[What do you think of private equity? I've been looking at it for days and am considering building up a position. I'm waiting for a correction as the shares have been running a bit hot].

Private equity is an asset class in which capital is invested in unlisted companies in order to promote their growth or to restructure them. Typical investment areas of private equity firms are corporate takeovers, growth financing, restructuring, real estate, infrastructure and corporate succession.

In the past, high minimum investments of over €10,000 and limited transparency were major hurdles.

Today, private equity investments are easier as there are "low-cost ETFs (0.7 TER)" and platforms that enable access even for small investors.

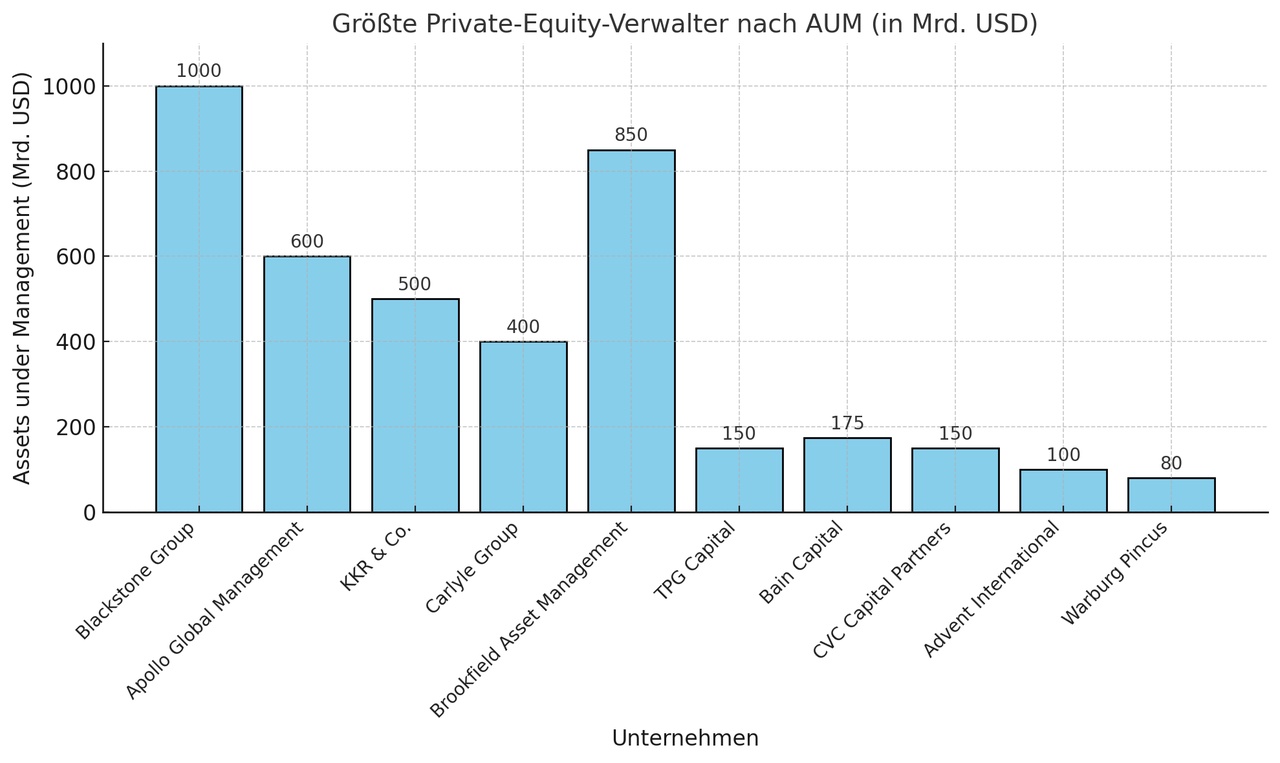

