New addition to the depot

$LNTH (-2,8%)

Lantheus Holdings

EUR 6.59 bn market cap

P/E RATIO 18

2-digit earnings growth forecast for the coming years

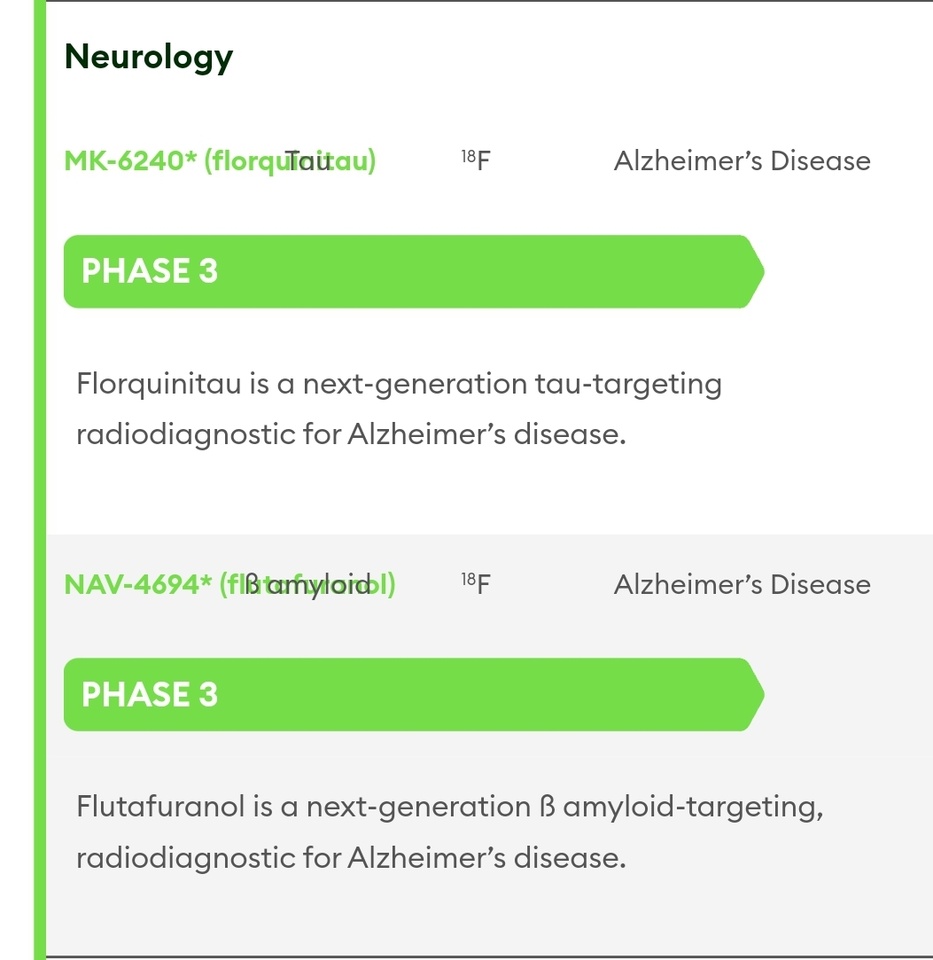

Broadly speaking, the company is involved in radiopharmaceutical oncology and precision diagnostics, etc.

The radiopharmaceutical oncology products support medical professionals in detecting, combating and monitoring cancer.

