Dear Community,

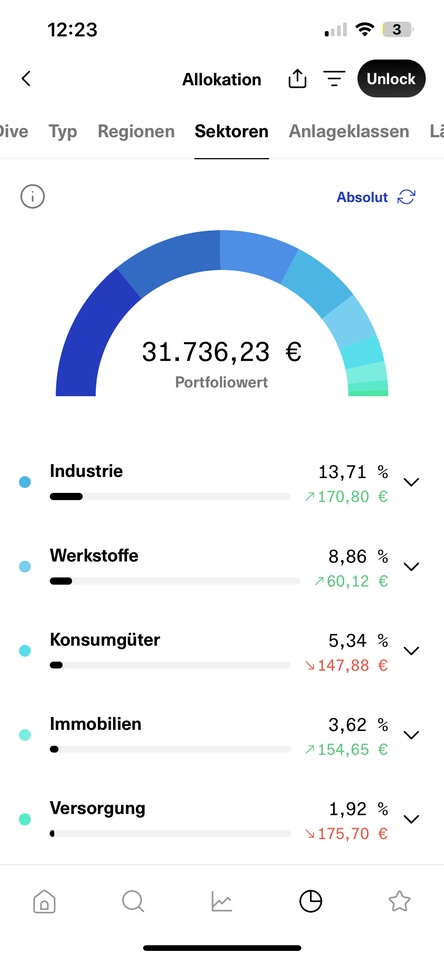

here are the sectors of my depot

I think I have too much consumer staples...and too little healthcare!

I also think I have too much tech in my portfolio and I'm missing strong healthcare companies.

I would like to $LULU (+1,01%)

$EKT (-0,06%)

$ZBRA (-0,61%)

$ADM (-0,43%) and $MNST (-0,43%) throw them out.

$PEP (-0,05%)

$CAT (-0,77%) I would buy more shares before adding new ones.

Which stocks from the financial sector do you find interesting?

i would also like to reduce the size of my portfolio so that i have a better overview.

Thank you very much!

what would you do specifically