The Kikkoman $2801 (-2,24%) share seems too interesting at the moment not to share my thoughts with you 🙂

I haven't looked at the consumer goods sector, but none of the big standard stocks seem particularly interesting to me ($NESN (-1,94%) , $ULVR (+0,02%) , etc.).

In addition, due to the exchange rate, I'm currently looking more closely at Japanese companies and have stumbled across Kikkoman.

Kikkoman is not only the absolute market leader in the soy sauce sector here, but is also one of the largest manufacturers of soy sauce in its home country of Japan, where the majority of sales are generated. Kikkoman also produces other products in the sauces and seasonings sector, all of which are also market leaders. Kikkoman has held this position for many years and it should be difficult for competitors to shake it.

Fundamental aspect:

Over the past 15 years, Kikkoman's P/E ratio has averaged over 30.

We are currently trading at around 21, which is well below the historical average.

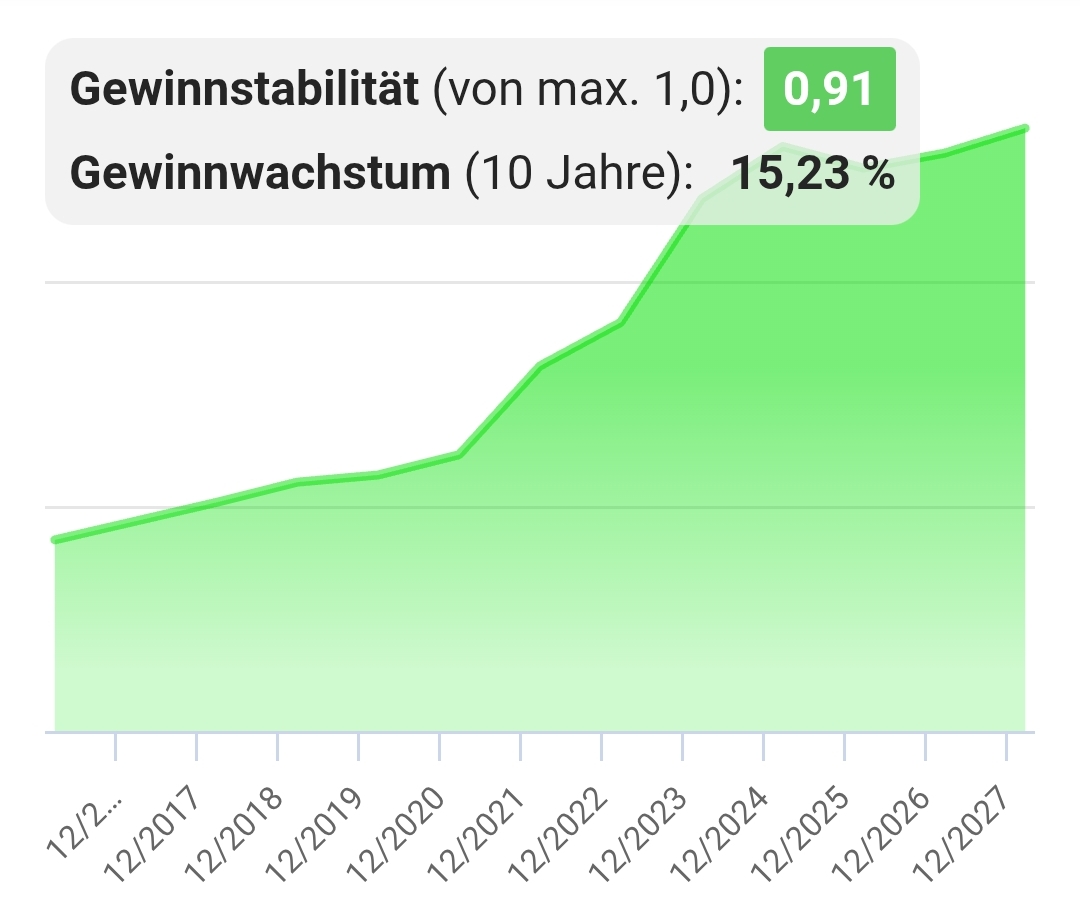

Over the past ten years, Kikkoman has achieved average annual earnings growth of over 15%. Despite the current challenges posed by inflation and supply chain issues, the company has been able to further increase its profits, although a slowdown in profit growth is becoming apparent, which is probably also triggering the current correction.

