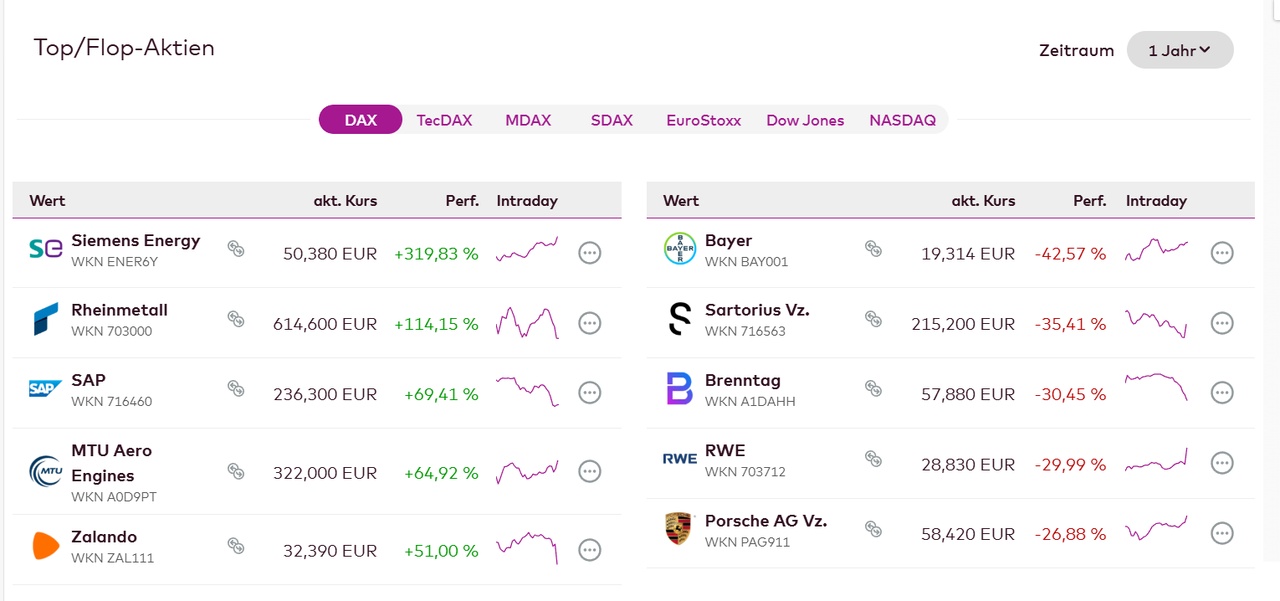

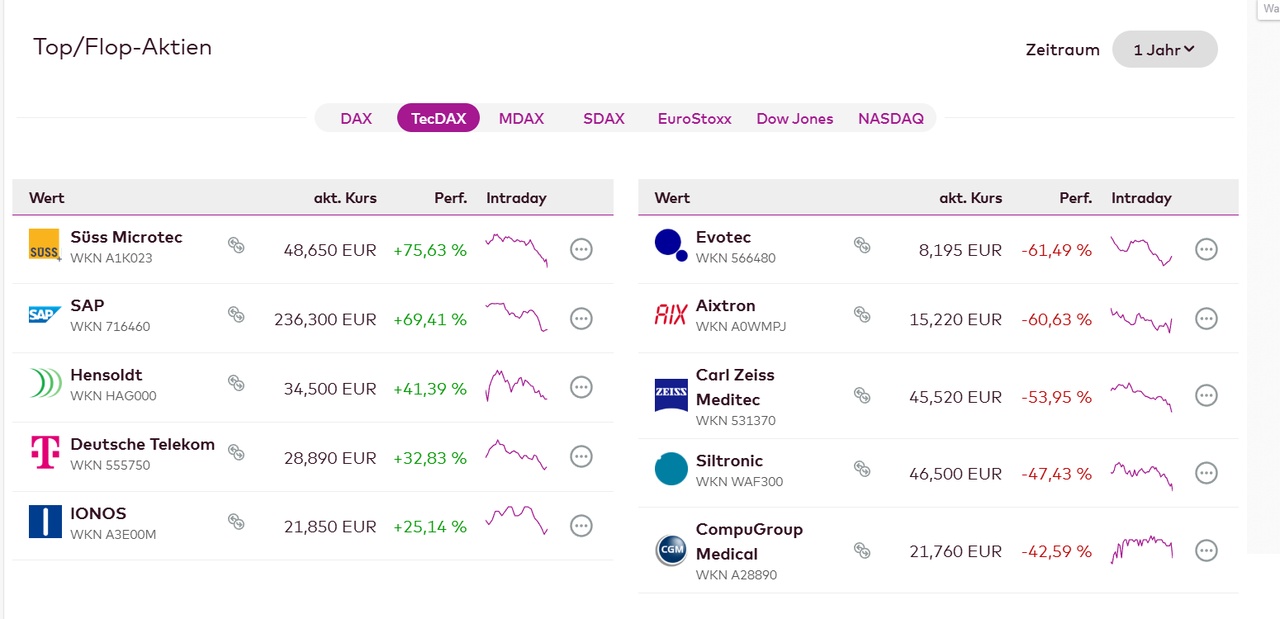

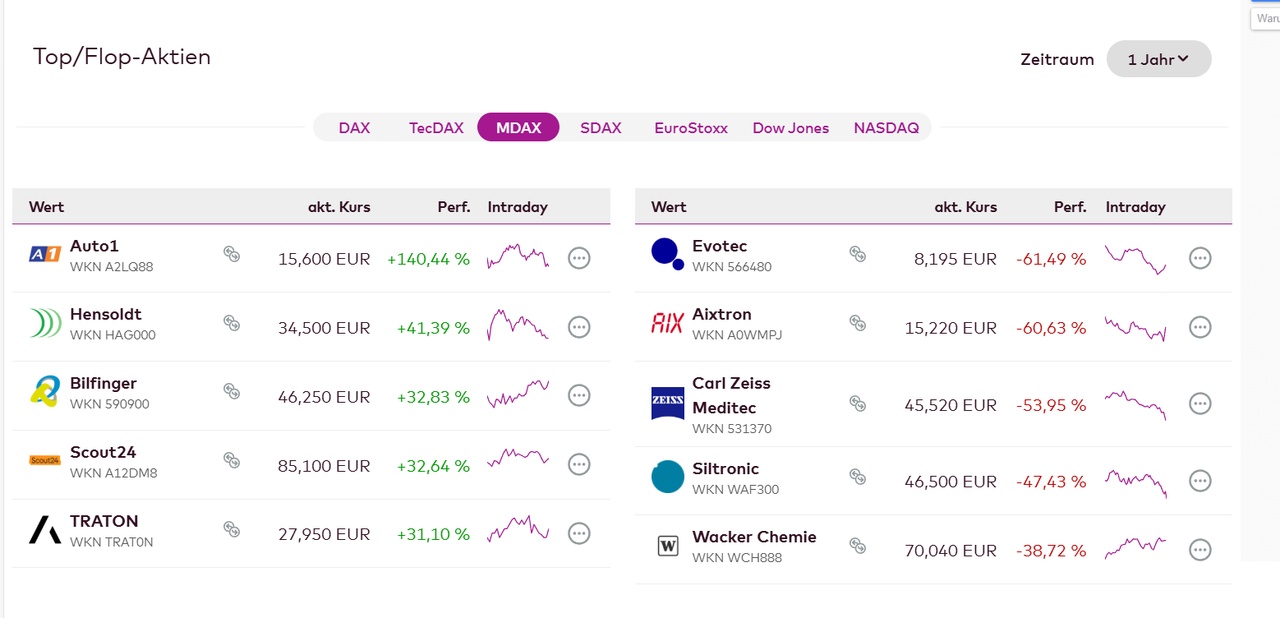

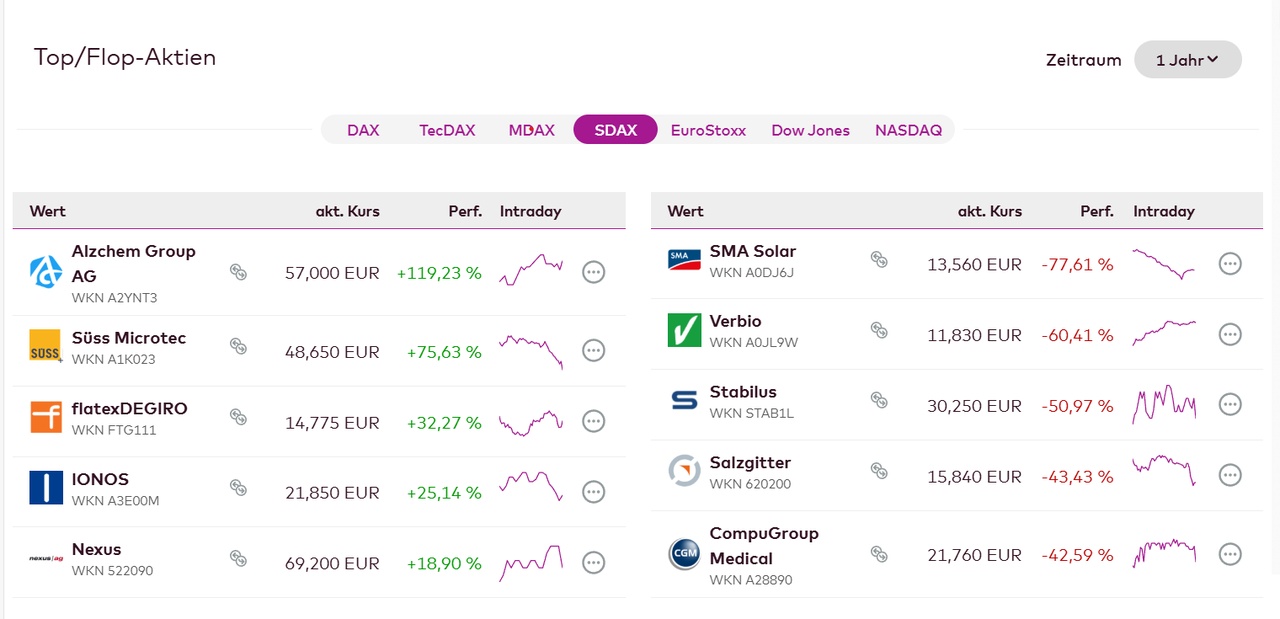

