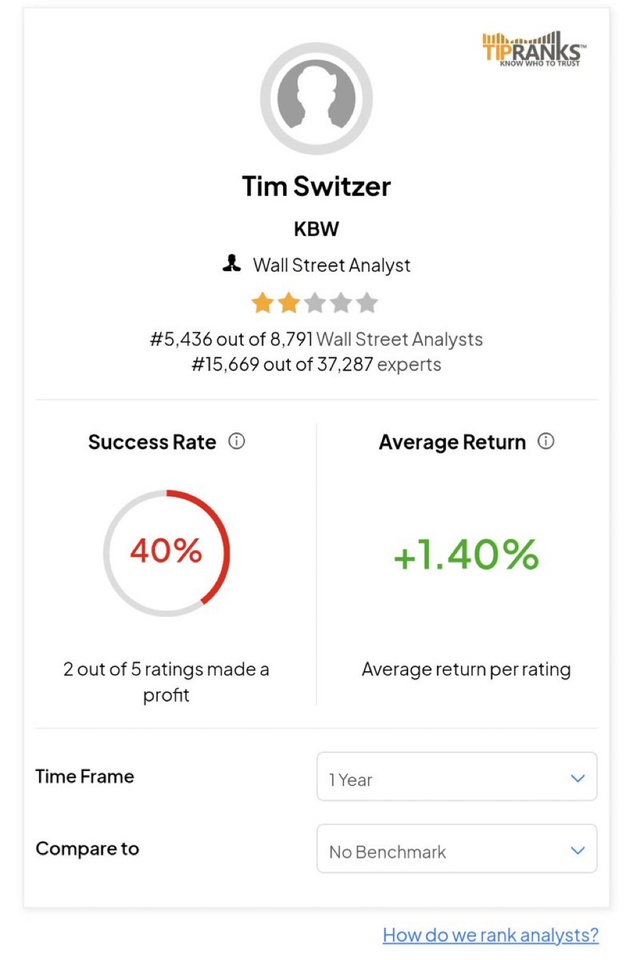

On January 3, 2024, an investment bank called Keefe, Bruyette and Woods (KBW) downgraded the rating $SOFI (-2,08%) to "sell" with a one-year price target of USD 6.50.

This triggered the second worst day in the history of the share, which plummeted by 14%.

Funnily enough, they played the same game again this year 2025 , downgrading $SOFI (-2,08%) downgraded again right after the turn of the year, which again led to double-digit share price losses.

Keefe, Bruyette & Woods downgraded the share $SOFI (-2,08%) from "Market Perform" to "Underperform" and lowers price target from 8 to 7 US dollars

Somewhat implausible if you look at the analysis.

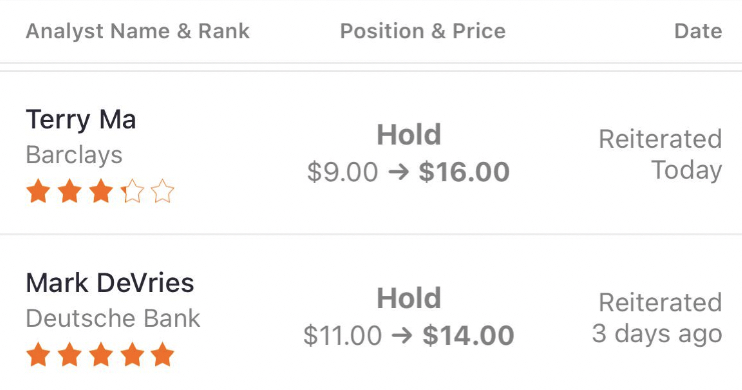

As fast as it went down, it is now going up again, more analysts since January 3rd with much higher price targets and better valuations.

Barclays analyst Terry Ma raises $SOFI (-2,08%) price target from 9 to 16 dollars

Just a few days after Deutsche Bank raised its SoFi price target from 11 to 14 dollars.

Timothy Switzer, analyst at Keefe, Bruyette & Woods, upgraded from "sell" to "hold".