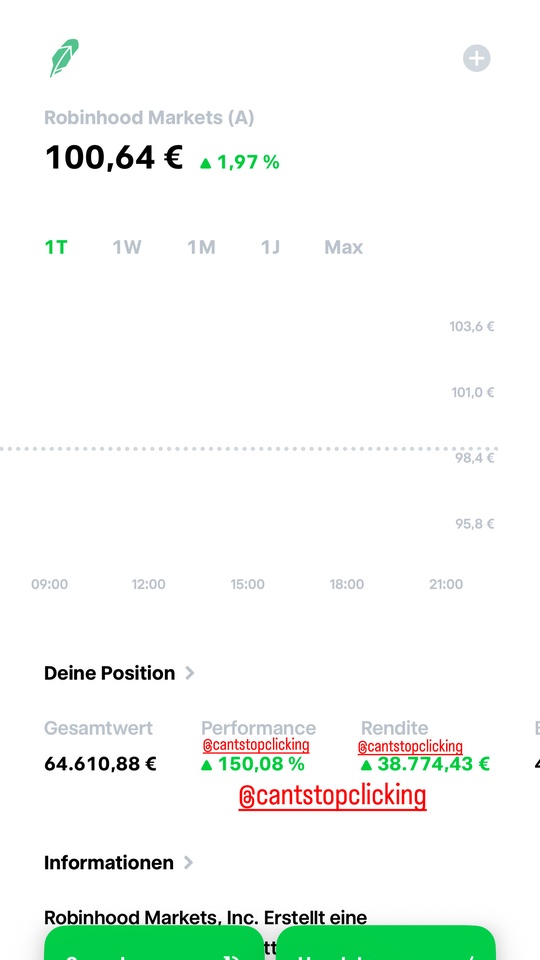

Robinhood has become my largest position in the portfolio developed 🚀

It was not the perfect entry. It was not the perfect time. And also not the perfect execution of the trade. After all, I sold almost 25% of my position at around € 43 with a profit of +17% 🤡

But it was the right move: $HOOD (-2,19%) to buy when others were selling!

Today, looking back, it seems obvious that the share price would rise, but three months ago, in the middle of the crash, there was pure panic 📉.

With a growing user base, booming stock and crypto trading and a clear market position, I am more convinced of Robinhood than ever before.

Robinhood has delivered very strong Q2 figures:

📊 Turnover +45 % to 989 million $

💵 Profit doubled to 386 million $

👥 26.5 million customers (+10 % YoY)

💰 279 billion $ Assets under custody (+99 % YoY)

-> This catapulted the share to a new all-time high. And investors are eagerly awaiting the inclusion in the S&P 500. The next rebalancing date is scheduled for September 2025 in September 2025.

What do you think of the share?

*No investment advice, buy or sell recommendation.

#robinhood

#hood

#aktien #aktieninvestment

#aktienhandel

#aktientipps

#aktienanalyse

#börse

#börsenhandel

#investieren

#depot

#finanzen

#finanzielleunabhängigkeit