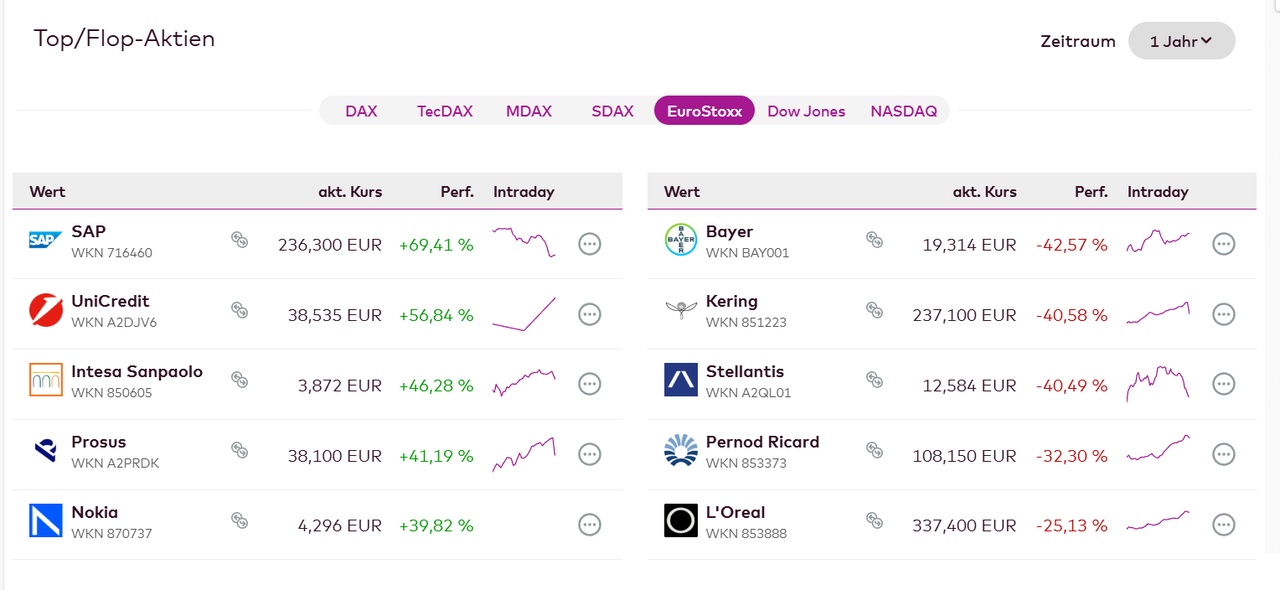

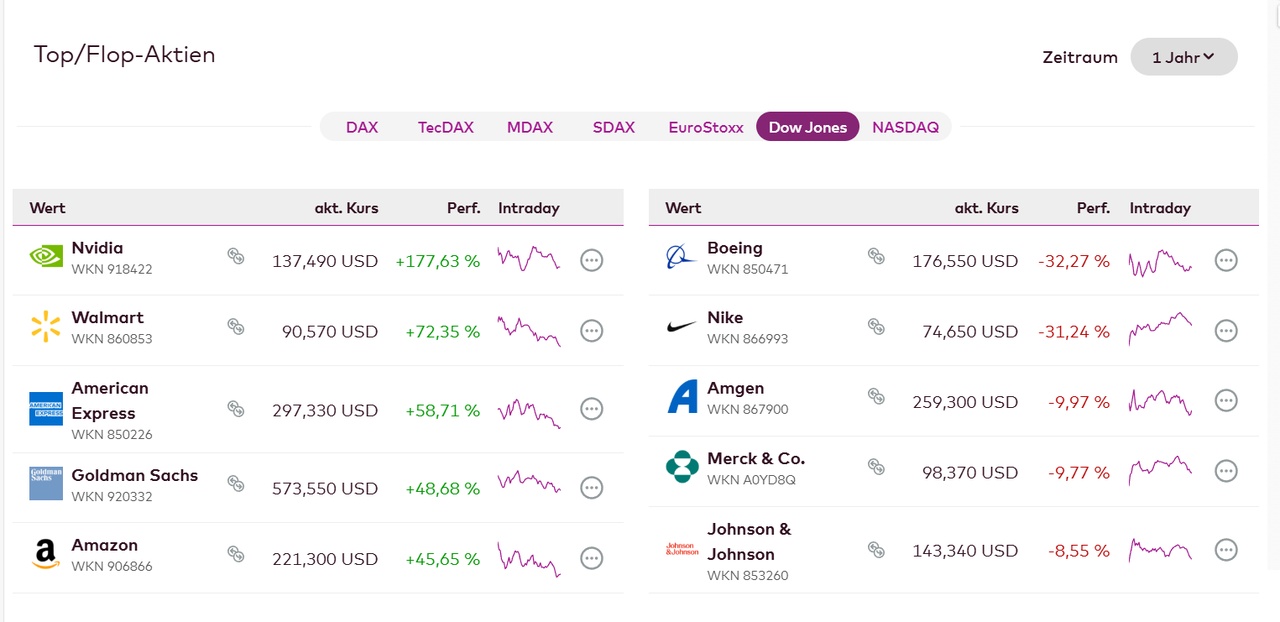

Hello everyone, the tops and flops at the end of the year.

With Aixtron $AIXA (-2,36%) I