$OXY (+2,14%)

$OD7F

$OOEA

$00XM

$BRNT (+8,57%)

$IS0D

$SLB (-1,59%)

$COP (+0,21%)

$WENS (+0,44%)

$EXH1 (+0,99%)

$WNRG (+0,56%)

$SC0V (+0,57%)

https://oilprice.com/Energy/Oil-Prices/JP-Morgan-Oil-Could-Hit-130But-Were-Still-Calling-60.html

Around 20 % of global oil production flows through the Strait of Hormuz

Around 90% of Iran's oil exports pass through the Strait of Hormuz every year, which corresponds to around 83% of all Iranian exports. This is due to the fact that almost all Iranian oil export terminals and major ports are located in the Persian Gulf and there are no significant alternative routes such as deep-sea piers or pipeline infrastructure outside the Strait.

The Strait of Hormuz is a narrow stretch of sea between Iran and Oman.

It is only 33 kilometers wide, but almost 21 million barrels of oil are transported through it every day.

That is equivalent to one in every five barrels consumed on earth. It is by far the most important energy bottleneck on our planet.

For this reason, it would be a disaster if the Strait of Hormuz were even partially closed, we would lose access to more than 10 million barrels of oil per day.

There are no realistic alternative routes. Pipelines? Already almost at capacity. Alternative ports? Too small.

You can't divert 20% of oil traffic overnight.

After some research and my assessment what would happen/what would be the consequences if the Strait of Hormuz was blocked, closed:

Strategic:

The Strait of Hormuz is the world's most critical maritime bottleneck. Around 20% of the world's traded crude oil and 30% of the world's liquefied natural gas supplies pass through these narrow waters every day. If Iran were to block or significantly disrupt the Strait with mines, anti-ship missiles, drone attacks or speedboats, this would not only trigger a regional crisis, but also cause a systemic shock to the global economy, supply chains and security architecture.

Presumed initial effects:

Peak energy price: crude oil could rise by 30 to 60 US dollars within a few days. Brent could reach 130 to 150 US dollars, depending on the expected duration of the disruption. Natural gas, especially liquefied natural gas for Asia, would become acutely scarce. Expect *JKM LNG benchmarks in Japan and Korea to rise.

*JKM stands for Japan Korea Marker and is an important price benchmark for liquefied natural gas (LNG) in the Asian market, especially for deliveries to Japan, South Korea, China and Taiwan. The JKM is calculated by S&P Global Platts and reflects the spot market price of LNG cargoes delivered ex-ship (DES)

Naval and kinetic escalation: the US Fifth Fleet stationed in Bahrain would be rapidly mobilized. Mine sweeping, naval escorts and possibly kinetic attacks on Iranian coastal positions would result. Israel could take preventive action in Lebanon or Syria, fearing a regional encirclement.

Consequences:

Global trade shocks: energy shipments would have to be rerouted via the Suez Canal or the Cape of Good Hope, increasing costs and delivery times. Transport insurance premiums are rising rapidly. Prices for container transportation are rising again, especially to Europe and Asia. Additional port congestion and cascading logistical delays are to be expected.

Macroeconomic:

The central banks of energy-importing countries (India, Japan, EU) begin defensive foreign exchange market interventions and emergency procurement of energy. A reduction in reserves, a redistribution of state assets and possible covert bilateral agreements with the Gulf states are to be expected.

Supply chains will be strained:

Fertilizer prices are rising due to natural gas shortages. Food prices, especially wheat and soybeans, are soaring. Countries that rely on subsidized energy (Pakistan, Egypt, Indonesia) are confronted with currency problems and domestic instability.

Sovereign credit risk:

Rising energy costs are putting pressure on emerging markets' current accounts. Countries are coming under increasing pressure, leading to IMF interventions and sovereign debt downgrades. The periphery of the eurozone comes under renewed pressure.

US financial and military pressure:

Rising oil prices push inflation back up, while the Fed is under pressure to cut interest rates. Interest expenses for US debt are rising. At the same time, defense spending is soaring. The demand for dollars from foreign central banks is weakening, while the supply of government bonds is increasing. This increases the risk of a long-term liquidity vacuum. Interest rates could rise even if growth stagnates.

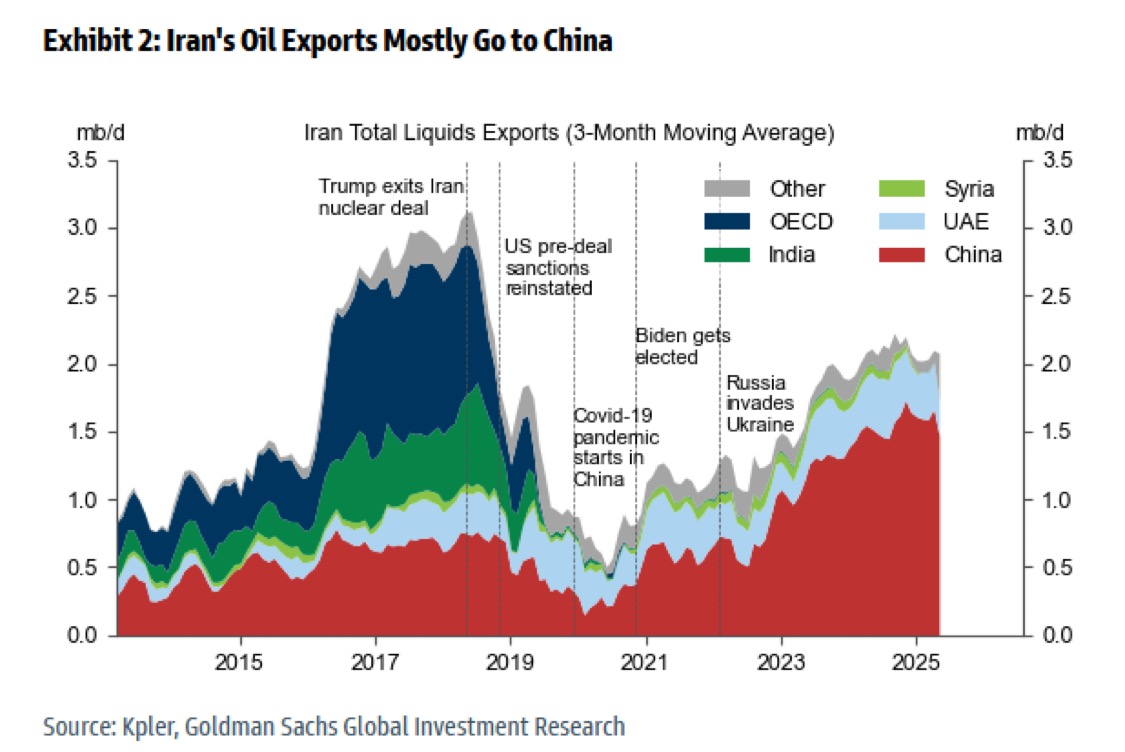

China, the main buyer of Iranian oil, finds itself in a geopolitical dilemma. It could intervene diplomatically or even provide a naval escort for Iranian supplies. This would be a direct challenge to US hegemony. Russia benefits from higher energy prices and global distraction, strengthening its influence in Ukraine.

Maritime cyber sabotage, hacker attacks on oil infrastructure or psychological disruption campaigns against the Gulf States or US critical infrastructure could also have consequences.

Other probable consequences of a closure of Hormuz:

- Re-introduction of energy shortage prices in markets where energy was priced in abundance

- Undermining confidence in the dollar and the US policy of deterrence, especially if the conflict drags on

- Acceleration of BRICS-led de-dollarization efforts as energy security becomes sovereign again