$SHEL (+0,48%) is currently considering $BP. (-0,43%) to take over the company. The potential transaction volume would amount to 80 billion US dollars, making it one of the largest M&A transactions in the history of Oil & Gas. BP is currently reviewing the offer, but negotiations have been slow so far. Shell & BP have not yet made any concrete statements. Shell officially described the reports as "further market speculation" and said it was focusing on its own performance and the interests of its shareholders.

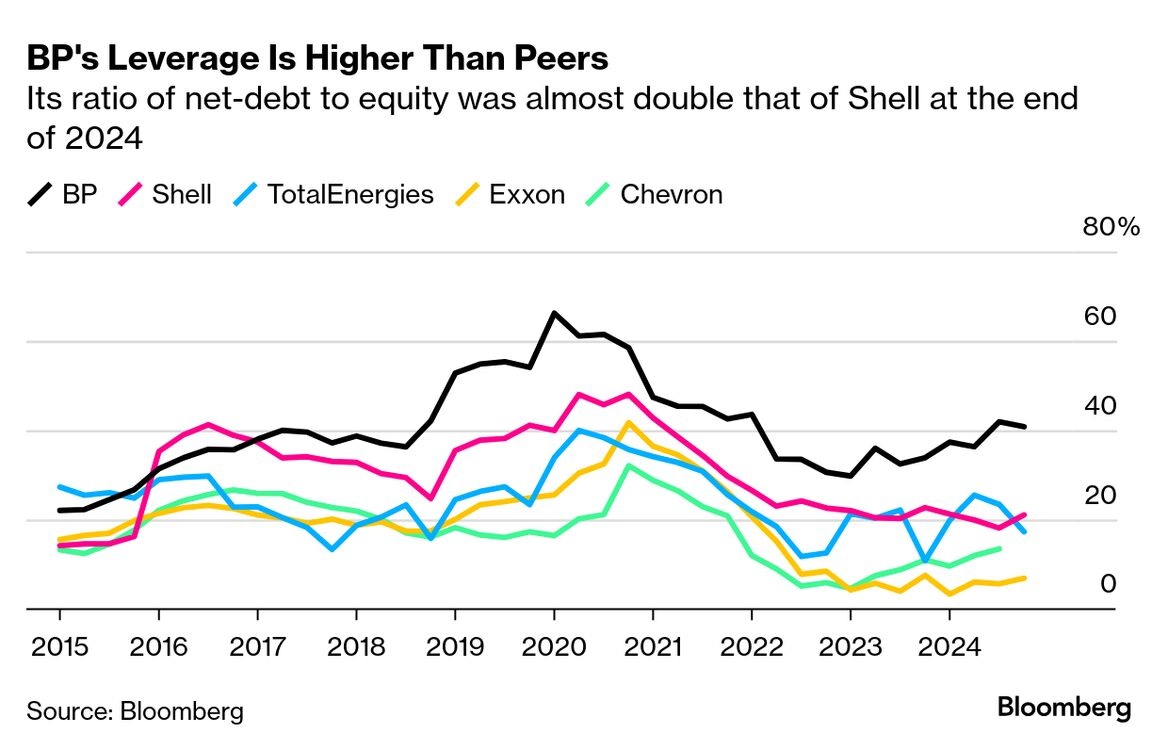

𝖭𝖾𝗍 𝖣𝖾𝖻𝗍 𝗍𝗈 𝖤𝗊𝗎𝗂𝗍𝗒 𝖽𝖾𝗋 Ö𝗅𝗄𝗈𝗇𝗓𝖾𝗋𝗇𝖾 𝖡𝖯, 𝖲𝗁𝖾𝗅𝗅, 𝖳𝗈𝗍𝖺𝗅𝖤𝗇𝖾𝗋𝗀𝗂𝖾𝗌, 𝖤𝗑𝗑𝗈𝗇 𝗎𝗇𝖽 𝖢𝗁𝖾𝗏𝗋𝗈𝗇. 𝖡𝖯 𝗐𝗂𝖾𝗌 𝖤𝗇𝖽𝖾 2024 𝗆𝗂𝗍 𝖠𝖻𝗌𝗍𝖺𝗇𝖽 𝖽𝖾𝗇 𝗁ö𝖼𝗁𝗌𝗍𝖾𝗇 𝖶𝖾𝗋𝗍 𝖺𝗎𝖿, 𝖿𝖺𝗌𝗍 𝖽𝗈𝗉𝗉𝖾𝗅𝗍 𝗌𝗈 𝗁𝗈𝖼𝗁 𝗐𝗂𝖾 𝖲𝗁𝖾𝗅𝗅.

A takeover would create a European oil giant that could compete with $XOM (+0,54%) and $CVX (+0,37%) could take on. BP in particular has been under pressure from activist investors for some time, as its attempted foray into renewable energies has been less successful. A stronger focus on oil & gas is therefore strategically desirable.