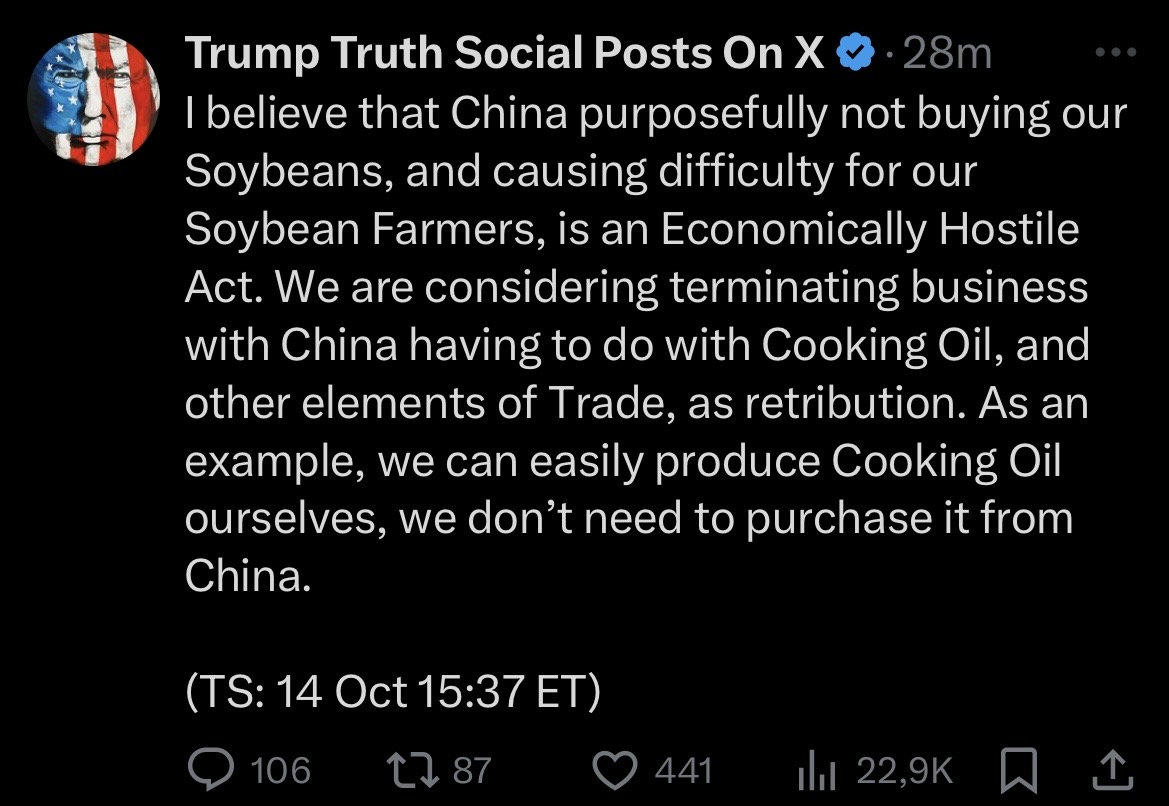

Trump threatens China with economic consequences over soybean purchases - including a possible end to business in the cooking oil sector. That sounds like a new round in the trade conflict 🇺🇸🇨🇳

I am considering whether, in this context, agricultural players such as $ADM (+1,54%) (Archer Daniels Midland) or $BG (+3,11%) Bunge Global could become exciting - both tend to benefit from stronger US domestic production and fewer imports from China...

What do you think: pure speculation or strategic opportunity?