It feels like sitting on a train that has gotten out of control and is speeding up. You don't know whether it will derail, whether the track will end at some point or whether there will be a collision. But right now, the train has come to a final halt at a stop and opened the doors, and I'm wondering whether I should get off or stay seated.

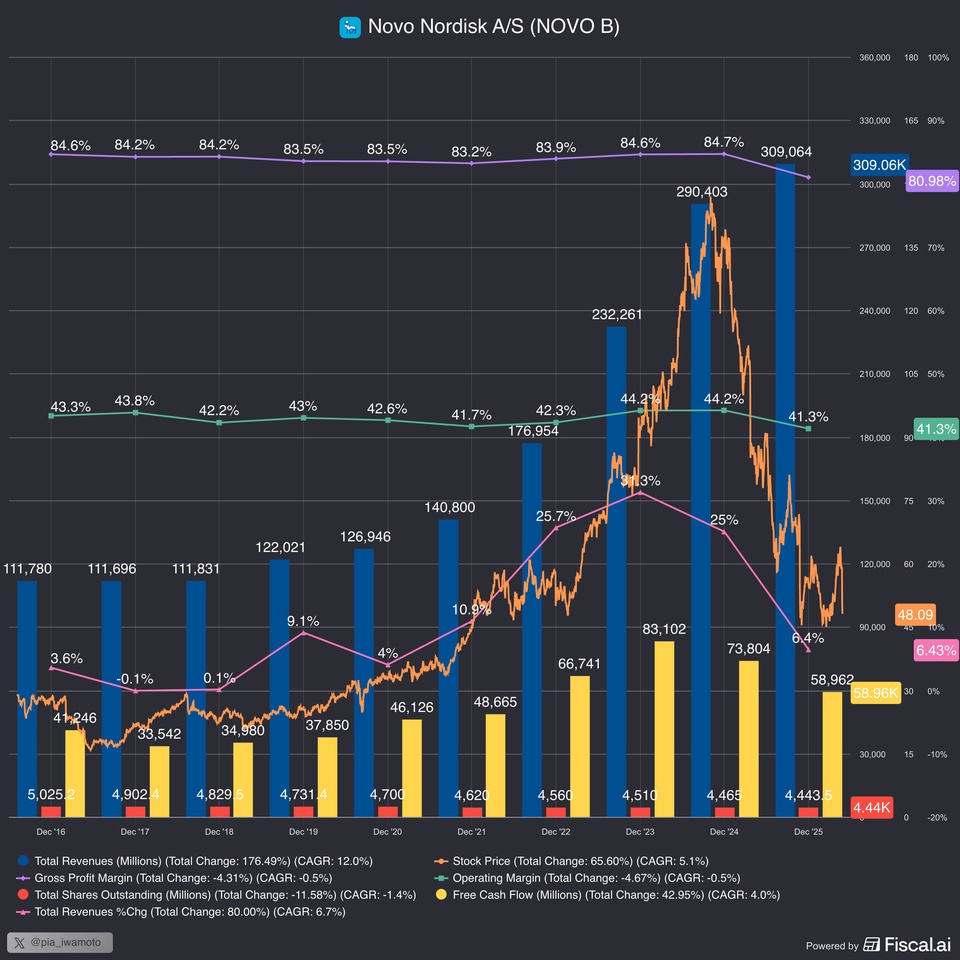

For this year, Novo Nordisk expects a currency-adjusted decline in sales of 5 to 13 percent 🚩. The company also referred to the expiry of patents for its diabetes and weight loss drug semaglutide 🚩

