TL;DR

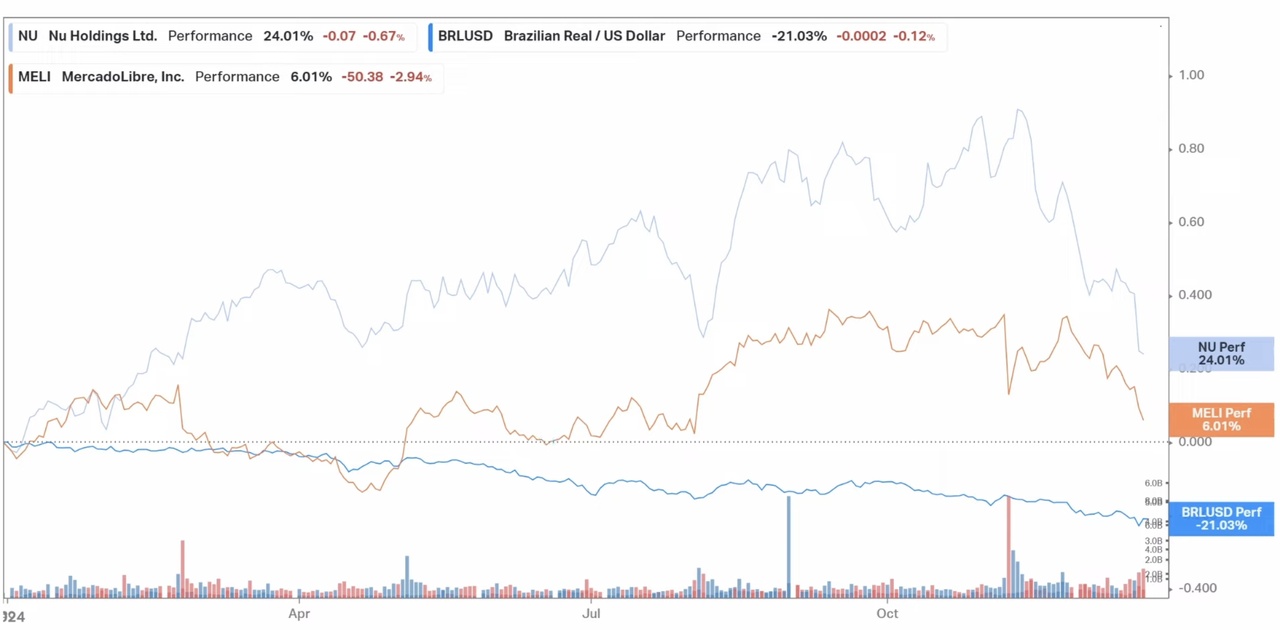

$MELI (+1,51%) controls around 1/3 of Latin American online trading and has recorded trading volume growth of 14% compared to the previous year as well as payment volume growth of 34% on its fintech platform Mercado Pago (both figures adjusted for currency effects). At the same time, the share price has fallen by almost 20% since the last peaks. This is due to currency-related losses in profits, as the main sales market Brazil, for example, is struggling with inflation and increasing currency weakness. In the long term, however $MELI (+1,51%) nevertheless a strategically well-positioned company that can continue to benefit massively from structural growth in its target markets.

