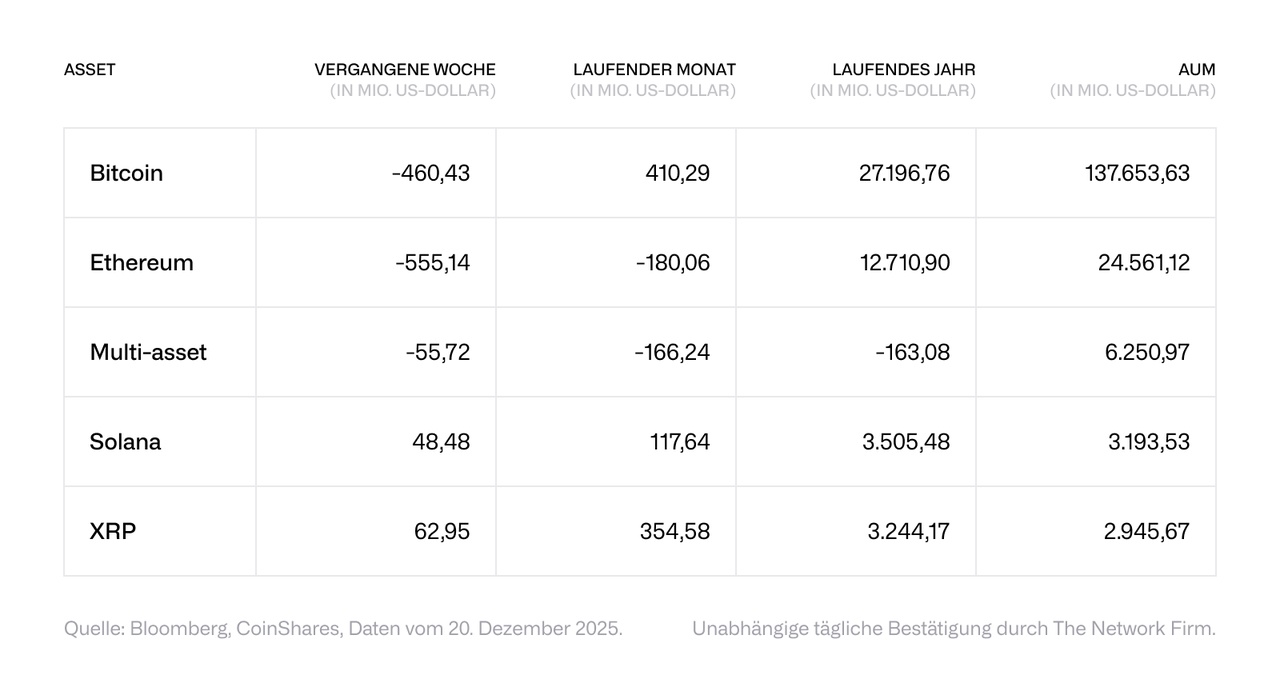

Digital asset investment products saw outflows of USD 952 million for the first time in four weeks. For James Butterfill, CoinShares' Head of Research, this reflects a negative market reaction to delays in the passage of the US Clarity Act, which have prolonged regulatory uncertainty for this asset class. Added to this were concerns about continued selling by so-called whale investors. As a result, it now seems extremely unlikely that exchange-traded products will exceed last year's inflows. Total assets under management currently stand at USD 46.7 billion, compared to USD 48.7 billion in 2024.

#ethereum recorded the largest outflows totaling USD 555 million. This is understandable, as Ethereum has the most to gain or lose from the Clarity Act. It is important to note that inflows this year have significantly exceeded the previous year's level: They amount to USD 12.7 billion so far, compared to USD 5.3 billion last year.