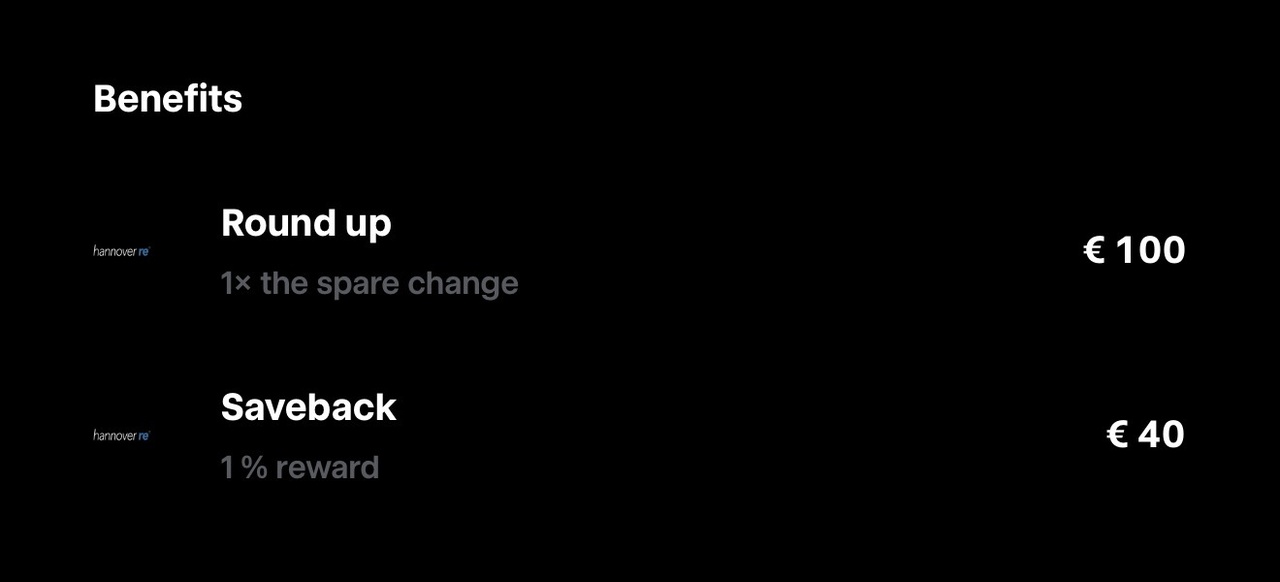

Since the beginning of June, I have been using the Trade Republic card for almost all payments in order to receive 1% cashback in the form of shares "for free". So far I've collected €40. On top of that I get another 100€ through round up. In contrast to Saveback, you pay this part yourself by rounding up card payments.

I have therefore invested a total of €140 in Hannover Re shares ($HNR1 (-0,04%) ). I would like to use the dividends to finance my vacation in the future :D