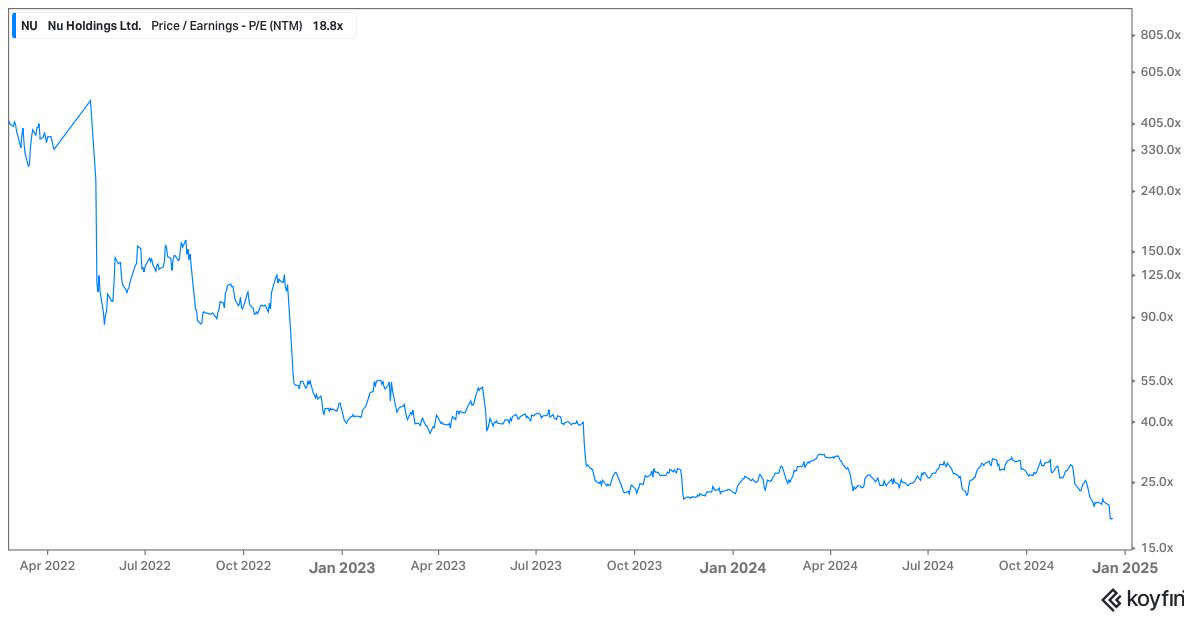

$NU (-1,23%) / $MELI (-1,49%) - YTD Performance vs Brazilian Real/US Dollar

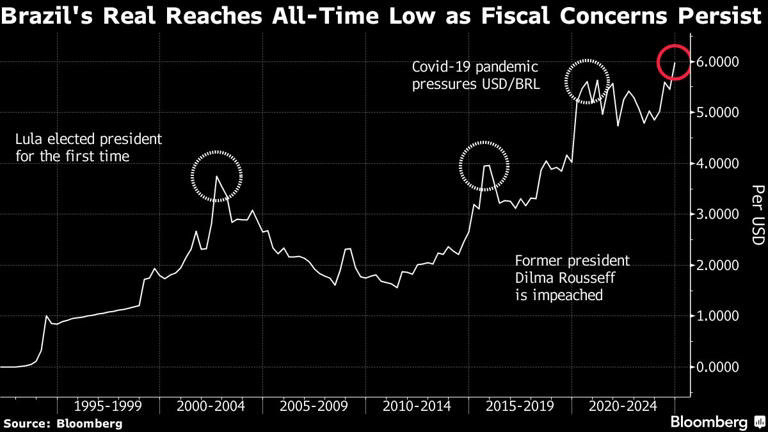

The Brazilian real is at a historic low against the USD. This is because the central bank is raising interest rates and the government is cutting spending by 12 billion dollars by 2026 to combat inflation.

The macroeconomic situation of high inflation has been a problem since Covid and even before. However, the entire region is growing at high rates. If you can keep inflation under control, things can look really good macroeconomically.

$NU (-1,23%) and $MELI (-1,49%) have done well so far anyway .

The 🇧🇷 central bank announces a cash auction of up to 3 billion US dollars on December 26