Leverage ETFs for double or triple returns? And then hold them for the long term? But they have such blatant drawdowns, financial flow and AktienMitKopf warn against it, there must be something you can do?

You can! Here are my two pennies.

Surely some still remember the posts of @Xeophon about leveraged ETFs. Thereupon I thought to myself, like some others probably also, "Yes super double yield, but for years huge drawdowns sit out is somehow also too hot for me". But then at the end the golden words, "You can massively minimize these by putting uncorrelated leveraged Treasury Yields in your portfolio." Of course, as an average ETF saver, you immediately go into overdrive when you read "uncorrelated, leveraged Treasury Yields." What is that? What's that for? I don't want to read into it. It's too complicated for me. Anyway, those were my first thoughts when I read about the HFEA strategy as a stock market newbie in 2020. But now, almost 1 year later, the words leveraged treasury yields ring a bell. There was something there. And off I went into the rabbit hole called HFEA. With over 13000 posts and countless backtests and analyses, you have reading material for a few weeks.

What does HFEA mean?

Derived from the 2019 thread of the same name in the Bogleheads forum: "HEDGEFUNDIE's excellent adventure [risk parity strategy using 3x leveraged ETFs]".

TLDR, how does this one work?

By holding uncorrelated leveraged assets like the S&P 500 x3 and US Treasuries x3 at a 55/44 ratio, you increase return more than you increase risk (https://www.whitebox.eu/faq/was-bedeutet-risikoadjustierte-rendite ). So you take the leverage up and at the same time remove the disadvantage of the daily reset of the ETF, through lower drawdowns. So: savings plan, every 4 months rebalancing and ready is the bower. Excess return but only slightly higher risk than holding an unleveraged S&P 500 ETF.

But where is the risk?

The risk is that if the S&P500 and Treasuries crash at the same time you lose everything. But that has never happened in the last 30 years according to Hedgefundie. and generally very unlikely. See the linked thread for more details. It is worth mentioning that Treasuries correlate more strongly with stocks, the shorter their maturity is. And this is also the biggest problem for German investors: In DE there are no leveraged US Treasuries with 20+ years maturity. In DE, not everything is leveraged so easily! US Treasuries 20y x3 daily short are available... Further risk: ETPs are not ETFs, see sources. Everyone must evaluate the risk himself.

I have Trade Republic, I have money left, where is WKN?

To drive the strategy as easy as possible in Germany you have to make 3 trade-offs.

1. no x3 ETFs in Germany, so you must either resort to the WisdomTree ETPs or buy CFDs at eToro. There are supposed to be European products at Trading212 that track the US indices. But whether T212 or the products are so cool I doubt.... more details about eToro CFDs, Trading212 etc in the sources.

2. there are no leveraged US Treasuries with 20+ years maturity. Alternative: WisdomTree US Treasuries 10y x3. As said the short-dated treasuries correlate less with stocks than the long ones, which is not good for us, (you can exchange the ticker TYD(Treasuries10y) with TMF(Treasuries20y) in the backtest and compare the Final Balance 😭 )

3. tax free rebalancing is not. Since rebalancing is essential for survival, you have to bite the bullet and pay the taxes. After all, the cigarillos in the Harz4 district don't buy themselves.

Finally I would like to say that I simply do not know anything about trading US products in Europe and foreign brokers. I just wanted to follow the HFEA strategy as simple as possible without registering with 20 brokers or doing my taxes myself. And this is mMn easiest on Trade Republic with the WisdomTree ETPs, for which, by the way, you can also set up a savings plan. And we love savings plans. Absolute savings plan base investment is what they say on Getquin I think 😘 No seriously, savings plan is important, especially with the MSCI USA x2, otherwise you hang in the worst case 20 years in the red. Whether CFDs, ETPs or T212, which means more risk must tell you others.