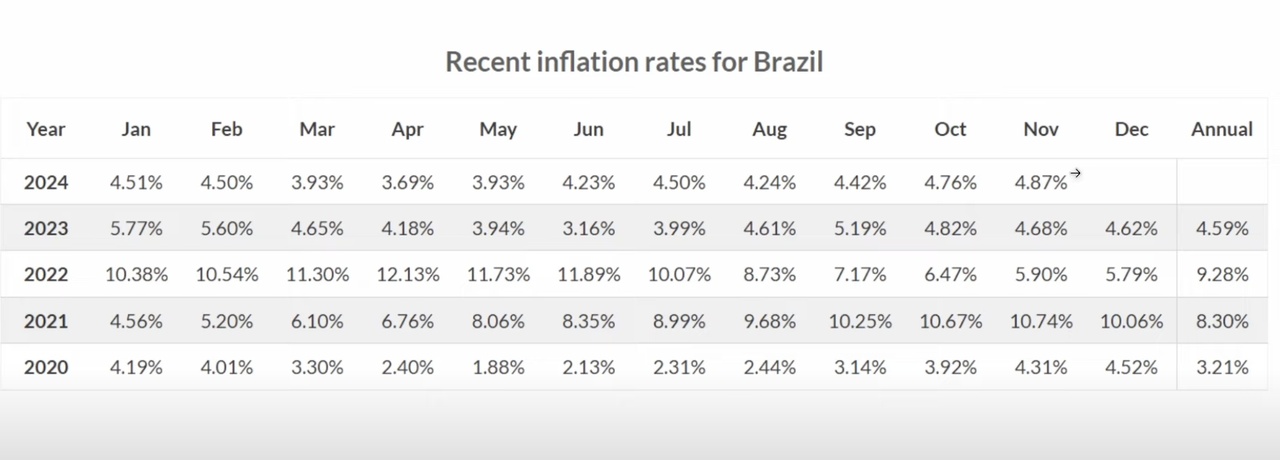

Brazil, the main sales market, is struggling with a renewed rise in inflation

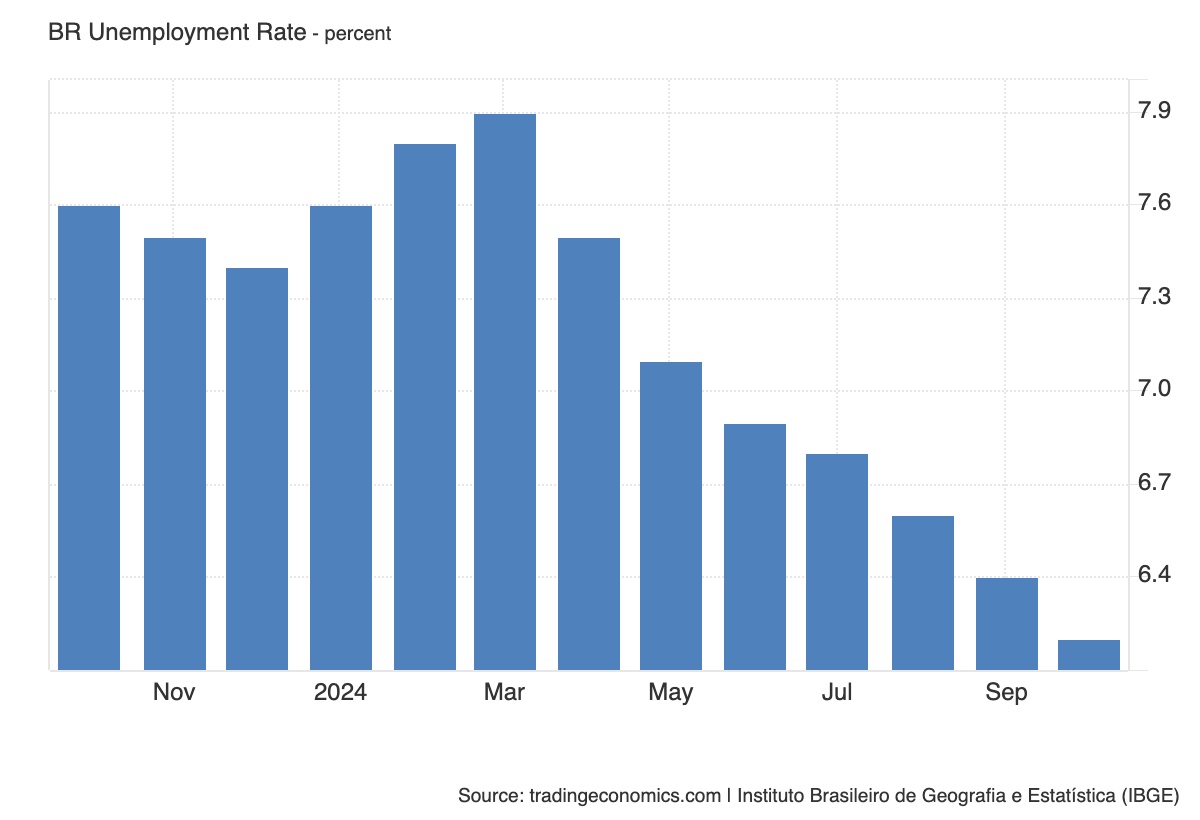

Historically, Brazil last had a year with average inflation of below 4% (3.21%) in 2020. However, in 2021, the figure rose to an average of 8.3% and in 2022 even to 9.28%. At the beginning of 2024, inflation hovered around 4% in May and then even below 4%. Recently, however, inflation has started to rise again - a negative trend is taking hold. On a positive note, however, the expansionary measures have led to a sharp fall in unemployment in Brazil and it looks as if this trend could continue.