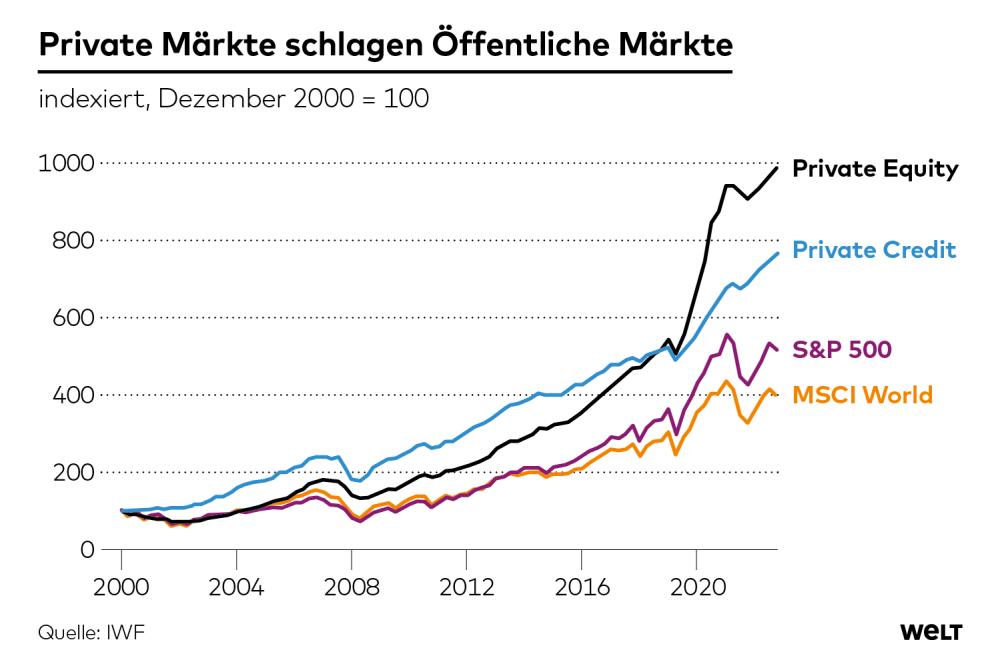

In recent years, private equity has become a popular investment option as investors can benefit from the high returns and stability provided by strategic investments in private companies. In addition, participation in unlisted companies can provide further diversification. Three of the best known and largest companies in the private equity sector are KKR, Blackstone and Brookfield.

- KKR Kohlberg Kravis Roberts & Co.

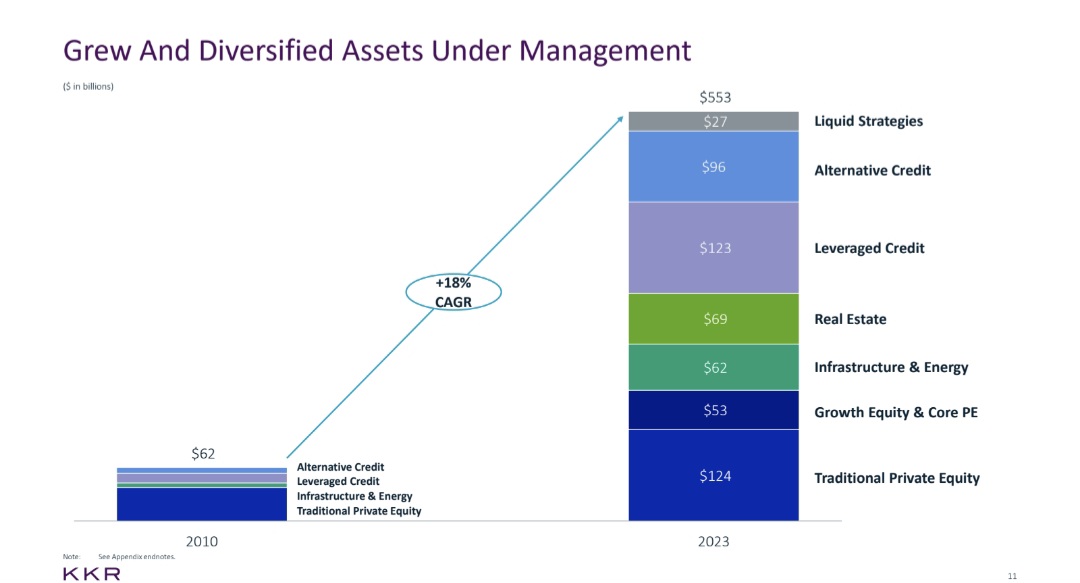

$KKR (-0,77%) is one of the oldest and largest private equity firms and has established itself as a leader in the global financial landscape. The firm is known for its broad-based investment strategy targeting a variety of sectors, including infrastructure, real estate and energy.