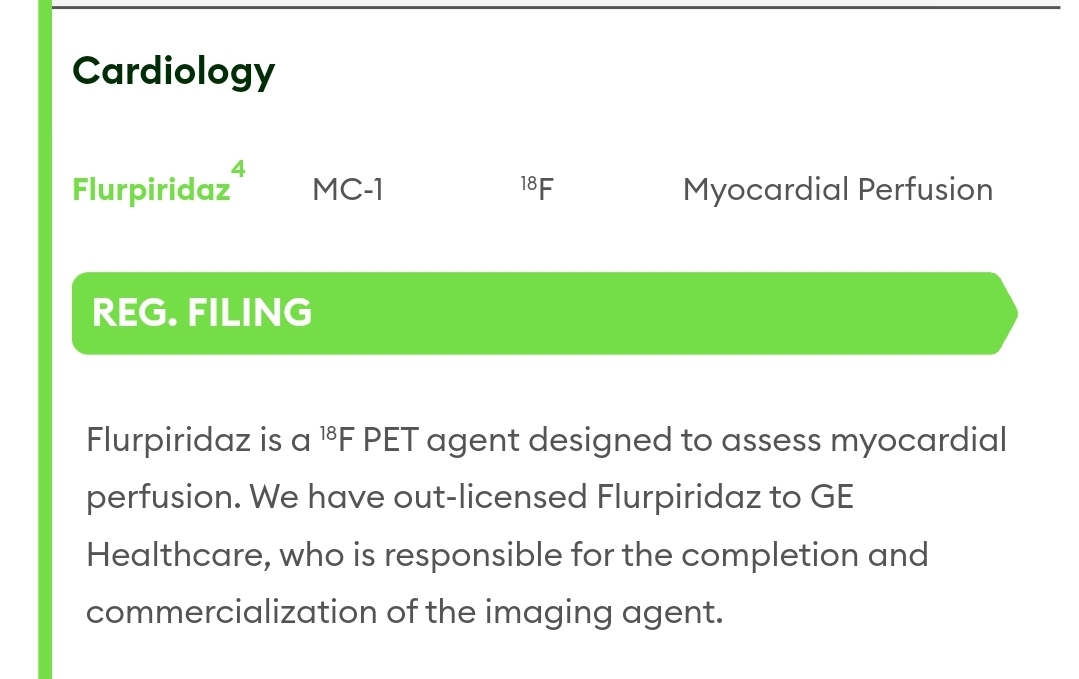

Dis precision diagnostics products help healthcare professionals detect and track diseases at an early stage - when it matters most.