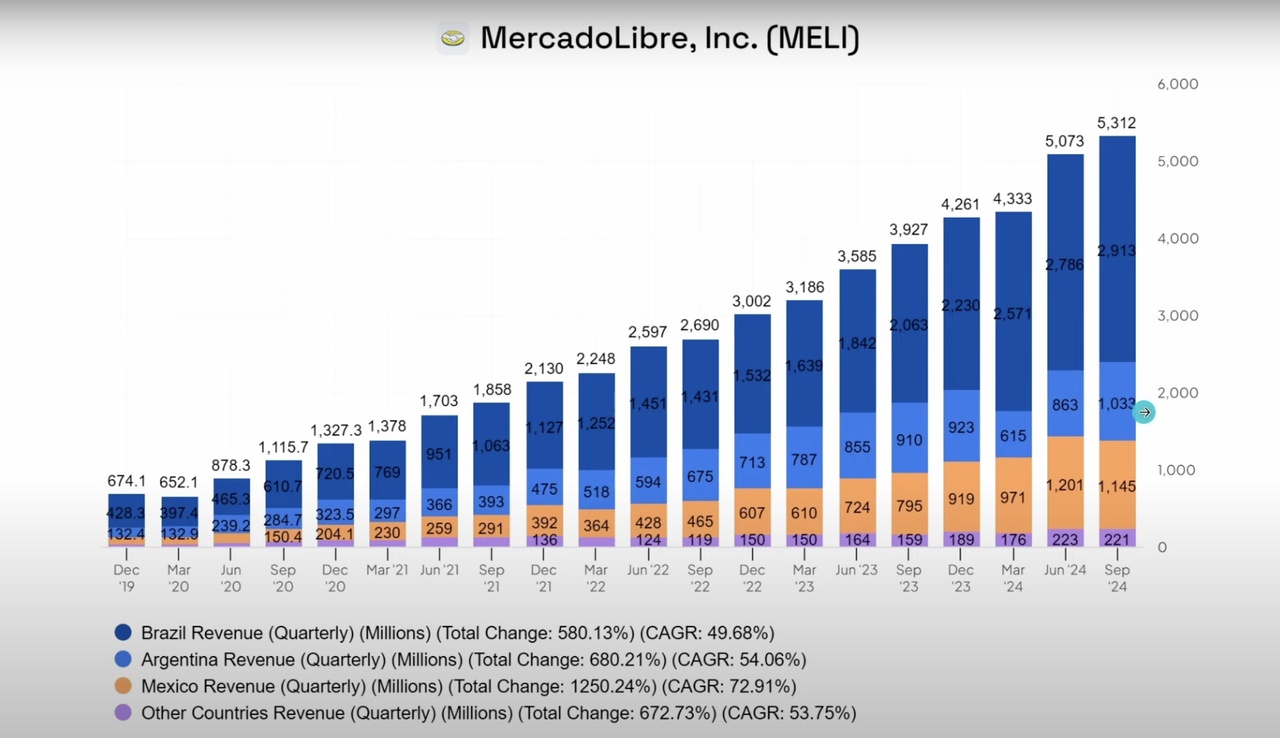

What currency fluctuations mean for Mercado Libre

$MELI (+1,51%) Mercado Libre generates most of its profits in Brazil, Mexico and Argentina. The Brazilian market accounts for more than half of its sales, followed by Mexico and Argentina with around 20% each. However, the financial reports are $MELI (+1,51%) in US dollars (USD). As a result, if the Brazilian real (BRL) weakens, the currency-adjusted profits also lose value. This problem led to increased uncertainty among investors after the Q3 earnings. However, if you look at the previous year, for example, you can see that the BRL had already lost purchasing power beforehand. These currency weaknesses can lead to a reduction in profits in the short term, but could diminish in the long term with the structural growth of the Brazilian economy.

