Why "green" hydrogen can't live up to the hype. - Part 2

Values Community,

First of all, a big thank you that my last contribution on the subject of "hydrogen" was so well received or even sourly received.

In order to understand the context, I ask you to read part 1 as well, so that as few misunderstandings as possible occur.

https://app.getquin.com/activity/MDWIzGWvkU?lang=de&utm_source=sharing

Here again 5 reasons why the stock market values "green" hydrogen too high. Numbering follows the last post.

Please take a more speculative view. Clairvoyance is not my superpower.

6. storage medium, no energy carrier!

Contrary to the perception of many, hydrogen does not serve as an energy carrier, but as a storage medium.

Hydrogen can be produced extremely cheaply via electrolysis in the event of overproduction on the power grid. Why? The efficiency does not matter at all. The electricity is surplus anyway and is not needed anywhere else.

In fact, we would already have this surplus of electricity in Germany today. Due to the high prices, however, it is probably more lucrative to export it than to promote domestic electrolysers with it. It doesn't matter whether the electricity is generated from renewable sources or fossil fuels, and thus at least laying the foundations for a sustainable hydrogen industry. I can recommend the negative success story of the highly praised "WunH2" project in cooperation with Siemens. $SIE (+1,12%) , can be recommended. The failure should, speculatively, have a signal effect.

7. geopolitics - finally new dependencies again.

Hydrogen should serve the general public accordingly for "everything". Heating medium, alternative fuel, chemical raw material, ...

However, nobody questions the production sites. These will not be able to take place in the temperate climate zones. Europe is also generally quite limited due to population density. This means that production sites are already being relocated to more southerly countries, such as those bordering the Mediterranean or African states. There are also concrete plans for hydrogen pipelines to Europe. Algeria, Angola, Egypt, ... These are all countries that are generally known for their legal security and economic obligations.

But what is the disadvantage, although it would of course be more efficient because of the solar intensity? We are once again becoming dependent, but in the case of an "energy turnaround" this will hit us much harder than the last time we were dependent on Russia.

None of today's investors can say in retrospect that they did not know this. $PLUG (-7,89%) are already reaping the fruits of great investments, especially in Egypt, according to one magazine, or even the German flagship company $PNE3 (-0,25%) with its involvement in South Africa.

8. safety first!

Hydrogen is probably the most dangerous gas in terms of explosiveness that could be handled. From a volume concentration of 18%, it inevitably leads to an explosion on contact with atmospheric oxygen! Furthermore, it is still flammable from 4% volume concentration.

Who wants to be around in the event of a leak from a pipe, container, motor vehicle, etc.? Volunteers? - Please don't!

Examples for the extent of such a reaction is for example the crash of the Hindenburg. Here, however, "only" a fire occurred, because the concentration of oxygen in the air was too low.

A possible solution would be the mixture with nitrogen. However, according to the risks involved, this would mean that a volume concentration ratio of approx. 95/5 would have to exist. This aspect alone again speaks in favor of the air separation giants Linde $LIN , Air Liquide $AI (+0,4%) , Air Products $APD (-0,91%) or also Nippon $4091 (+0,67%) to name a Japanese company, which would find new sales opportunities in the field of nitrogen for safety reasons.

9. storage and capacities

A topic that is very rarely addressed, but is part of every value chain - storage.

It's not as simple as people like to think: "Let's just do away with natural gas and use the existing infrastructure for hydrogen." Nonsense! Hydrogen and natural gas are fundamentally different in their makeup! Hydrogen is the element with the highest energy density, but it is also the most finely porous. This means: Hydrogen would still volatilize in existing storage facilities because the porosity, i.e. the ratio of the void volume to the total volume, of the materials is for the most part insufficient in Germany.

Hydrogen is transported and stored in liquid form. Hydrogen is compressed to 700bar and cooled in isolation at -250 degrees Celsius.

This would benefit plant manufacturers such as Sulzer $SUN (+1,54%) , Voestalpine $VOE (-1,31%) or Hexagon Composites $HEX (-1,04%) .

In context, this means that the infrastructure must first be created before we can even think about regenerative hydrogen in the future. In my contribution to Vorwerk $VH2 (-0,99%) from which I would advise against at the moment, I also explained profiteers of the infrastructure change. For example Vinci $DG (+0,05%) , Ferrovial $FER , Hochtief $HOT (+4,71%) or Strabag $STR (-1,77%) .

