$PM (-3,14%) convinces with first-class constant growth. I am more than satisfied with the results. Double-digit growth in top and bottom line and the RRP are becoming more and more profitable. There really isn't much to say here. I assume that $PM (-3,14%) will have reduced its debt well in about 2 years and will then put the FCF totally into shareholder value. I say by then the profit of RRP will have more than doubled.

Volume (bn units)

HTU: 37.1 +12%

Oral: 5.3 +27.2%

Vapor: 0.6 +100%

Total RRP: 43 +14.4%

Combustibles: 144.8 +1.1%

Total: 187.8 +3.8%

Rep share: 23%

Revenue (bn $) reported I organic

RRP: 3.9 +15 I +20.4%

Combustibles: 5.4 +0% I +3.8%

Total: 9.3 +5.8% I +10.2%

RRP share: 42%

Gross profit

RRP: 2.7 +27.7% I + 33.1%

Combustibles: 3.5 +2% I +5.3%

Total: 6.3 +11.8% I +16%

RRP share: 43%

Operating income

Total: 3.5 +16.4% I +16%

EPS

RD EPS: 1.72$ +24.6%

AD EPS: 1.69$ +12.7%

AD EPS ex. Currency: 1.76$ +17.3%

PM has raised its guidance for 2025

AD EPS: 12-14%

US ZYN volume (doses): 800-840 mln

RRP

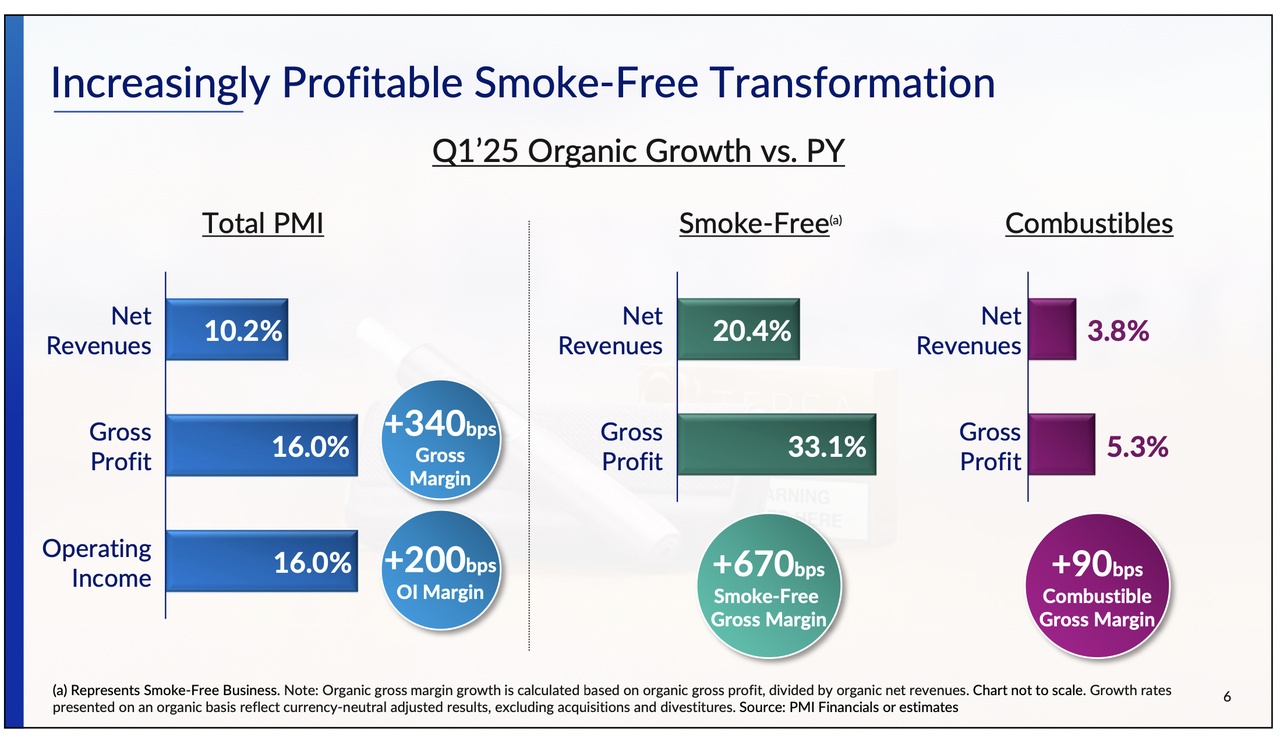

- Accounts for 42% of total net sales and 43% of gross profit.

- Strong growth: +14.4 % in delivery volumes, +15.0 % (20.4 % organic) in net sales, +27.7 % (33.1 % organic) in gross profit.

- Smoke-free products available in 95 markets, multi-category portfolio in 46 markets.

- IQOS: Second largest nicotine "brand" in existing markets, 9% share of the combined cigarette and HTU market (+1.0 percentage points). Dominates the heat-not-burn category with ~77% volume share.

- JapanIQOS IMS volume +9.3 %, market share +3.0 percentage points to 32.2 %. HTU category over 50 % nicotine share in 13 major cities and 8 prefectures.