- Blackstone

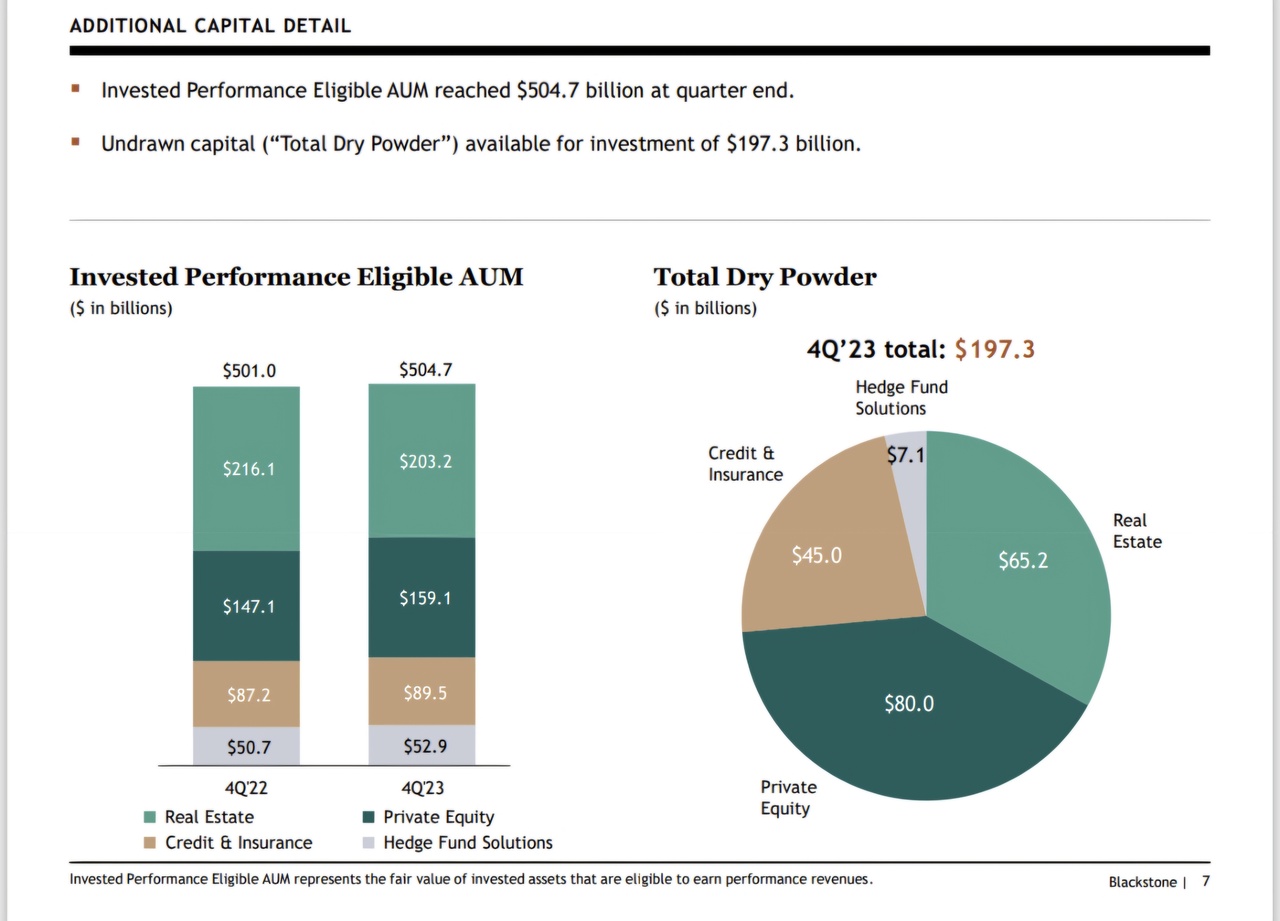

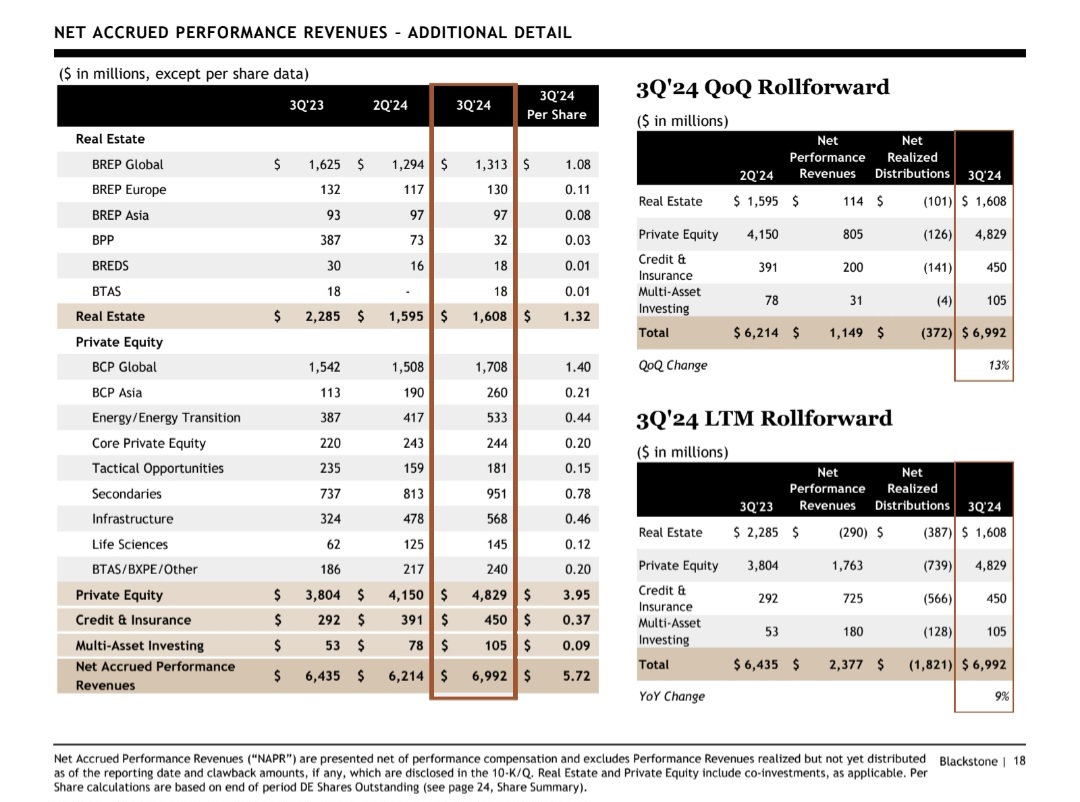

$BX (-1,14%) the largest private equity firm in the world, has also expanded its focus to these sectors, but is particularly known for its real estate and real estate funds.

