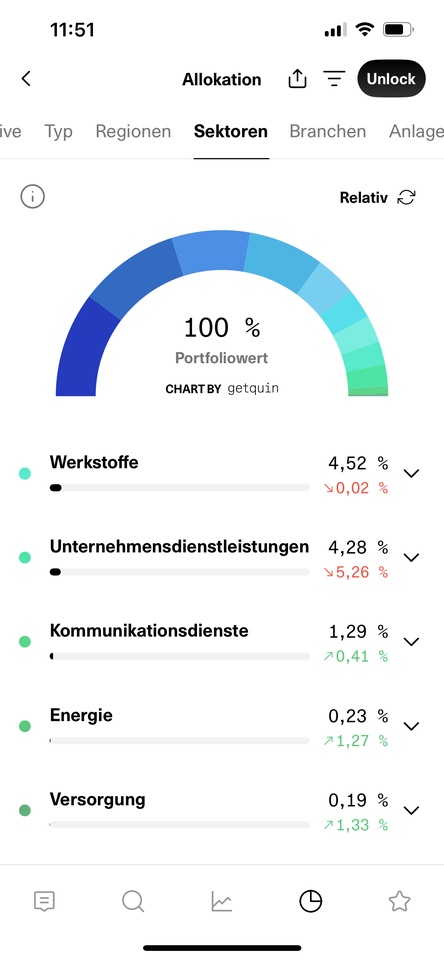

Dear community, as you can see, the above-mentioned sectors are poorly represented in my portfolio, so in order to diversify my portfolio more, I am looking for exciting stocks that I would like to take a closer look at.

Especially $VST (+4,6%) and $CEG (+6,67%) performed well due to the AI hype and the supply of data centers. $NEE (+1,38%) has more difficult cards to play at the moment due to Trump's policies.

Do you currently have any companies on your watch list?