myself had a big flop in my portfolio. But for 2025 I am quite reliable with Aixtron.

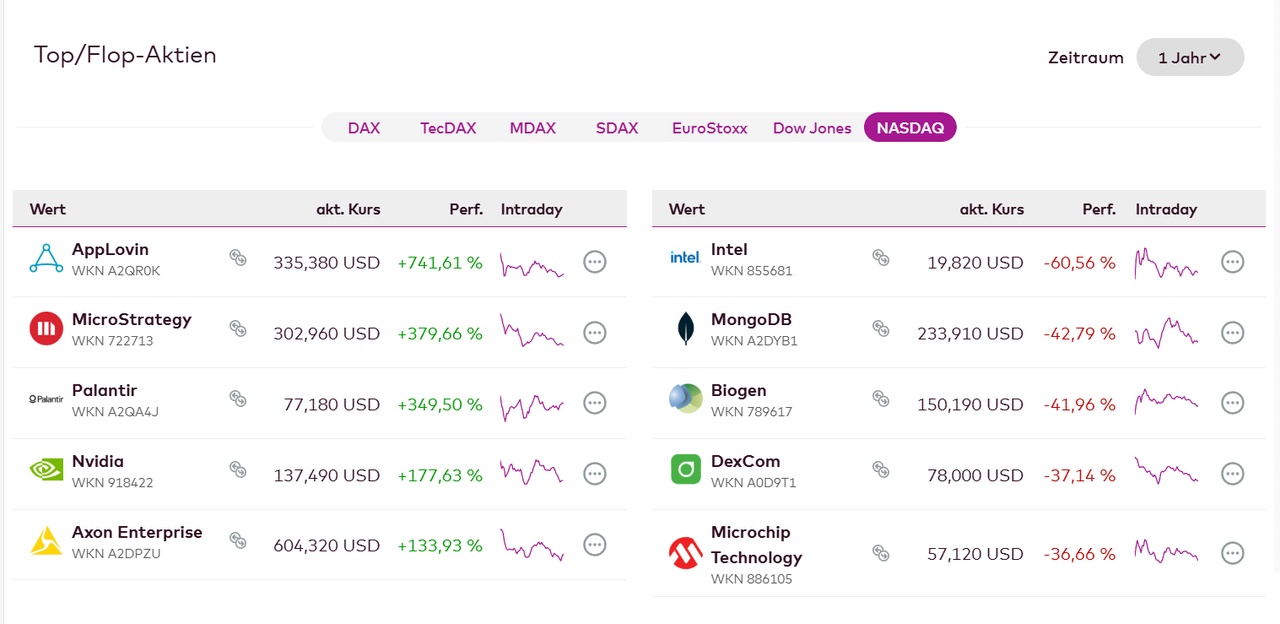

AppLovin $APP (+0,27%) and Nvidia $NVDA (-1,69%) were then my top stocks.

Which stocks were top and flop for you?

Which flop stocks are you confident about in the new year?

Will the top stocks continue to be top?