The recent development of $NOVO B (+3,27%) around the oral Wegovy appears to promote growth at first glance, but on closer inspection turns out to be a clear burden on profitability.

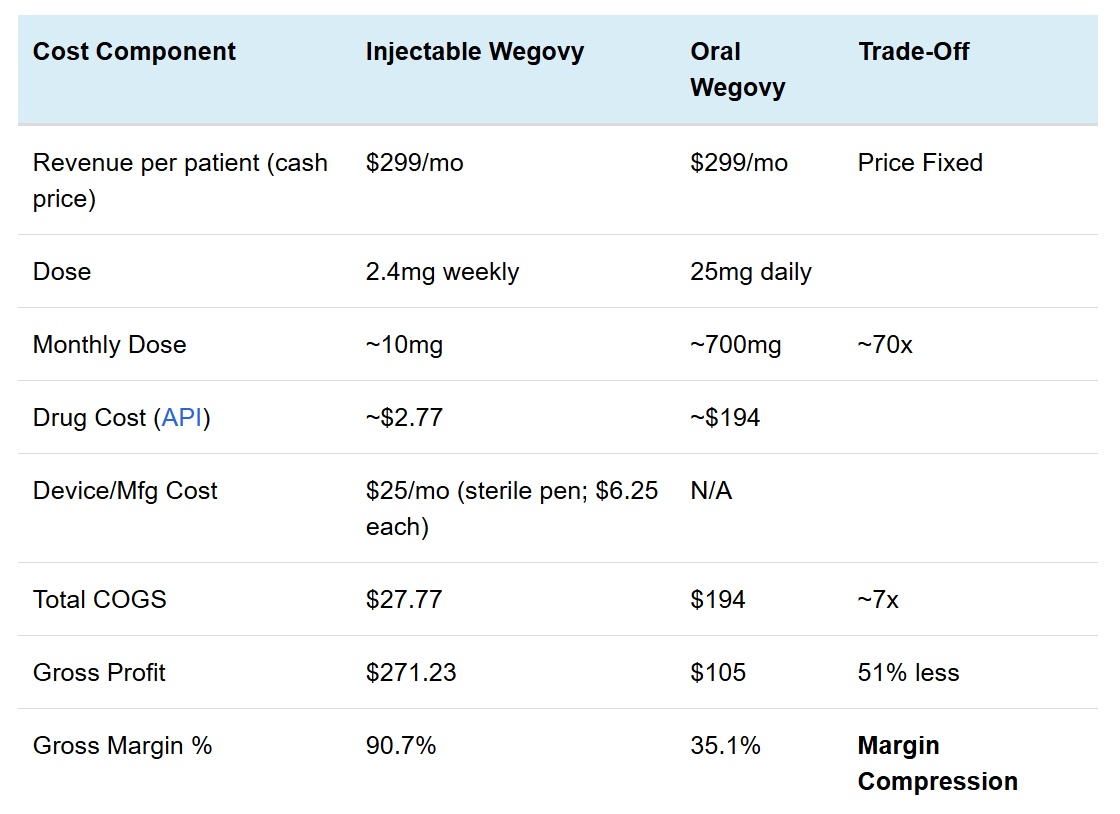

Due to the very low bioavailability of an orally ingested peptide, around 70 times more active ingredient has to be used compared to injections. At the same time, prices for Wegovy have fallen significantly, leading to sharply rising production costs and falling revenue per patient and putting margins under considerable pressure.

This means that sales do not necessarily increase, as the margins reduce this effect. In addition, the advantage is only there as long as Lilly does not launch a product on the market. In addition, this leads to lower margins in the entire pipeline.

Competitive pressure further exacerbates the situation. $LLY (-0,3%) Lilly is about to enter the market with an oral GLP-1 product on a small molecule basis, which is structurally cheaper to manufacture and puts Novo at a long-term disadvantage in terms of both price and margins. Despite potential sales growth, this threatens a sustained deterioration in earnings quality.

As a result, Novo still remains a risk area for me: value is not yet being generated here and the risk/reward profile does not fit for me!

The future will show: Will NOVO get 3x more customers as a result of the price cut? Then the price cut will have paid off and sales will remain the same. Has the barrier to trying Wegovy through oral pills fallen? (YES) But as I said, this can take time and initially weigh on sales!

My motto: Wait and see how it establishes itself, you may lose a return of 20% but you have certainty!