Good morning dear Getquin members,

a healthy and successful 2025 from me too.

Today I am writing a post on the computer and hope that the grammar and sentence structure is better than on the mobile device.

My thanks go to the members here:

@Simpson

@TomTurboInvest

@InvestmentPapa

@Lorena

@Alumdria

@DividendenWaschbaer and many others who have changed their names or are no longer active here. Great contributions, interesting dialogs and stay as you are.

It was a coming and going (thank God) of some users here. But the population has remained except for a few who are no longer active here.

So now to my post background:

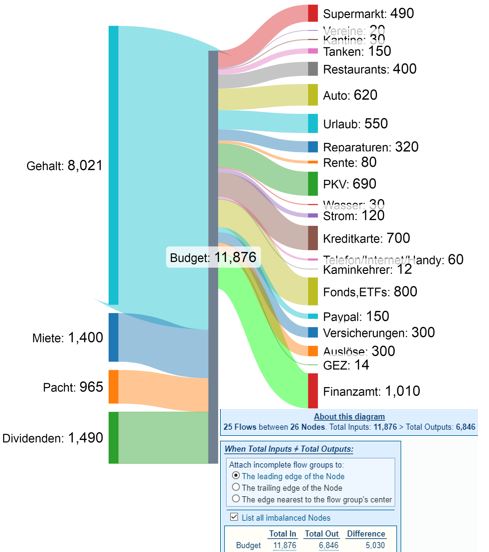

I received a lot of Sankey from you in 2023 and always asked myself how I was doing. After (unfortunately) not keeping a budget book for a long time, in 2024 I had the motivation to meticulously document my expenses every day. Even in the pub, on vacation or anywhere else, I had a small backup book with me and wrote down the beer mat. :-)

Now here is the overview for you.

My other monthly or one-off income and expenses. At the end of the year 2024 divided by 12, this gives you an overview of my average monthly income vs. expenses.

My expenses are surprisingly high:

- Purchases in supermarkets ~500 EUR per month (food and drinks)

- cars Mobility ~650 EUR (insurance and repairs) without refueling

- Vacation ~550 EUR (I go on vacation twice a year for 3 weeks - that costs, as well as a weekend in the Alps once a month)

Since I expect higher costs in 2025 (property tax (taxes are robbery), mobility and various increased insurance premiums that are already here for transfer, I will look at the potential for savings in detail...

The employer has also reduced the salary (special payment and Christmas bonus) by approx. 5% in 2025, the 2% pay rise won't help here either

I received the graphic here: #sankey

#sankeychallenge

https://sankeymatic.com/build/

Sankey Motivations received from: @Fabzy

@DonkeyInvestor

Result of my Sankey budget book:

Income minus expenses is savings amount (wrote a user here the other day) is invested in

2 parts: $VWRL (+0,27%)

2 parts: $VUAG (+0,6%) and

1 part: $CSNDX (+1,31%)

So if you have any suggestions, motivations or questions, please leave them in the comments.

So long Smudo