Depot review September 2024 - The first green September in my depot since 2019 📈

September is generally regarded as the worst month on the stock market, with a negative monthly performance more than 50% of the time. This is also consistent with my experience since 2013. In 11 years, it has been negative 6 times and positive 5 times. From 2020 to 2023, the last 4 years were all negative. However, September 2024 is now the first positive September since 2019, which means it is exactly 50/50 for me - 6 positive and 6 negative Septembers since 2013.

The Fed's interest rate turnaround and the stimulus in China have certainly contributed to the positive trend

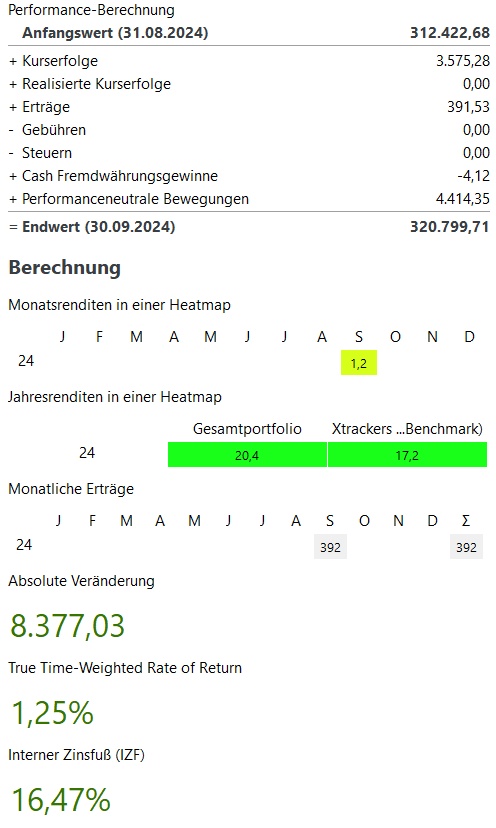

Monthly view:

In total, September was +1,2%. This corresponds to price gains of ~3.600€.

The MSCI World (benchmark) was +1.0% and the S&P500 +1.3%

Winners & losers:

A look at the winners and losers is particularly exciting this month.

On the winning side at the very top are my China ETF with € +1,300 and is thus back in the green for the first time in a long time. The following winners are also a colorful mix with Meta, Bitcoin, Home Depot and Sea. Really a very broad mix with no clear tendency towards regions, sectors or the like

On the loser side in my portfolio in September were mainly pharmaceutical stocks. Novo Nordisk, Amgen and Johnson & Johnson. Even worse, with price losses of ~€700 each, were only Palo Alto Networks and ASML.

The performance-neutral movements in September were just under €4,500. The premium refund from my private health insurance also played a large part in this. In September, I received over €2,000 back for the year 2023, which was of course invested directly to compensate for any higher pension contributions.

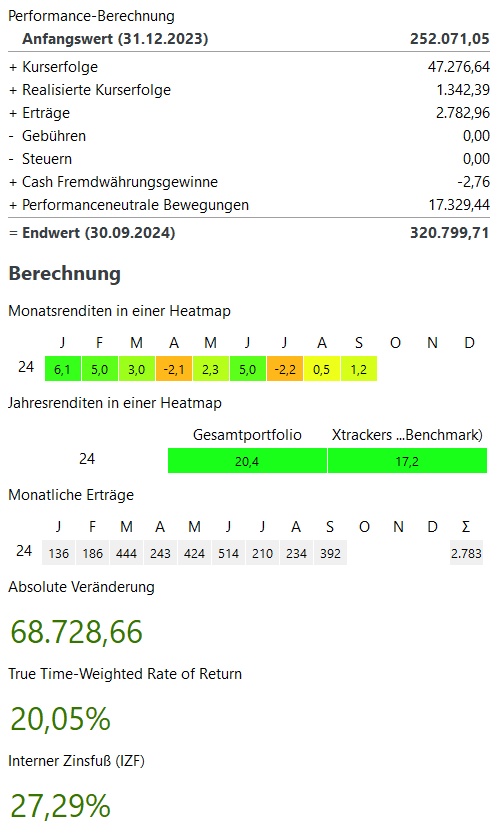

Current year:

My performance in the current year is +20,4% and thus above my benchmark, the MSCI World with 17.2%.

