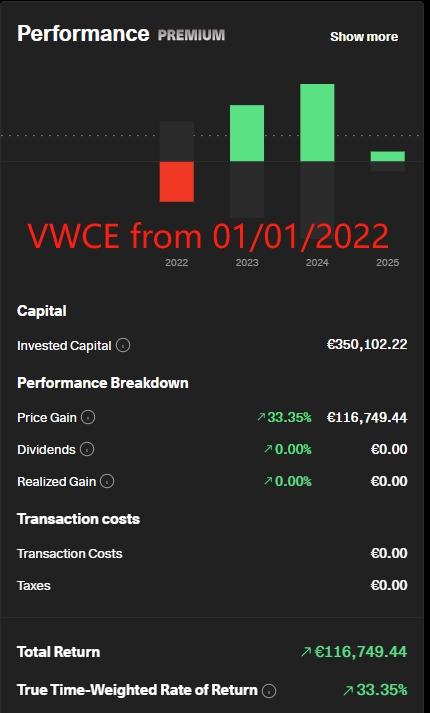

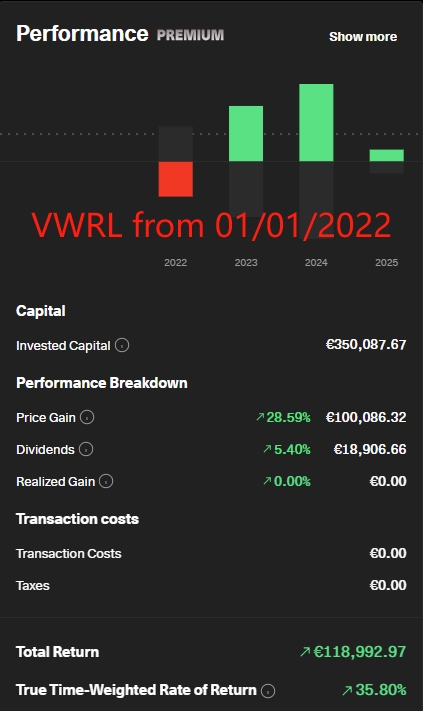

Everybody is telling me that ACC always wins over DIS on the total return, but I have created 2 test portfolios here in Getquin with the following parameters:

Capital: 350.000 euro

Investing date: 01/01/2022

one portfolio containing only $VWCE (+0,51%) and the other only $VWRL (+0,47%)

To keep it simple:

- I didn't reinvest any dividend = Disadvantage for VWRL

- I didn't calculate any dividend tax = Advantage for VWRL (still not everybody has to pay dividend tax)

The screenshot clearly shows a win for the VWRL-distributing version.

How do you explain that?