Iren Limited ($IREN (-0,88%) ):

Iren limited is mainly a bitcoin miner, using 100% renewable energy. Besides that, it is diversifying its business model through investments in HPC and AI Data Centers, for now this has only been a fractional part of revenue though. Iren is actively building out capacity, having 31 EH/s by the end of 2024 and expanding to 50 EH/s by mid 2025.

This is due to three smaller already operating data centers in Canada (BC) and one in Childress (Texas) just going live. Totally operating energy of 80MW in Mackenzie, 50MW in Prince George, 30MW in Canal Flats and by end of 2024 350MW in Childress. Expecting an expansion of 400MW in the first half of 2025. The new Sweetwater project that is being build out would add another 1400MW, making it one of the largest data centers worldwide.

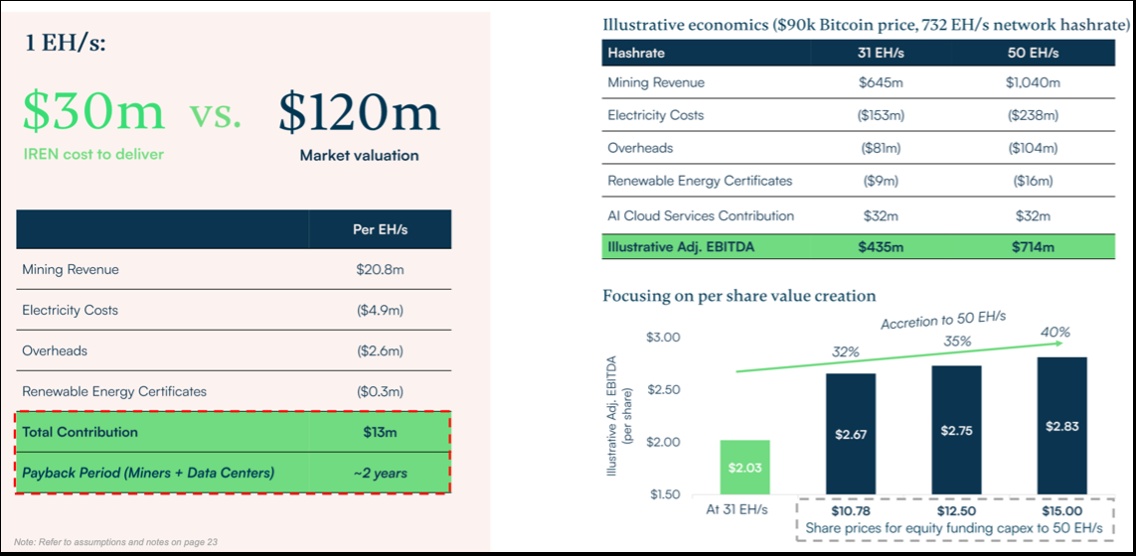

The main advantage compared to competitors is their full focus on renewables and being fully vertically integrated. This enables much lower costs to mine bitcoin compared with competitors.

Main catalysts 2025:

• Full operation of the Childress data center, enabling huge value creation through their mining business:

• More diversification into HPC and AI data centers, enabling a hedge towards a falling Bitcoin price.

• Cheaper mining compared to competitors, making a falling Bitcoin price less influential, since the margins are higher. Better KPI’s overall.

• Buildout of Sweetwater data center to go live in H1 2026.

• An increase in Bitcoin price.

• New project land being contracted.

• Cheap valuation compared to competitors forward EV/EBITDA is 4,9, dropping a lot more in fiscal 2026 due to Childress fully operating. 2026 EV/EBITDA will probably be around 2-2,5 regarding prices of bitcoin around $90k.

Risks for 2025:

• Bitcoin correction.

• Problems with the buildouts of Childress and Sweetwater, delaying capacity increases.

• Difficulties adapting to more HPC and AI services.

• Quality issues with data centers and hardware.

KPI’s to watch:

• Costs to produce one Bitcoin.

• Operating data center capacity and hash rates.

• Revenue growth and margins overall.

• Diversification into HPC and AI data centers.

Price target:

• With a constant bitcoin price of around $90k.

• Around $30 per share regarding an EV/EBITDA of 7 in FY26.