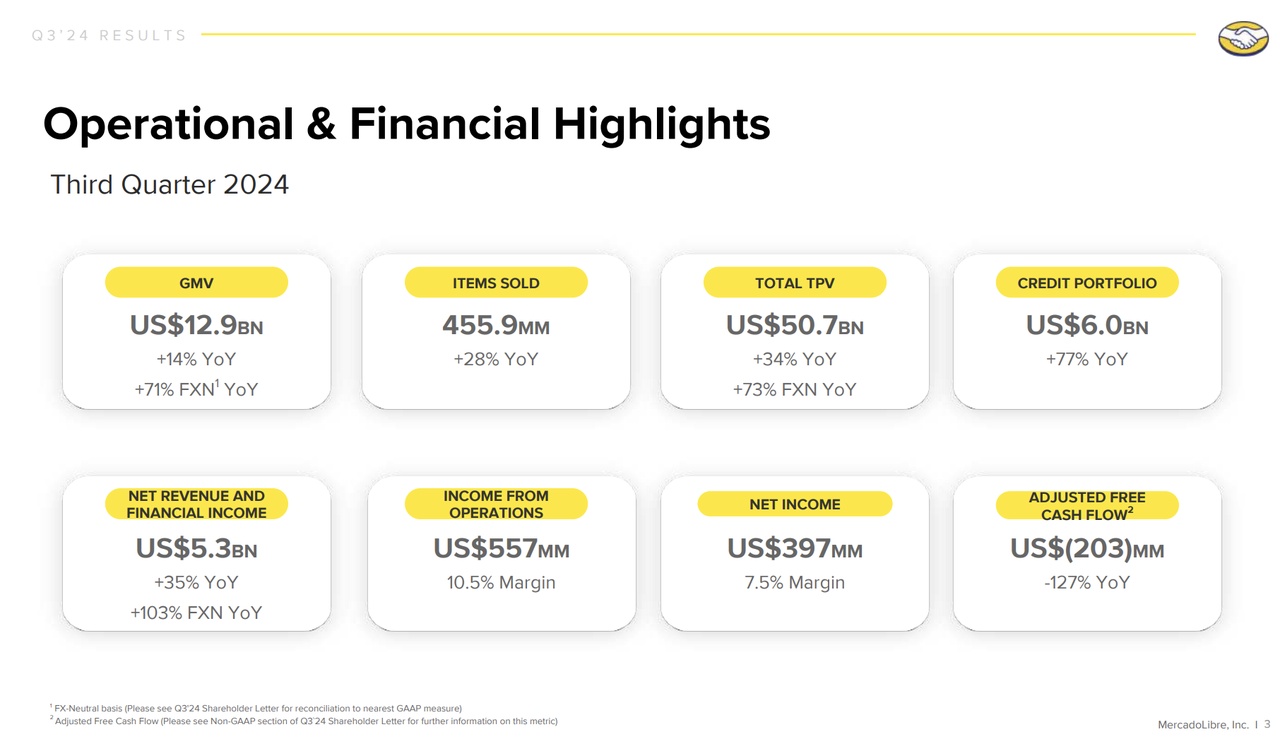

Despite uncertainties, Q3 '24 was also strong

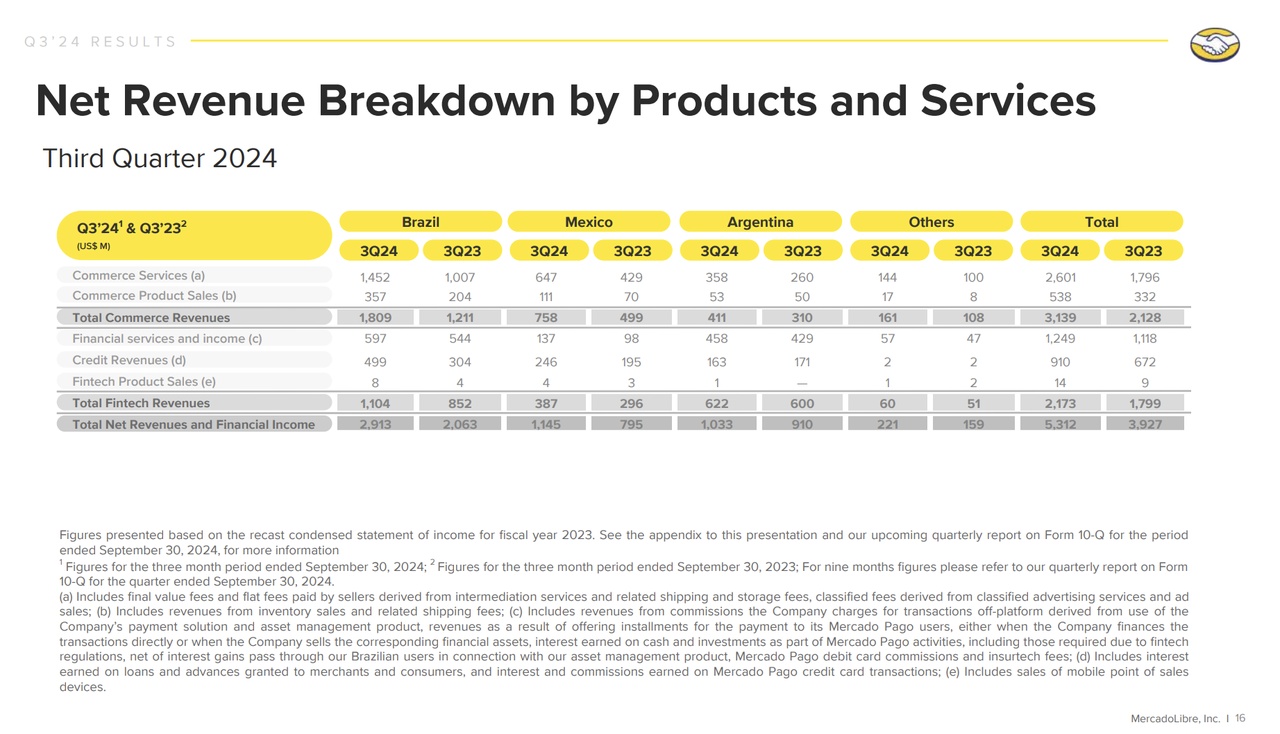

$MELI (+1,51%) consists of 2 core businesses: Mercado Libre, the e-commerce platform for peer-to-peer and B2C commerce and Mercado Pago, an FIntech platform that offers numerous services to both end consumers and merchants. In the past quarter, the operating KPIs tracking these two segments were very positive:

- The number of unique buyers increased by 21% year-on-year to almost 61 million (fastest growth after Corona). Fintech Monthly Active Users (MAU) also grew strongly, by 35% to 56 million compared to the previous year.

