Depot review May 2024 - And another NVIDIA month!

It was May 2023 when the NVIDIA story began and in May 2024 NVIDIA continues to trump everything.

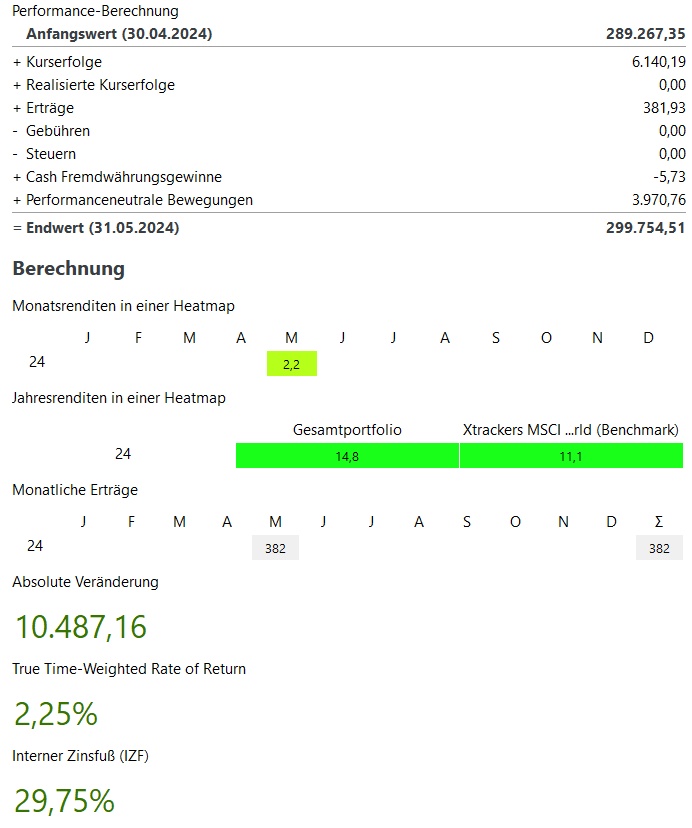

In total, May was +2,2%. This corresponded to gains of ~6.200€. The negative April (-2.2% / -6,500€) is thus balanced out again.

Winners & losers:

On the winning side there were NVIDIA there was actually only one notable asset with Ethereum. The main driver of the ~6.200€ price gains, however, was NVIDIA with over €4,000 in price gains.

On the losers' side it is a colorful mix of Salesforce, Starbucks, Sartorius or MasterCard - all with slight losses with the exception of Salesforce after the rather mediocre quarterly figures

The performance-neutral movements in April were €4,000. I bought in April for ~€1,400.

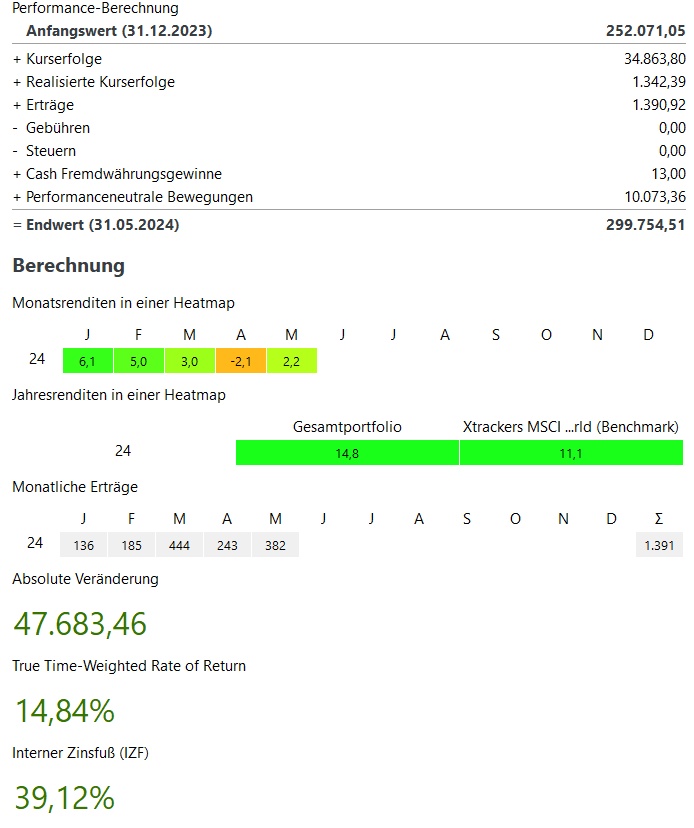

My performance in the current year is +14,8% and thus above my benchmark, the MSCI World with 11.1%.

