$INT Here is an analysis from Montega. Too bad about the good story, but I expect a total loss:

Rating from Montega AG on Intellego Technologies AB

Company: Intellego Technologies AB

ISIN: SE0016075063

Reason for the study: Update

Recommendation: n.a.

since: 09.02.2026

Target price: n.a.

Last rating change: -

Analyst: Ingo Schmidt, CIIA

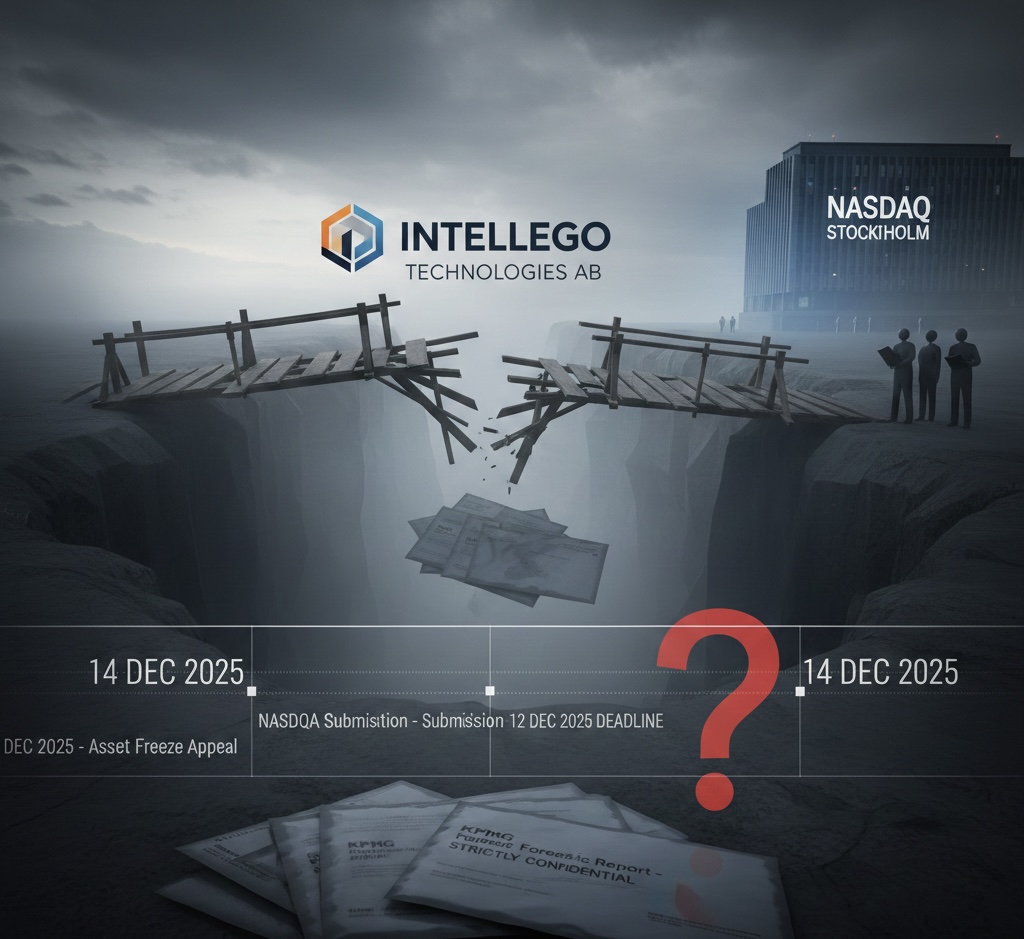

KPMG report confirms worst fears

After Intellego Technologies as well as Nasdaq First North had the

the auditing company KPMG with a comprehensive special audit, the

the results of the forensic investigation were presented on January 30, 2026.

investigation were presented. While we had already pointed out irregularities

reporting irregularities at an early stage, the extent of the manipulations now

extent of the manipulation by former CEO Claes Lindahl that has now been revealed is

is shocking and puts the company to an enormous test.

Early warning signals confirmed: In our research update of

08.10. we had already suspended the rating for Intellego Technologies AB due to the

due to insufficient transparency. Our fears regarding the discrepancy

discrepancy between operating performance reports and the actual cash flow situation

cash flow situation have unfortunately been confirmed by recent events.

Systematic fraud by Claes Lindahl: The details published on January 30th

details published on January 30 show a degree of manipulation that goes far beyond

far beyond isolated errors. KPMG concludes that over 99% of the

of the sales reported for 2025 were systematically faked by Claes Lindahl

to deceive investors and the Board. According to the KPMG report

Lindahl systematically created two different sets of documents for the same orders/declarations of intent.

two different sets of documents. While one version, according to the KPMG report

real, often non-binding negotiations with potential customers, a second

potential customers, a second, manipulated version contained firm

acceptance commitments and fictitious payment and delivery terms. The latter

served as the basis for booking millions in sales that never actually existed.

never existed. In doing so, he apparently deceived all other

intellego employees and management colleagues as well as institutions such as the

the Swedish Export Credit Agency (SEK) and EKN by submitting manipulated

manipulated documents, which ultimately led to criminal charges of serious fraud.

fraud.

Executive Board fights for stock market listing - AGM at the end of February: The current Executive Board

is, by its own admission, endeavoring to come to terms with the events and is striving to

to maintain the company's stock market listing. We consider

this goal in view of the seriousness of the allegations and the necessary

forensic investigation of the financial statements. A

will be the Extraordinary General Meeting convened for February 23.

Extraordinary General Meeting convened for February 23. At this meeting, the management must

shareholders the extent to which a reliable database can be restored and what strategic

can be restored and what strategic options remain.

The most important consolidated holding Dario (UK), which was not part of the

which was not part of the investigations, could play a role.

Conclusion: The Intellego case remains a cautionary example of the importance of

of sound corporate governance and transparency. Our early warning has been

nevertheless surprised by the extent of the alleged criminal acts.

criminal acts. As long as the financial situation is not fully clarified

and audited financial statements are available, we are not in a position to value the share.

the share.

+++ This announcement does not constitute investment advice or an invitation to conclude

certain stock exchange transactions. Please read our RISK NOTICE /

DISCLAIMER at http://www.montega.de +++

About Montega:

Montega AG is an innovative investment banking boutique with a clear focus on medium-sized

focus on medium-sized companies and acts as a platform provider for the exchange

between listed companies and institutional investors.

Montega produces high-quality equity research, organizes a wide range of capital

capital market events in Germany and abroad and offers comprehensive support with

support with equity and debt financing. The mission:

To bring issuers and investors together and ensure transparency in the

stock market environment. In doing so, Montega concentrates on those market

market participants whose language the SME experts speak best

small and mid caps on the one hand and asset managers on the other,

family offices and investment boutiques with an investment focus in the small

on the other hand.

You can download the complete analysis here:

https://eqs-cockpit.com/c/fncls.ssp?u=44a18ff182b54552a8d4d28e458a6a0d