- Commerce volumes are increasing rapidly: Gross Merchant Volume (GMV) growth in Q3'24 at constant currency reached 34% YoY in Brazil and 27% in Mexico, driven by numerous initiatives to convert offline commerce to online commerce. In Argentina, growth in items sold accelerated to 16% as consumption trends improved.

- Loans growing at pace: Mercado Pago's loan portfolio reached $6 billion in Q3'24. This is an increase of 77% year-on-year, with growth across all products and markets. Credit cards grew the fastest at 172% year-on-year, with the portfolio reaching $2.3bn.

- Growing payment platform: Total Payment Volume (TPV) growth remains solid in all markets, with year-on-year growth of 30% in Brazil and 46% in Mexico at constant currency.

Mercado Libre

- Mercado Envios: The economic strength of the company has $MELI (+1,51%) managed to build an end-to-end logistics and shipping service that covers all process steps from storage to delivery

- On Mercado Libre, retailers also have the opportunity to advertise their products, thus generating Mercado Libre advertising revenue

- MELI+Similar to Amazon, there is a loyalty program which can be divided into 2 categories:

- MELI+ Essential (approx. 2$ per month) which includes free deliveries, discounts and other benefits on the platform

- MELI+ TOTAL (approx. 5$ per month) is the counterpart to Amazon Prime and extends the basic package with streaming services such as Disney+ and Deezer

Mercado Pago

- $MELI (+1,51%) s fintech arm which offers a suite of financial services, a combination of PayPal and Square

- Money can be digitally in a wallet to make online and offline purchases and also enable payment via QR codes, for example

- Mercado Credito enables consumers and merchants to take advantage of a wide range of financing options

- Mercado Pago also offers the option of depositing money in interest-bearing accounts and thus keep more cash flow on the platform

- For sellers, Mercado Pago offers payment systems and business process solutions that serve as a one-stop-shop for sellers and facilitate the entry into e-commerce