Chart "Analysis

(I am definitely not a profit wheeler, so please forgive me if this is too simplistic😅)

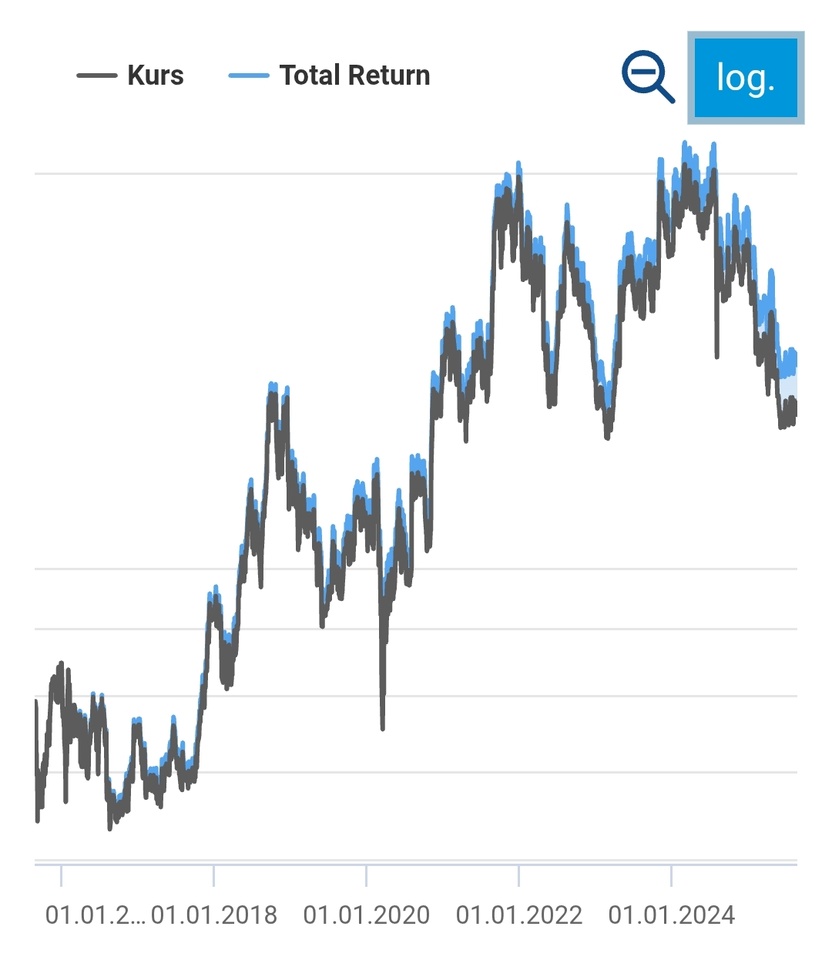

From a technical point of view, the share has undergone a correction in recent months and is approaching a crucial support zone. The area around the 1300 yen mark (high - September 2018) has repeatedly served as strong support in the past (March 2021, June 2022, March 2023).

I think that a reversal at this support will take place this time as well.

Exchange rate

Another positive factor is the current favorable exchange rate between the euro and the yen. The yen is historically weak against the euro, which makes purchases of Japanese equities comparatively favorable for European investors.

I hope you enjoyed this brief assessment of $2801 (-2,24%) and perhaps, like me, you have become aware of a great company that has so far received less attention, at least on this platform.

Sources:

Data and graphics from

https://aktienfinder.net/aktien-profil/Kikkoman-Aktie

and exchange rate from Google