And another record: in 2024, companies worldwide paid out dividends worth a total of 1.75 trillion dollars, which is 5.2% more than in the previous year.

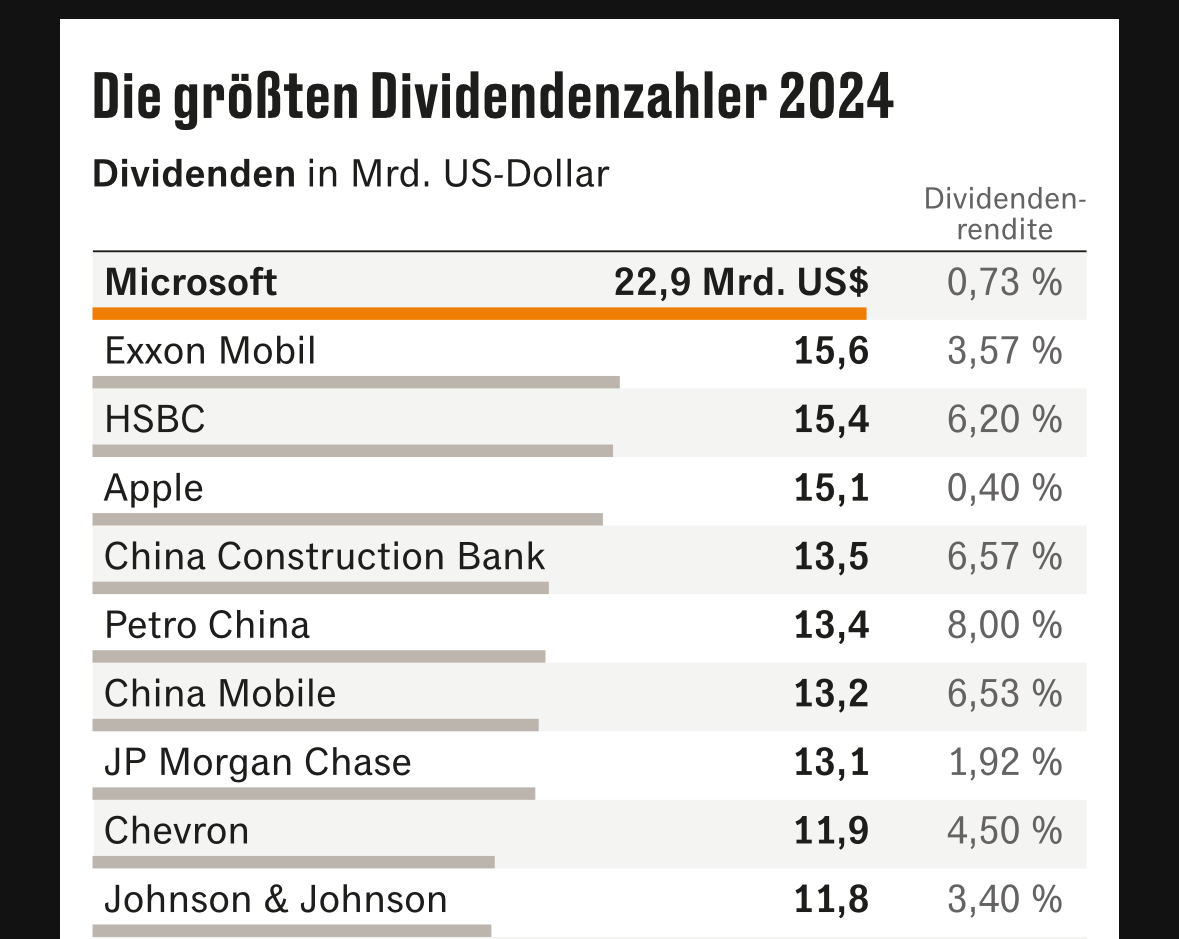

The major US tech stocks, which previously paid out nothing at all for many years, played the leading role. Alone $META (-1,17%) Meta (Facebook ), Amazon $AMZN (-1,56%) and the Chinese online retailer Alibaba $BABA (-0,46%) were responsible for a fifth of the increase. And $MSFT (-1,69%) Microsoft once again paid the highest dividend worldwide at 22.90 billion dollars. In second place is $XOM (+0,93%) Exxon Mobil with 15.60 billion dollars and only just behind it $HSBA (-3,37%) HSBC with 15.40 billion dollars (see table).

Overall, the top group is heavily dominated by American and Chinese companies. Just under half of the increase comes from the financial sector.

Dividends are particularly important for investors who value current income. The key indicator here is the dividend yield, i.e. the payout in relation to the share price. A high percentage can be based on earnings strength and a shareholder-friendly corporate policy. However, very high dividend yields in particular are sometimes the result of falling share prices and therefore indicate a lack of confidence in the earnings power and therefore also in the medium and longer-term ability to continue to pay high dividends. Therefore, this figure alone can never be a good reason to buy.

Source (excerpt) & chart: Handelsblatt