Hey guys, I think I got a bit lost in the ETF world.

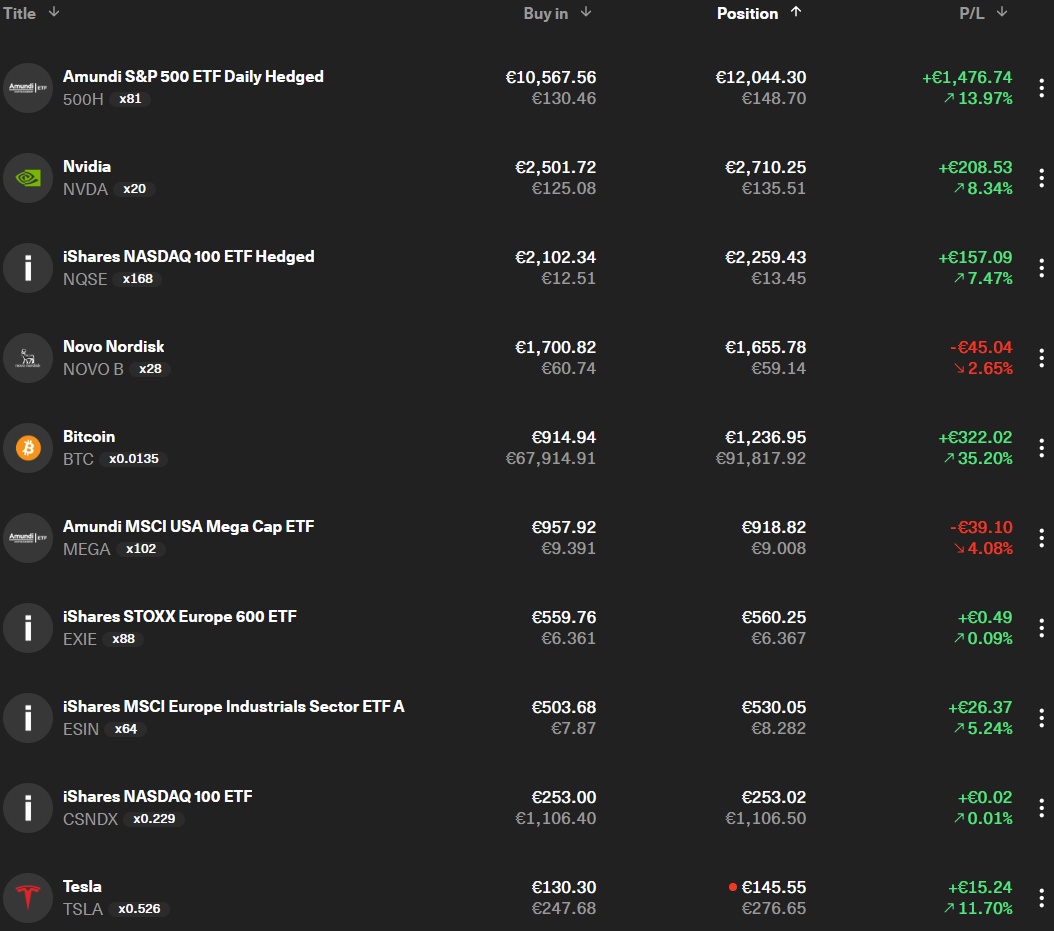

I’ve been investing for 1.3 years now, and until now, apparently, I was investing in hedged S&P 500 ETFs, which have brought me quite a nice profit so far (+4% YTD) thanks to the strength of the euro and the NASDAQ. I’ve already managed to build up a considerable amount during that time, but I’ve realized that for the long term, I may have picked the wrong ETF.

So my question now is: is $CSNDX (-0,84%) the most popular ETF for retirement investing, and is it a good idea to use dollar-cost averaging there over the long term? For now, I’m mainly interested in the NASDAQ 100, as it has outperformed the S&P 500 recently.