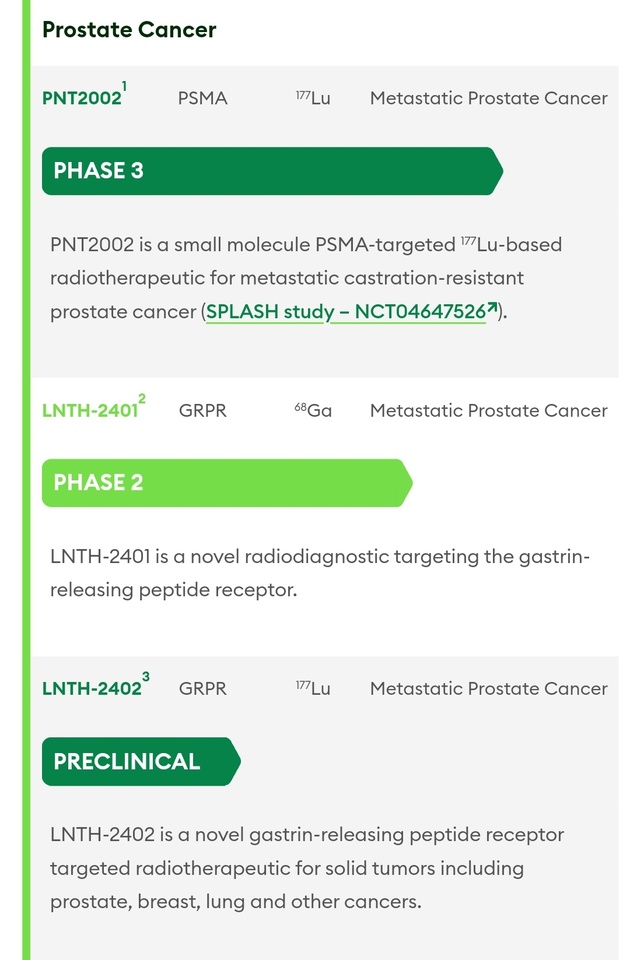

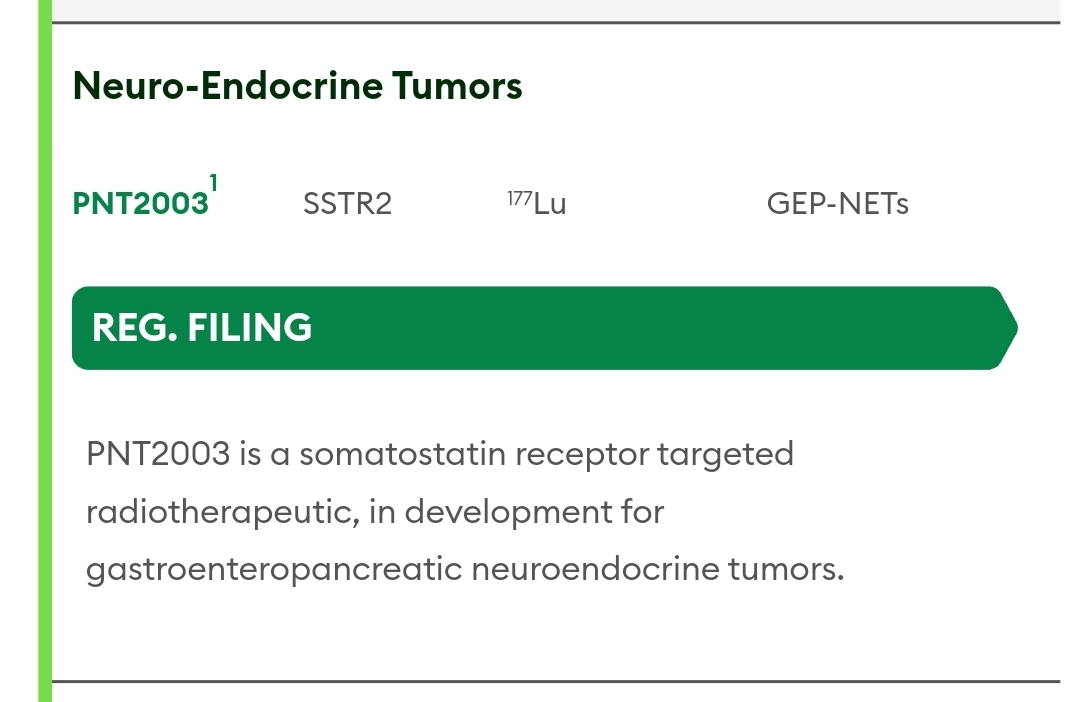

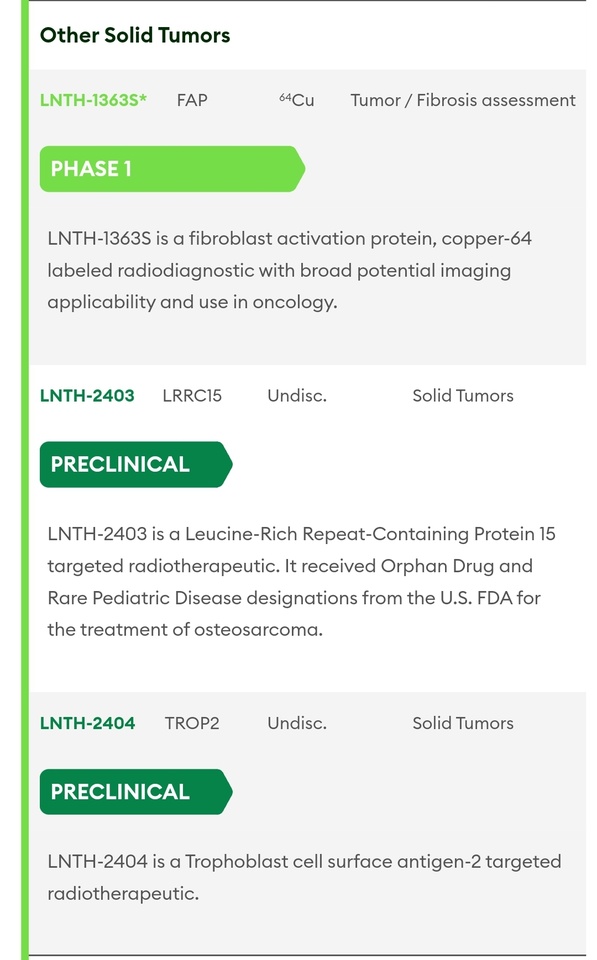

In addition to diagnostic products, there are also therapeutic products and some in the pipeline.

Many of you will come into contact with the products at an older age (although I wouldn't wish it on anyone). Be it because of prostate cancer or to visualize the coronary arteries during a check-up.