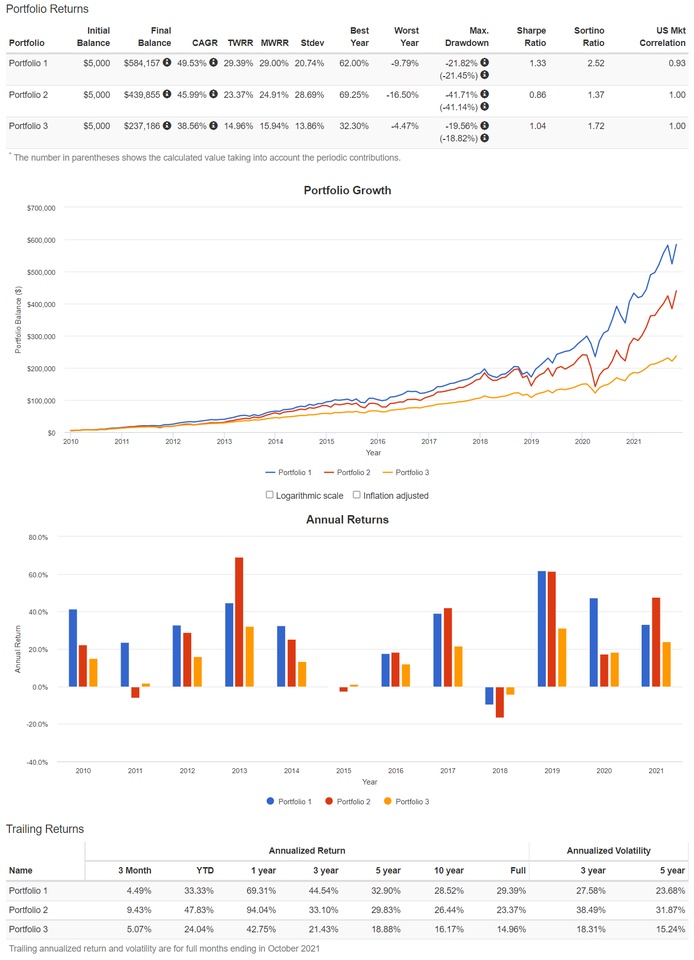

I attach a backtest, 2010-2021, comparing 55/45 S&P500x3/Treasuries10yx3(Portfolio1) with the S&P 500x2 ETF(Portfolio2) and the unleveraged S&P500 ETF(Portfolio3) with one time investment of 5000$, monthly deposit of 500$ and 4-monthly rebalancing. (You can't choose the WisdomTree parts and the MSCI USA x2 on the site of course, but cutting corners is what we are used to, so I chose comparable ETFs).

Worth mentioning: the maximum drawdown of Portfolio1 is with 21% only minimally higher than that of the unleveraged S&P500(19%), the Final Balance with $584,157 however more than twice as high($237,186). (the final balance of the original HFEA portfolio with 20y Treasuries would have been $837,319 over the same period...). Further backtests are linked in the HFEA thread, where more than just the corona crash is included. As I said, absolute Rabbithole.

That's it from me for now. Beautiful Sonntach and Tschüssing! Say hello to my wife when you see her.

Sources:

Posts by @Xeophon: https://app.getquin.com/activity/DwsljatSPN

https://app.getquin.com/activity/HkVUyjKzMB

HFEA Thread 1 https://www.bogleheads.org/forum/viewtopic.php?t=272007

HFEA Thread 2 https://www.bogleheads.org/forum/viewtopic.php?f=10&t=288192

Risks from the WisdomTree things: https://www.bogleheads.org/forum/viewtopic.php?p=5961677#p5961677

HFEA, eToro, trading212, HFEA in Europe: https://www.reddit.com/r/LETFs/comments/qkyj1h/hfea_via_cfd_on_etoro_as_a_european/

https://www.reddit.com/r/LETFs/comments/qdwdi2/letfs_optimal_portfolio_eu_version/

What the fik are Treasuries? https://www.zmp.de/forum/zmp-terminmarktwelt/t-bonds-unterschiede-verschiedener-us-staatsanleihen

I don't know anything about leveraged ETFs, help: YT /watch?v=ODKgYTlS4Rg (contradicts the backtests and is very superficial, but explains simply and understandably about the specifics of daily leveraged ETFs)

P1: S&P500x3/Treasuriesx3, P2: S&P500x2, P3: S&P500