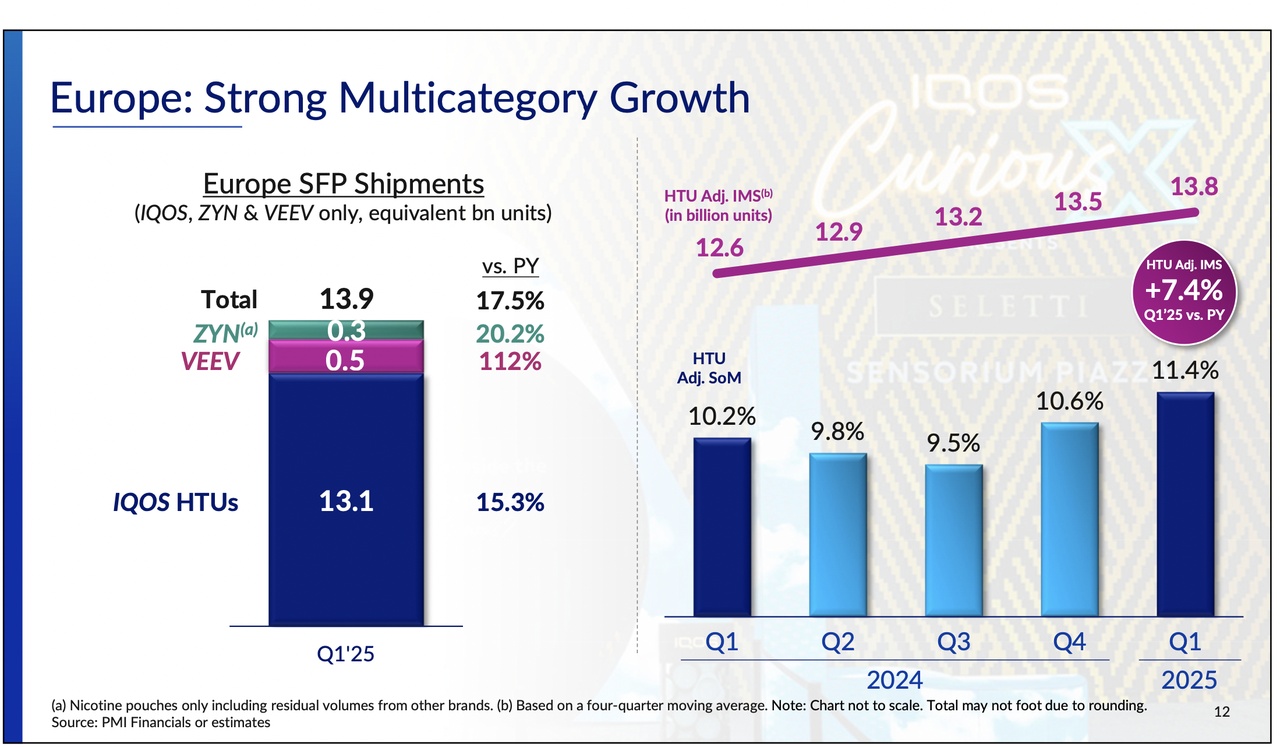

- EuropeIQOS market share +1.2 percentage points to 11.4 %, IMS +7.4 %. Strong growth in Spain, Germany, Bulgaria, Greece; HTU share over 30 % in six cities (e.g. Budapest, Athens, Rome).