In total, my portfolio currently stands at ~321.000€. This corresponds to an absolute growth of ~€69,000 in the current year 2023. ~49.000€ of this comes from price increases, ~2.800€ from dividends / interest and ~17.000€ from additional investments.

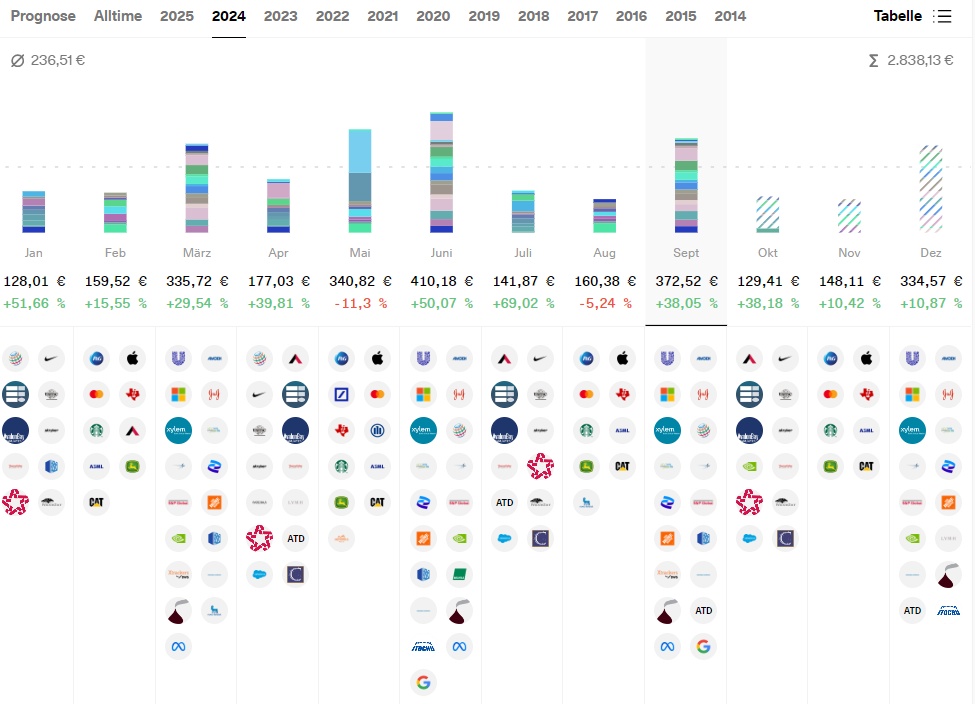

Dividend:

- Dividends in September were 23% above the previous year at ~€360

- Amgen is in the lead with a (gross) dividend of €50 every 3 months. But Johnson & Johnson with €45 is also a delight

- In the current year, the dividends after 9 months are +25% over the first 9 months of 2023 at ~2.210€

Buys & sells:

- I bought in September for approx. 3,500€. 2,100 of this came from the premium refund from my private health insurance and went into the WisdomTree Global Quality Dividend Growth

- As always, my savings plans were executed:

- Blue ChipsLockheed Martin $LMT (+1,09%) Republic Services $RSG (+2,16%) Thermo Fisher $TMO (+0,08%) ASML $ASML (-1,57%) MasterCard $MA (+0,73%) Deere $DE (-0,67%) Northrop Grumman $NOC (+2,4%) Itochu $8001 (+1,09%) Salesforce $CRM (+0,59%) Hermes $RMS (+1,21%) Constellation Software $CSU (+4,57%)

Growth: -- ETFsMSCI World $XDWD (+0,27%) Nikkei 225 $XDJP (+0,5%) and the WisdomTree Global Quality Dividend Growth $GGRP (+0,37%)

Crypto: Bitcoin $BTC (-1,17%) and Ethereum $ETH (-0,06%)

Sales there were none in September

Target 2024:

My goal for this year is to reach €300,000 in my portfolio. Due to the extremely positive market development in the current year, my portfolio currently stands at ~€321,000.

At the beginning of September, my portfolio was still quite a bit lower at €304,000 due to the weak start to the month. At this point, it was therefore quite a way off the previous high of €320,000 in June.

I have now reached a new high of €321,000 and am optimistic that I can still beat my year-end target of €300,000.