Realistically, it will be in Germany only in 20+ years, which for me again does not reflect the current stock market values of the H2 companies.

For the time being, I exclude the adsorption of hydrogen to solid or liquid media. From the current point of view, it does not seem to be a mass solution for the whole society.

10. mobility in individual traffic

The biggest dichotomy, with many still seeing renewable hydrogen in the race, is private individual transport.

The electric car will dominate private households and rightly so! The big disadvantage of the hydrogen car here is efficiency.

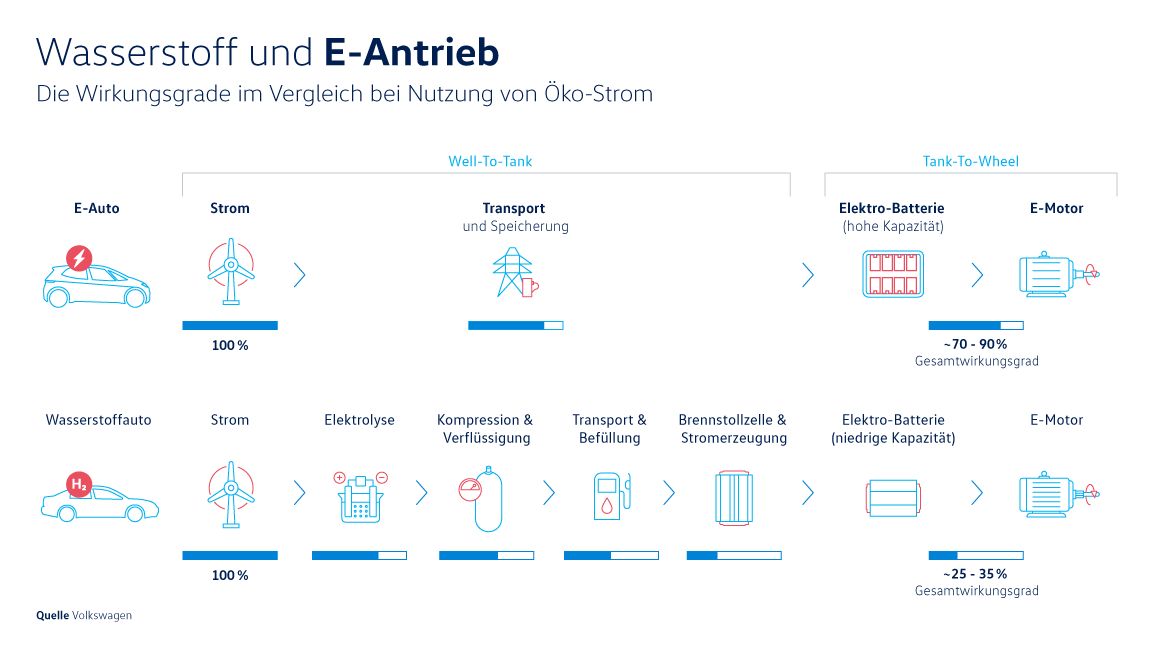

While electric cars can use electricity without further conversion and have an efficiency of between 70% and 90%, the form of energy in the hydrogen car must be converted several times.

Here, green hydrogen is produced with the help of electrolysis. For transport, this is compressed and liquefied. Only then is the vehicle refueled. The back reaction of the electrolysis now takes place by means of a fuel cell. An illustration of this can be found in the appendix.

Nevertheless, it is of course up to you to decide which fuel form you will prefer in the future, and this is in no way intended as an appeal to drive an electric car in the future. Compared to other carriers, however, it is the most sensible option in terms of efficiency.

I hereby expressly ask you to note that this is exclusively about the passenger car in this point. For reasons of resource conservation alone, I am in favor of the fuel cell as a drive system for freight transport on roads and railways, as well as in aviation and at sea.

Further energy sources and possibilities of the future power mix I will explain in further contributions.

Of course, if there is also interest, the pro-hydrogen arguments can also be brought to light in further articles. Because these outweigh without question. Nevertheless, the hype, as it is currently traded, is simply unjustified and at least 20 years too early. The stock market may trade the future, but dreaming will be punished.

Planned and already in process is:

- Why it still makes sense to invest in oil and gas producers for 30+ years.

- Waste-to-Fuel - Away with the garbage!

- Regenerative methanol production and the real opportunities for C02 reduction.