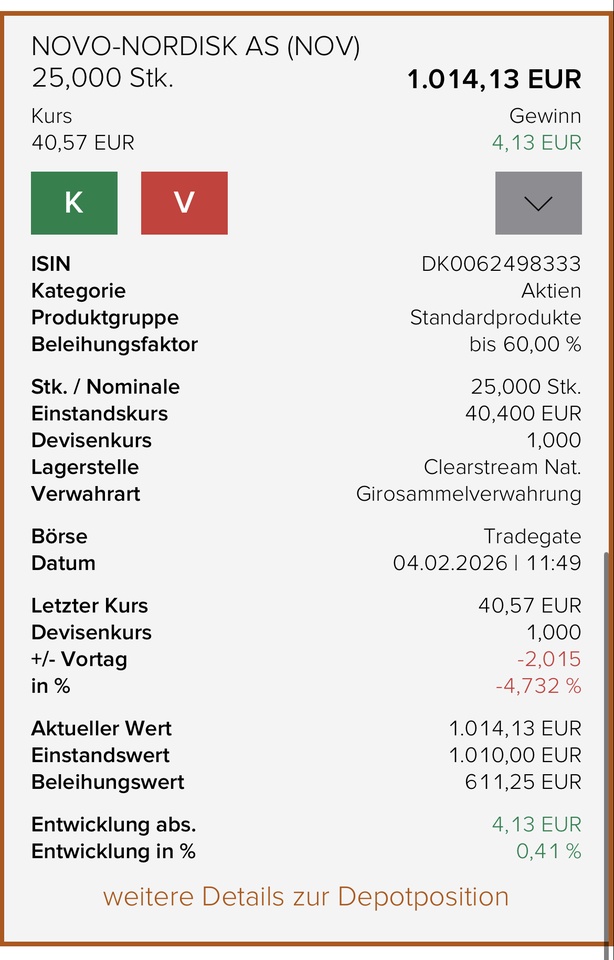

I would still have the opportunity to get off the train without visible damage 🥺

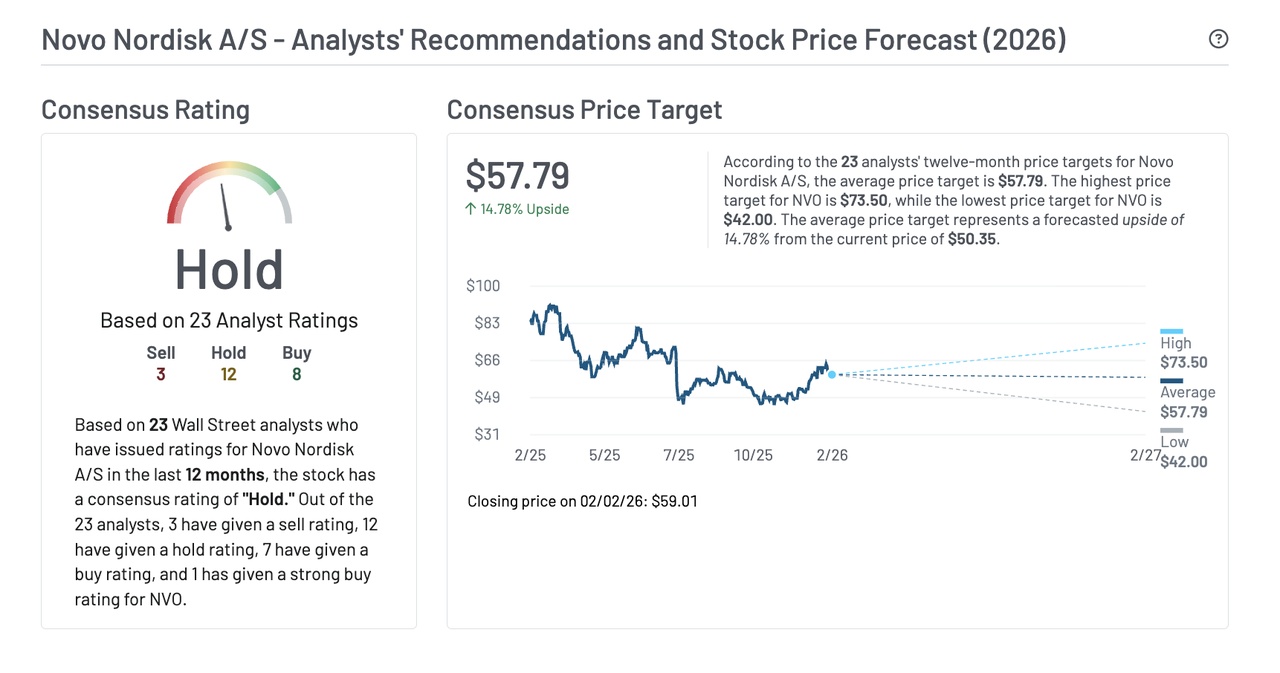

The analysts' comments are mixed and are likely to deteriorate again significantly over the next few days, as the new outlook has not yet been taken into account.

I only have insider purchases until the end of 2025 and they do not show a clear trend.

Fundamentally, the sale would be justified as the data has deteriorated and will deteriorate even further with the new outlook.

But fundamentally they are not bad...

Would you get off the train or see what happens? 😀

.

.

.

.

----------------------------------------------------------------------

The train story is based on the $AAPL (+0%) H/Kack series, which I rate at this point with 5 out of 10 points. So not a recommendation. But as a $NFLX (+2,6%) shareholder, I keep a close eye on what the "competition" is doing 😎