In total, my portfolio currently stands at ~300.000€. This corresponds to an absolute growth of ~€48,000 in the current year 2023. ~36.000€ of this comes from price increases, ~1.400€ from dividends / interest and ~10.000€ from additional investments.

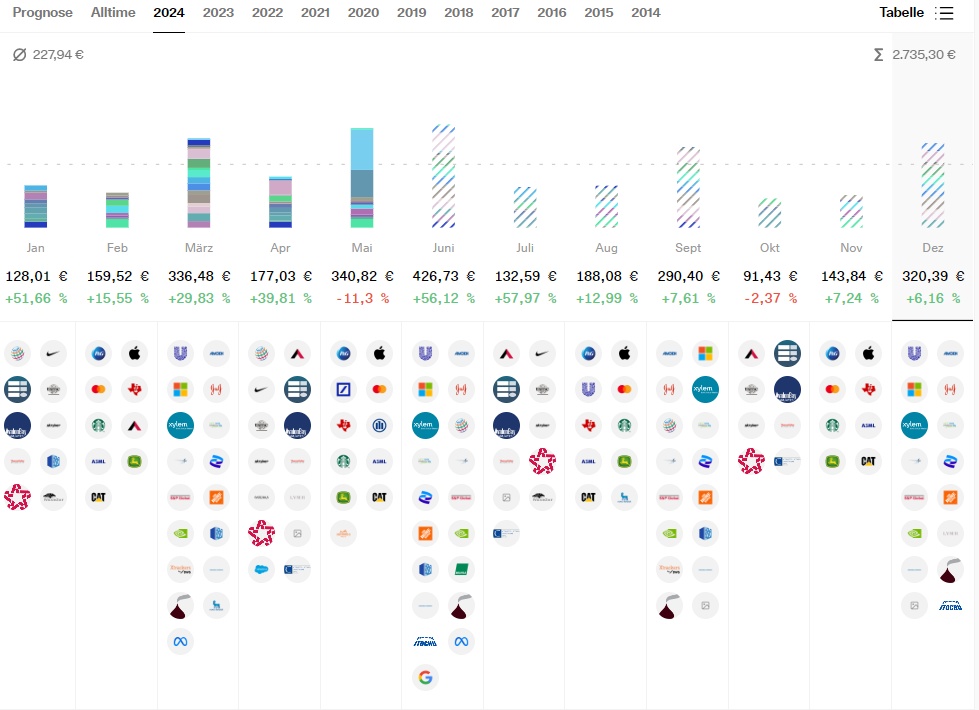

Dividend:

- The dividends in May were 11% below the previous year at ~€340

- This is the first month with a year-on-year dividend decline since June 2021

- However, there is a relatively simple reason for this - BASF paid out €85 last year, but BASF shares were removed from my portfolio a few months ago

- "Adjusted" for the BASF dividend, my dividends have grown by just under 15%

- In the current year, the dividends after 5 months are +14% over the first 5 months of 2023 at ~1.130€.

Buys & sells:

- I bought in April for approx. 1.400€

- As always, my savings plans were executed:

- Blue ChipsAlimentation Couche-Tard $ATD (+0,05%) Alphabet $GOOG (-0,71%) Amgen $AMGN (+0,34%) Caterpillar $CAT (+0,3%) Hershey $HSY (-1,12%) Johnson & Johnson $JNJ (-0,32%) Procter & Gamble $PG (-0,82%) S&P Global $SPGI (+0,88%) TSMC $TSM (-1,18%)

GrowthBechtle $BC8 (+2,26%) Synopsys $SNPS (+1,58%)

ETFsMSCI World $XDWD Nikkei 225 $XDJP and the WisdomTree Global Quality Dividend Growth $GGRP- CryptoBitcoin $BTC and Ethereum $ETH

- Sales there were none in May

Target 2024:

My goal for this year is to reach €300,000 in my portfolio. Thanks to the extremely positive market performance this year, I was already able to break this figure in May and even reached €307,000 in the meantime. In the last few days, the value has fallen slightly below €300,000 again - I am curious to see what the remaining 7 months will bring.