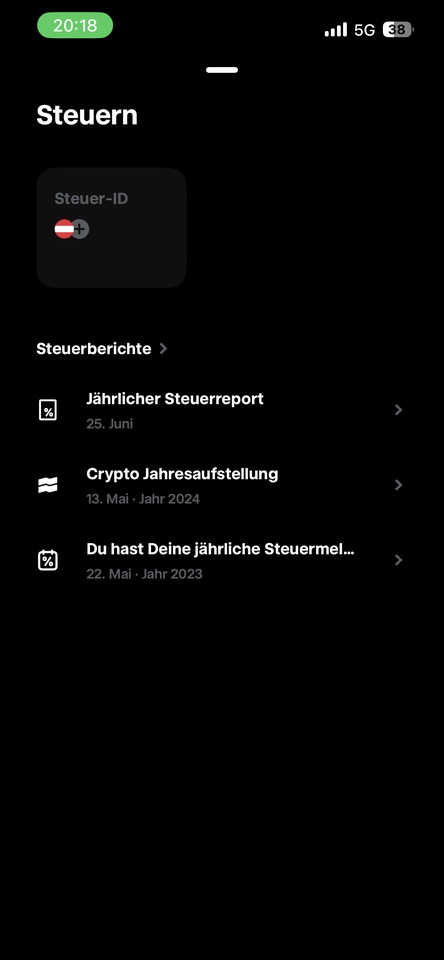

a) Shouldn't my loss pot be visible at this point?

It's not worth mentioning that I wrote to support weeks ago and didn't get an answer. (I don't expect that either🥲)

But time is running out, in Austria the loss pot is zeroed every year on the first of January.

b) Furthermore, I wanted to ask if it has ever happened to you to sell shares with a profit at Trade Republic and not pay taxes directly because losses were offset. I'm not sure but I think I've always had to pay the taxes first and then got a tax credit afterwards.

c) Today at around 15:45 $HIMS (+0,69%) and $IREN (+0,9%) with a three-digit loss and then bought the shares back at a lower price with limit orders.

c1) Does this work in Austria? I read somewhere that one day must pass... I can't imagine. What does it look like?

c2) Does Trade Republic correctly account for the loss now and any profit later when selling?

d) Does Trade Republic in Austria use the average price principle or does it still use the German FIF0?