Happy New Year, everyone! Peter Griffin here. 🍺

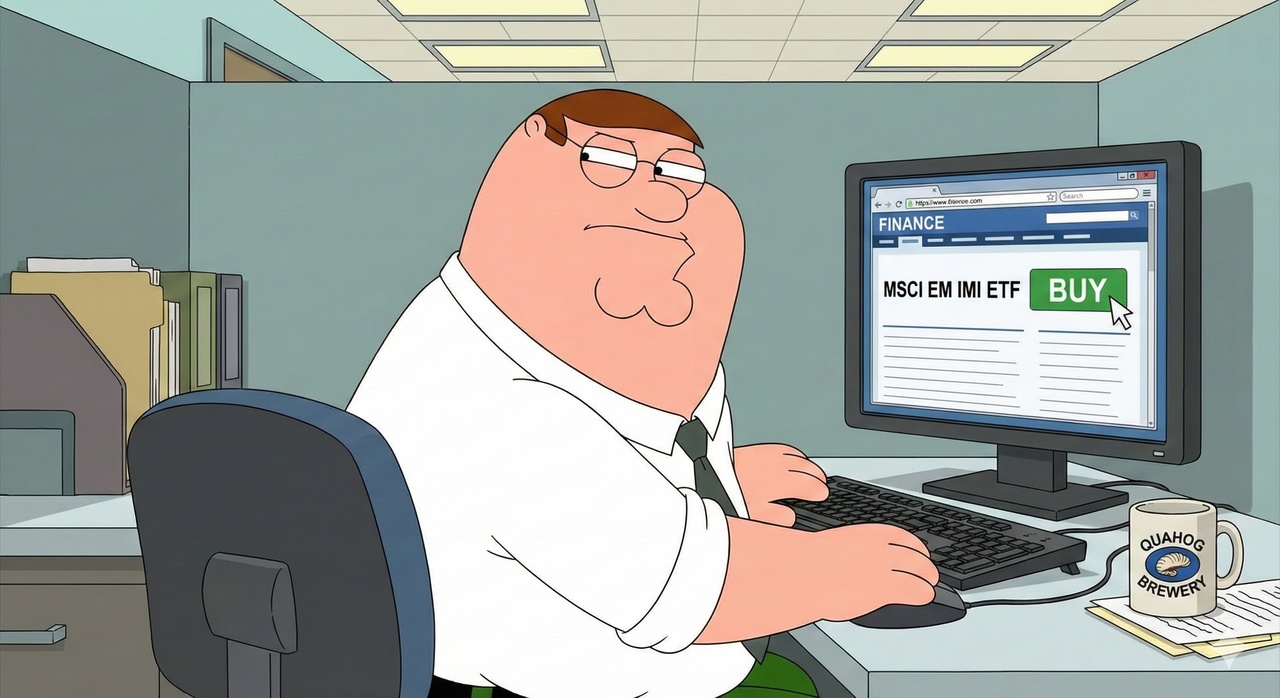

New year, new luck for my portfolio. My strategy for my core ETF holding is: 90% MSCI World and 10% Emerging Markets IMI.

But when I looked in at the start of the year... damn! My emerging markets allocation was far too low and far away from 10%. The portfolio had lost ground!

So I traded directly on January 5 to get everything back on track:

👉 12x $EIMI (+1.85%) - here I added a lot more.

👉 1x $IWDA (+0.55%) - just a small position.

With this purchase I have increased my rebalancing and am back to my clean 90/10 allocation.

Now the whole thing looks "freakin' sweet" again.

How are you starting 2026?

Here's to a green 2026! Hehehe.