We have to look at the situation in the long term. At the moment, these are real profits that are invested as capex. However, as long as there is always a return in the future, this could lead to a problem in the long term. $IREN (-9,15%)

$CIFR (-8,23%)

$NVDA (-6,14%)

$MSFT (-3,3%)

$AMD (-10,01%)

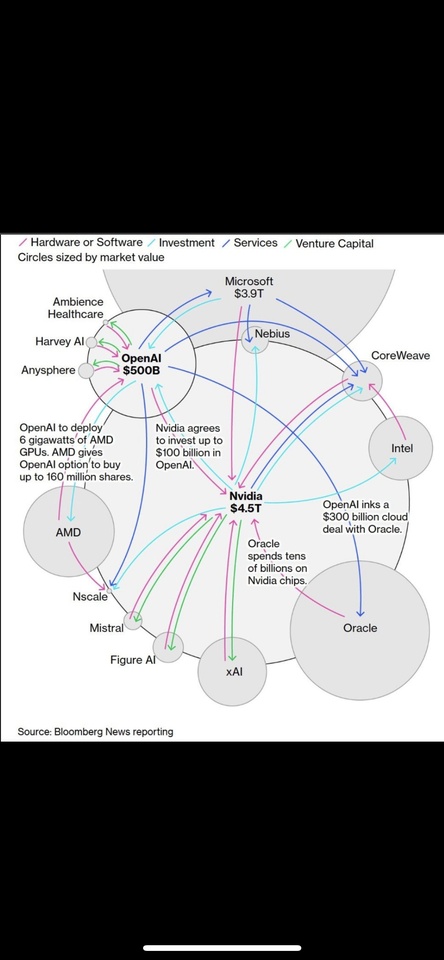

"The AI investment cycle shown is based on massive funding loops among the tech giants, but sustainability is being discussed. Bloomberg and others note that it is fueled by hype and trillions in capex that may be viable if AI generates real gains (e.g., through productivity gains). It could implode from inflated expectations, failure to monetize (like the dotcom era), rising energy costs, regulatory hurdles or economic slowdowns, according to Reuters and Fortune analysis."