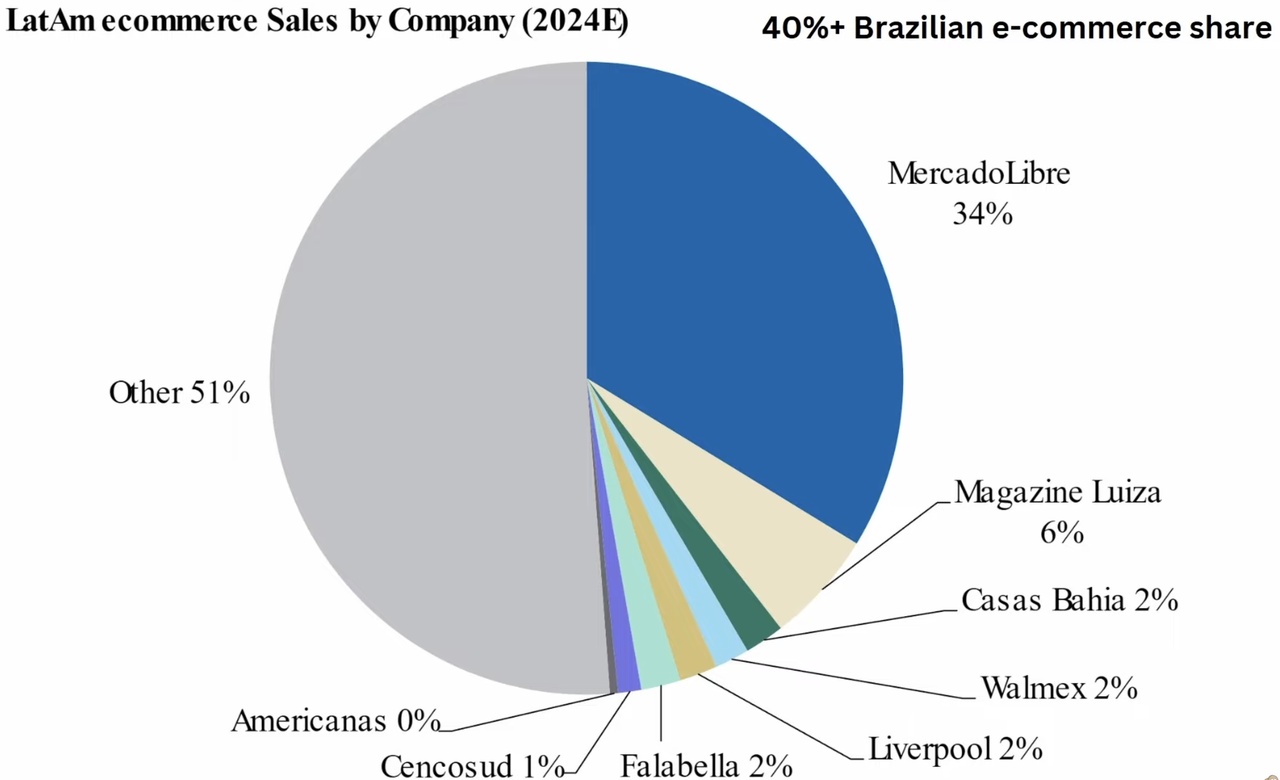

A potential 'tenbagger' in the long term

Due to the stable growth of the trading platform $MELI (+1,51%) is well positioned to control the majority of online commerce in Latin America. With the rapid growth of Mercado Pago's complementary financial services, MELI could control much more than just online commerce in the future, building an ecosystem that would be difficult to disrupt directly on the end consumer's cash flow. Large e-commerce players such as Amazon could only enter South America with major investments, but so far to no avail. Whether $MELI (+1,51%) can further expand its market share and become a quasi-monopoly in the region in future remains to be seen, but it seems plausible.

Personal anecdote

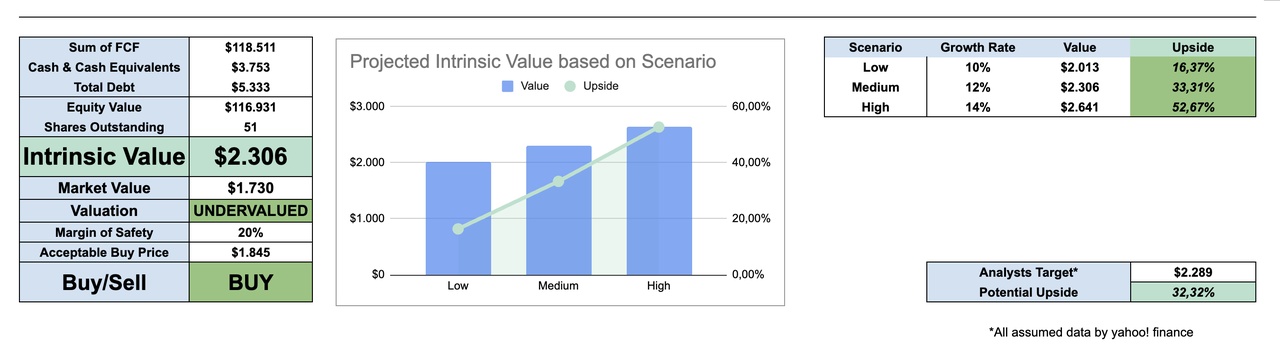

For my part, I have this company very high up on my watch list. Due to the enormous growth potential of the two businesses, the share price appears undervalued as at 12/2024. Assuming an average growth rate of 12% over the next 10 years (extremely conservative, 15-17% is more realistic), this results in a fair value of just under $2306, the current share price is just under $1730.