After the short overview of the business figures of $INRN (-1,12%) now the share presentation

💡 Once again a share presentation and of course from a Swiss company.

Interroll is a leader in products and solutions for material flow in logistics. In short, conveyor belts and sortation systems in airports and large warehouses. Among its 28,000 customers worldwide are companies such as Amazon, Coca-Cola, Coop, Walmart, etc.

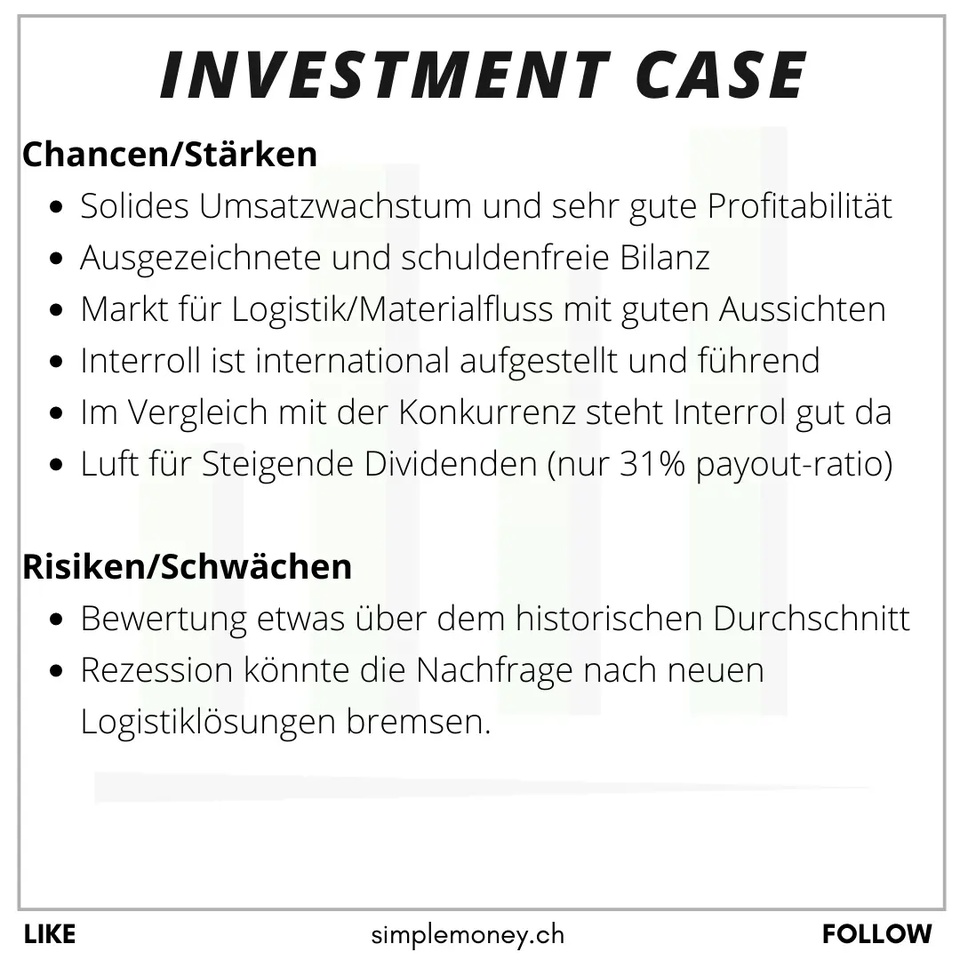

The Swiss company is therefore a market leader in an important and growing

market.

