$MC (-1,33%) - Failed takeovers of LVMH

and activities of the children of Bernard

Arnault

Did you know the following:

In the late 90s, LVMH tried to take over Gucci, but CEO Domenico De Sole resisted.

He diluted the share price and gave employees a stake, weakening LVMH's control. Then Kering stepped in and secured Gucci.

He also tried Hermes:

In 2010, LVMH secretly acquired 17 percent of Hermès ($RMS (+1,21%) ), triggering a storm of indignation. Hermès fought back with legal disputes and accused LVMH of insider trading and share manipulation.

After years of conflict, LVMH agreed to sell its 23% stake in 2014, ending the intense rivalry.

Who will be the next takeover candidate?

Thanks to all the successful takeovers, LVMH now has an extensive portfolio of 75 brands, which can be seen in the picture.

LVMH is the largest luxury company in the world.

The Arnault family:

Bernard will probably keep the company in the family. As he has five children who are already integrated into the company, these are the potential successors:

1. Delphine

2. Antoine

3. Alexandre

4. Frederic

5. Jean

Delphine (49) is Executive VP of Louis Vuitton.

Delphine has been with LVMH since 2001 and is in charge of brand development and strategy. She plays an important role in the success of LV.

Antoine (47) is CEO of Berluti and Chairman of Loro Piana.

Antoine focuses on expanding LVMH's presence in luxury fashion and plays a role in brand communication and acquisitions.

Alexandre Arnault (32) is CEO of Tiffany & Co.

Alexandre revitalized Tiffany by targeting younger audiences and improving its digital presence. As a result, profits doubled within a year.

Frédéric Arnault (29) is CEO of LVMH Watches. After being CEO of Tag Heuer.

Jean Arnault (26) is Director of Product & Communications at Louis Vuitton Watches.

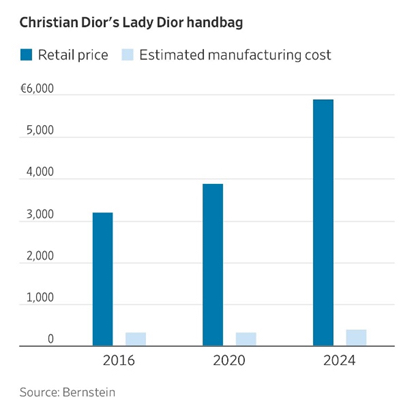

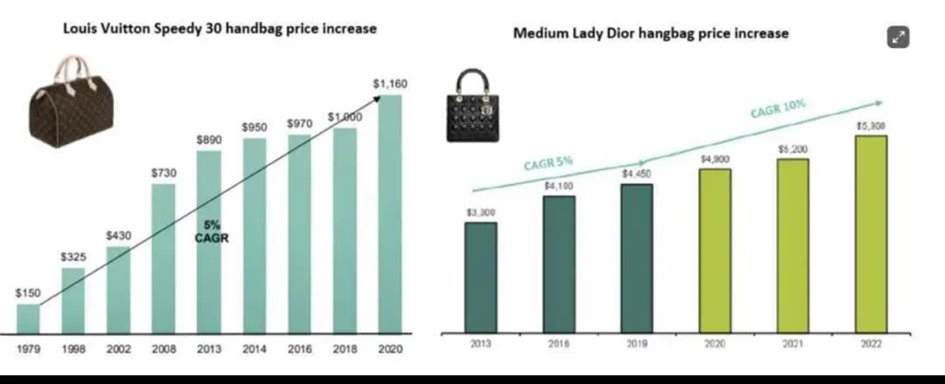

Finally, a few examples of LVMH's pricing power and price trends:

$MC (-1,33%)

$KER (-2,56%)

$RMS (+1,21%)

$MONC (-0,8%)

$BRBY (-2,62%)

$BOSS (-1,55%)