I am currently working with Constellation Software $CSU (-2,36%) and am wondering whether the market is currently overreacting here. Since the all-time high of over CAD 5,300, we have fallen to around 3,200 CAD down.

Why the sell-off?

- Leonard's departure: Mark Leonard has stepped down as CEO for health reasons. He is the legend behind the model.

- AI fear: Fears are rife that Gen-AI will disrupt the small niche software builders.

But:

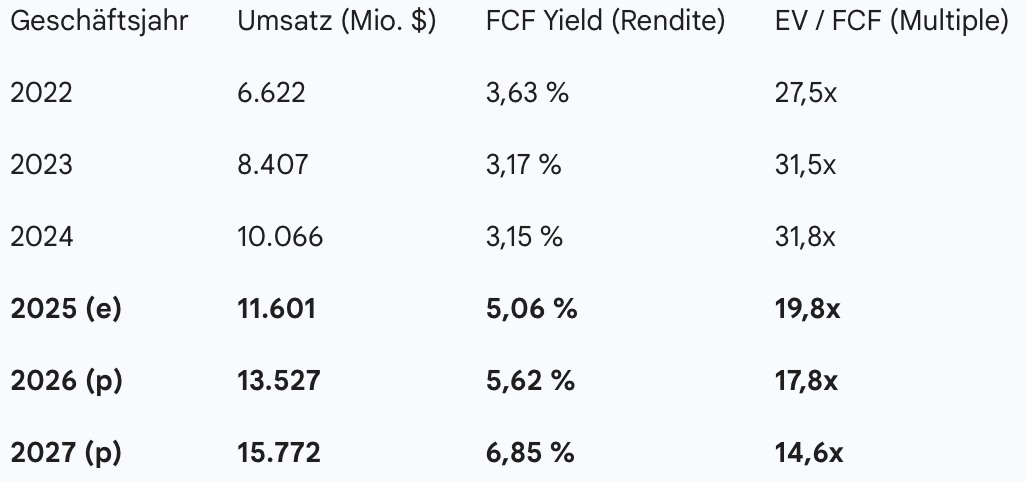

- While the share price is crashing, FCF recently rose by a whopping 46 % rise.

- The EV-to-FCF ratio is currently approx. 20 - a level that we have not seen for years. By comparison, we usually had to pay a multiple of 30+ for this quality.

(Source: Marketscreener)

To me, this looks like a classic "scissors" situation: The fundamentals (cash!) continue to grow, but the share price collapses due to emotional news. Is the business model really threatened by AI, or is this a rare opportunity?

I am invested with about 2% of my portfolio (currently approx. -20%), but am considering doubling the value.

I am looking forward to your opinions.