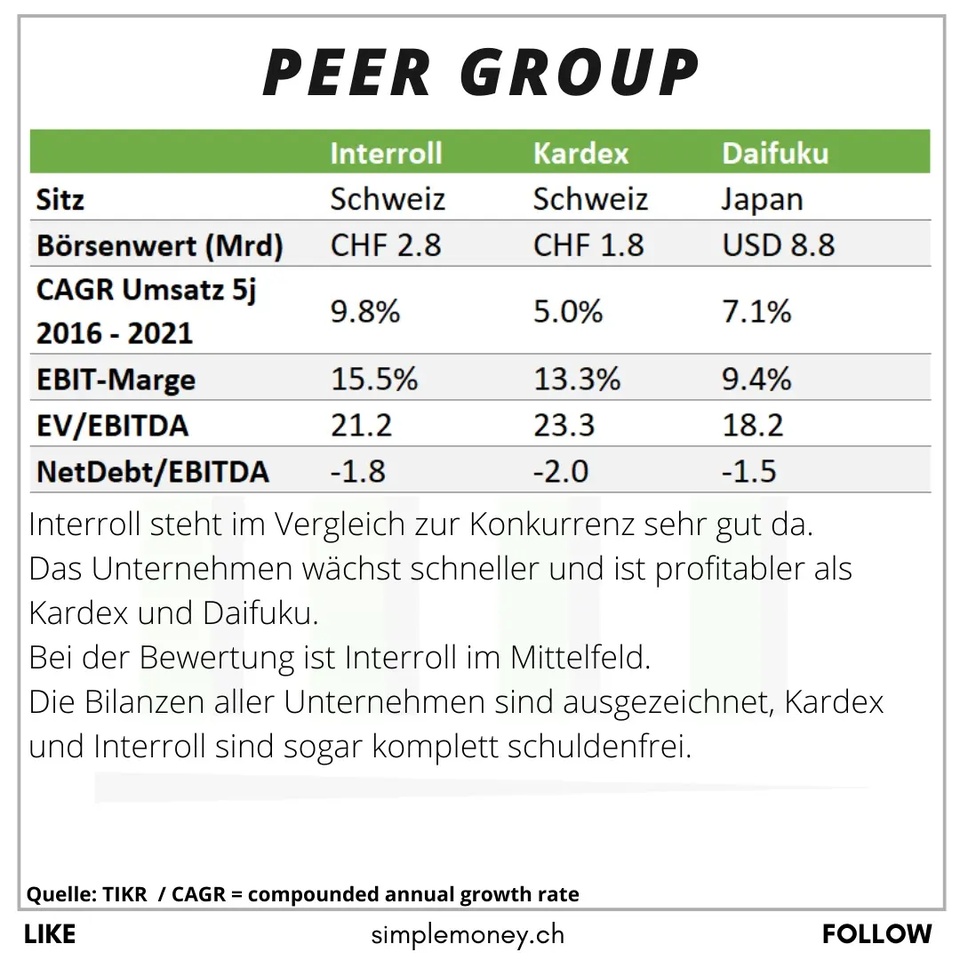

💪🏻 Compared to its competitors, Interroll does not have to hide. The company is growing faster and is more profitable than the competition from Switzerland (Kardex) and Japan (Daifuku).

📊 Interroll's balance sheet is also very strong and debt-free.

💸 The Interroll share comes with a dividend yield of just under 1%, so perhaps not the first choice for dividend investors. But watch out: the dividend has increased by over 17% per year on average over the last 5 years and the payout ratio is only 30%.