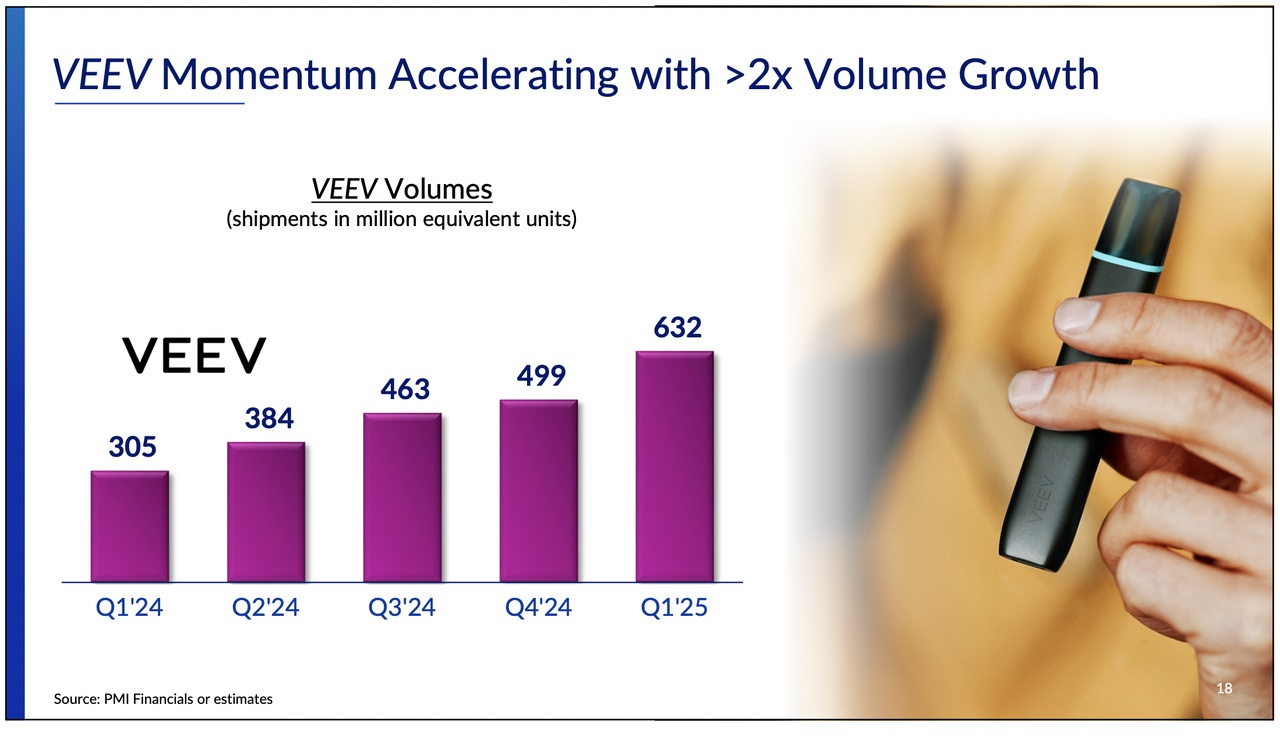

- E-Vapor: Doubling of delivery volumes, especially in Europe, with rising gross margin. VEEV is becoming more important for the multi-category strategy.