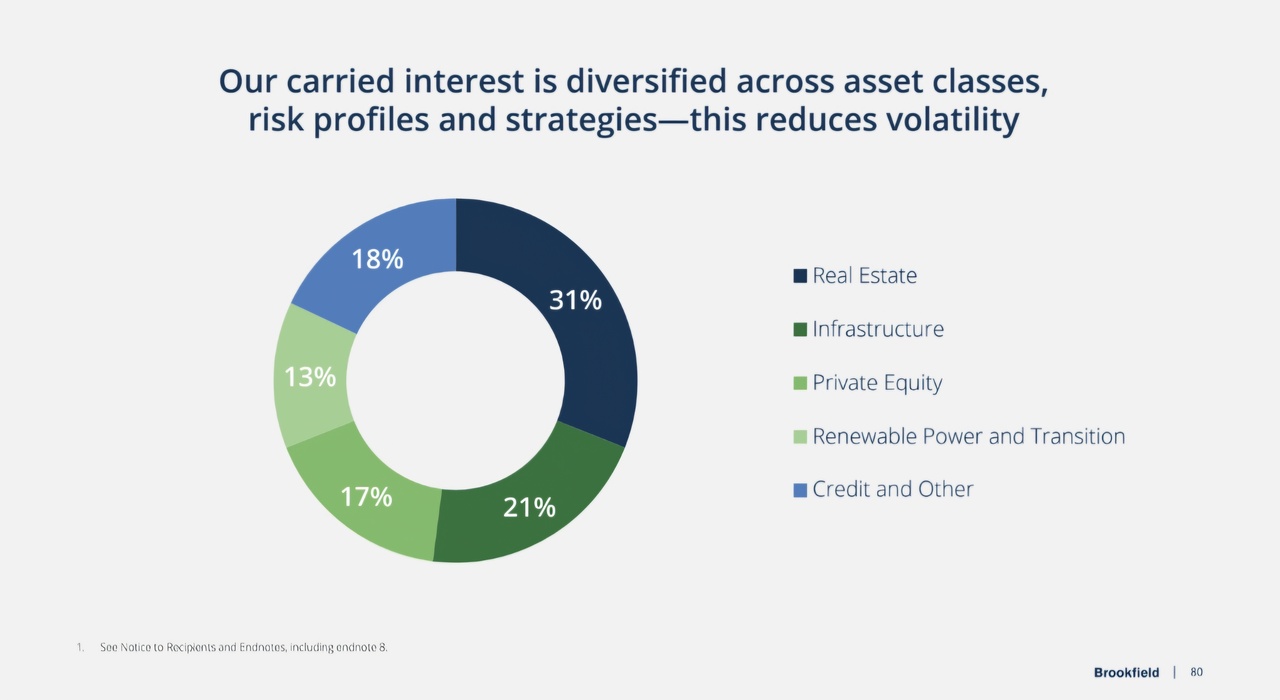

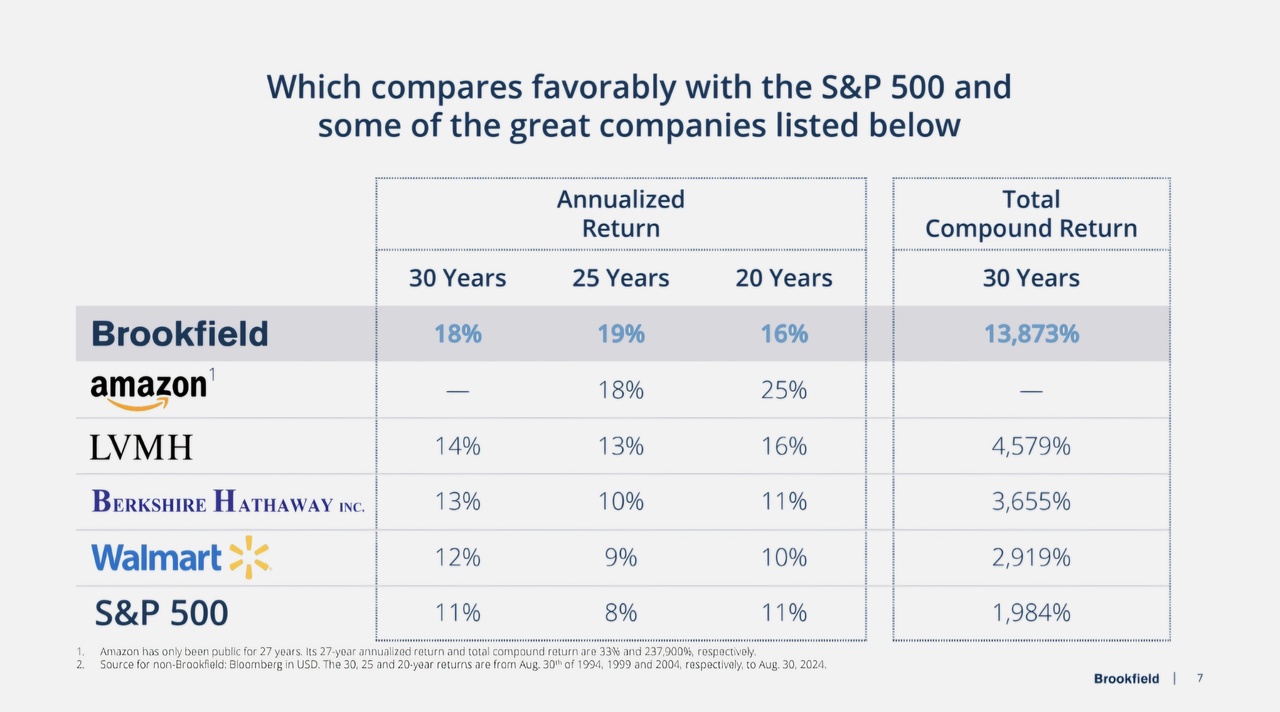

- Brookfield Corporation $BN (+1,44%) is another major player known for its broadly diversified strategy, investing heavily in infrastructure and renewable energy alongside private equity. All three companies offer strong long-term growth opportunities, but Blackstone stands out due to its sheer size and market leadership.

Investing in shares or ETFs?

- One listed ETF that invests in private equity is the "Listed Private Equity ETF" $IPRV (+0,19%) This ETF offers broad exposure to listed private equity companies, making it a practical option for investors seeking access to the asset class without having to invest directly in private funds. Over the last 20 years, the average return on private equity funds has been around 12-15% per annum.

- The disadvantage is that although ETFs are cheaper than funds, they offer lower returns and are expensive compared to other ETFs.

Conclusion

Advantages:

- Potential for strong company improvements and increases in value.

- High potential returns due to growth potential.

- Access to exclusive investment opportunities.

Disadvantages:

- Higher risk due to corporate restructuring or market conditions.

- High minimum investment and costs with traditional private equity funds. ETF with 0.7 TER.

Interesting videos on the topic of private equity:

CEO Brookfield Corporation

https://youtu.be/vmt1Li1Rnes?si=CWbRjgbW2Op3_3Ig

KKR Head of Europe

https://youtu.be/3tOR4SKdP0E?si=ohmesMorNYBsGZH1

More on the topic at @JtoTheB