.7

- Net profit margin: 12.29 %

- Dividend yield: 1.2 %

Valuation

Compared to international confectionery groups such as Mondelez or Hershey, Lindt is currently trading at a premium valuation, reflecting its strong brand position, robust balance sheet and solid historical performance.

Opportunities & risks

Opportunities:

- Strong brands with a global reputation and high pricing power

- Premium segment with low price sensitivity among customers

- Expansion in North America and Asia

- Solid balance sheet, practically debt-free

Risks:

- High valuation

- Dependence on commodity prices (especially cocoa, whose prices have recently risen sharply)

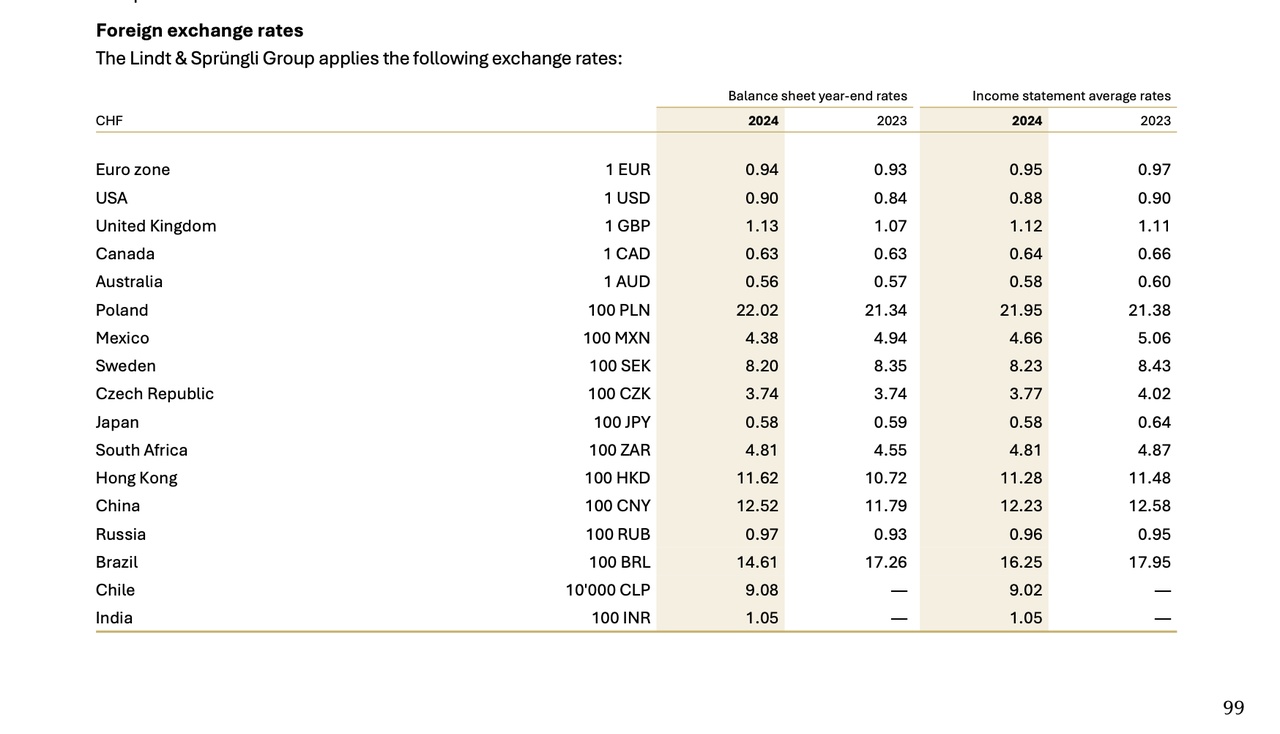

- Exchange rate risks, especially EUR/USD/CHF and Latin America

- I am rather skeptical about the own sales boutiques which are often located in tourist hotspots and shopping malls

Chart technique

The Lindt PS share has moved sideways since the all-time high in December 2021, but has recently been able to overcome important marks and resistances. The ATH was almost reached again in March 2025. If Lindt surprises with strong figures on July 22, I believe a new all-time high and a return to a visible upward trend is very likely.

Personal assessment

For me, Lindt & Sprüngli is a quality share with excellent brand management, high pricing power and a robust balance sheet. The valuation is high, but reflects the stability and market position. For long-term investors with a focus on quality and brands, Lindt can be an excellent addition to a portfolio, especially via the participation certificates, which are significantly cheaper than the registered shares.

Sources

- https://www.lindt-spruengli.com

- SIX Swiss Exchange

- Bloomberg, Reuters

- Onvista, finanzen.ch