- ZYN: Delivery volumes +27.2 % (pouches), +31.0 % (cans), driven by ZYN in the USA (+53 %, >200 million cans). Production capacity increased earlier than planned, strong demand.

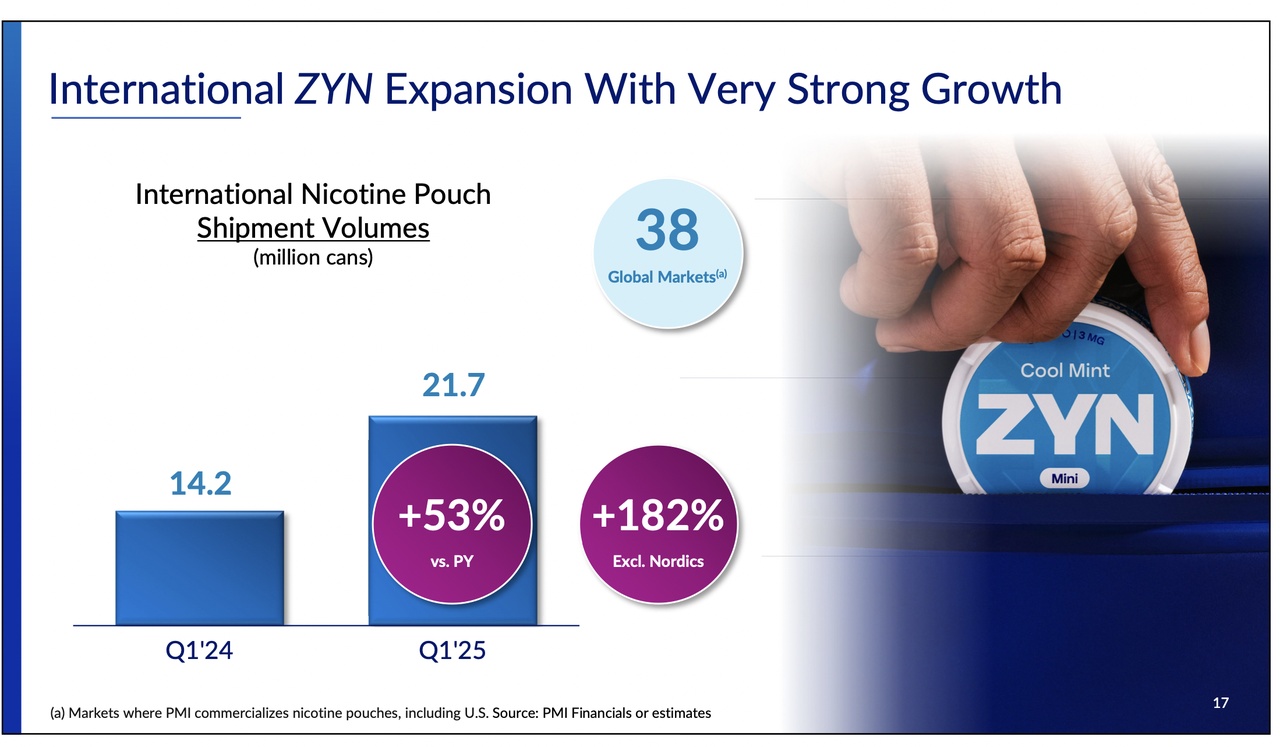

- Outside the USA: nicotine pouch volume +53 %, growth in emerging markets (Pakistan, South Africa) and new markets (UK, Poland, Italy).

Combustibles

- Volume growth and strong pricing, but negative regional mix; net sales stable (+3.8 % organic), gross profit +2.0 % (+5.3 % organic).

- Global brands (Marlboro) with market share gains, total share of cigarettes +0.4 % to 24.8 %.

- US cigarsNo divestment or spin-off planned following strategic review.