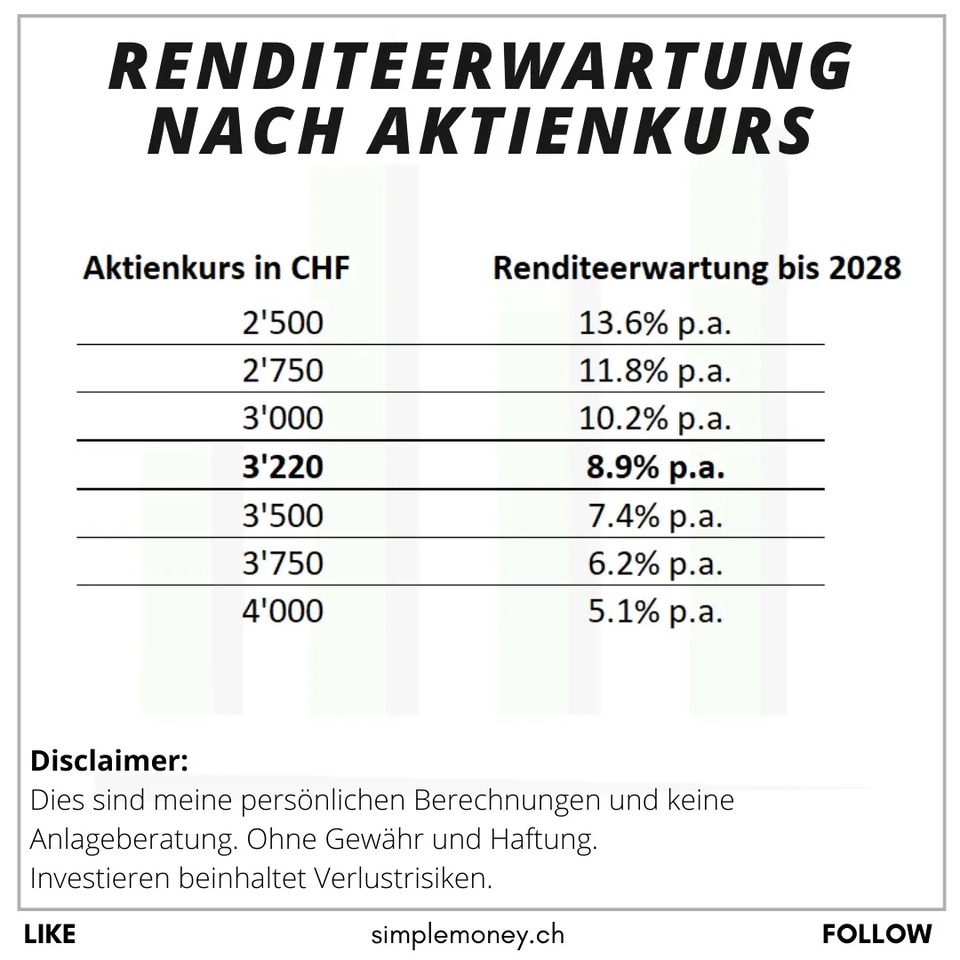

📈 Valuation:

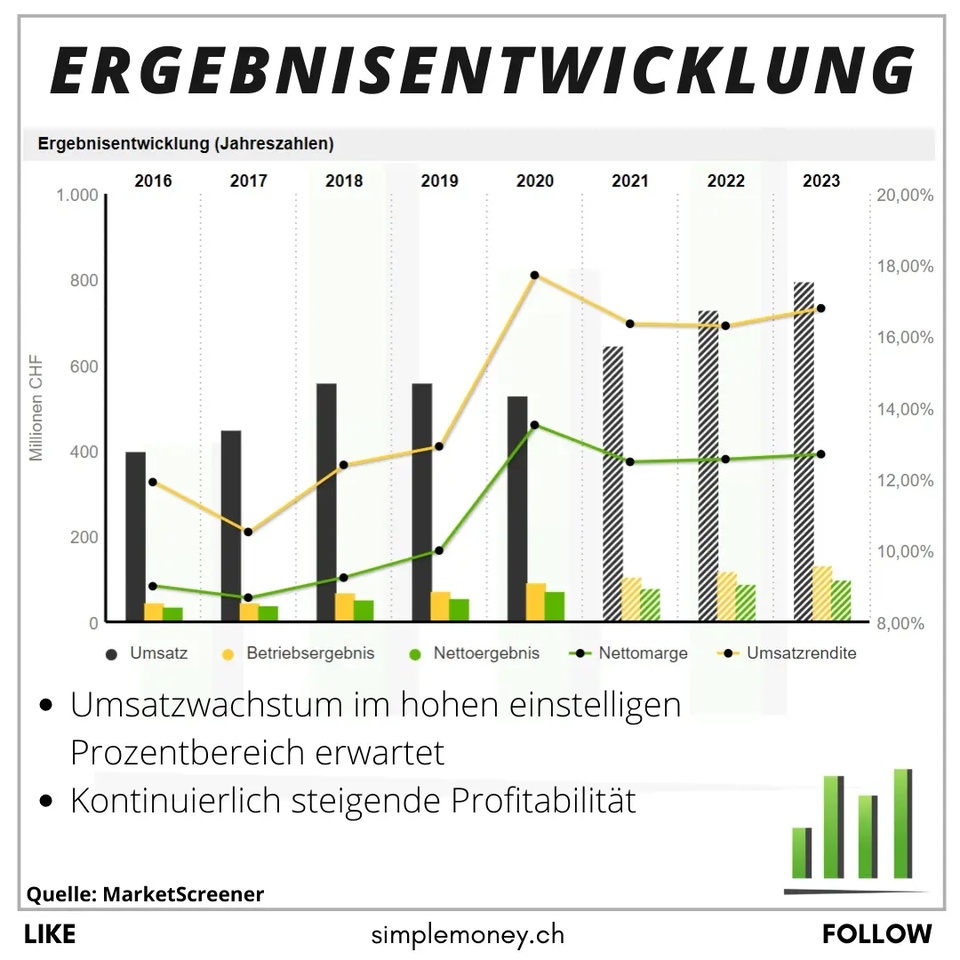

Currently, the valuation is still slightly above the historical average. In my model, I expect sales growth of around 8% - 9% for the next 6 years with slightly increasing margins. With a P/E of 26 (10y average) in 2028 plus dividends and share buybacks, I expect a return of a good 8% p.a. for the Interroll share.

Did you already know Interroll, do you find the company exciting?

You can find share analyses, my portfolio and much more on my blog. simplemoney.ch

No investment advice or liability from me. It is my personal opinion.