$8035 (-1,26%) . $ASML (+0,95%)

$MSFT (-3,23%)

$GOOGL (-1,06%)

Hello my dears,

I've been invested in these four companies for a few months now.

And I quickly noticed something here.

Alphabet and Microsoft behave almost the same way.

Sometimes one share is slightly ahead, but then it doesn't take long for the other share to follow.

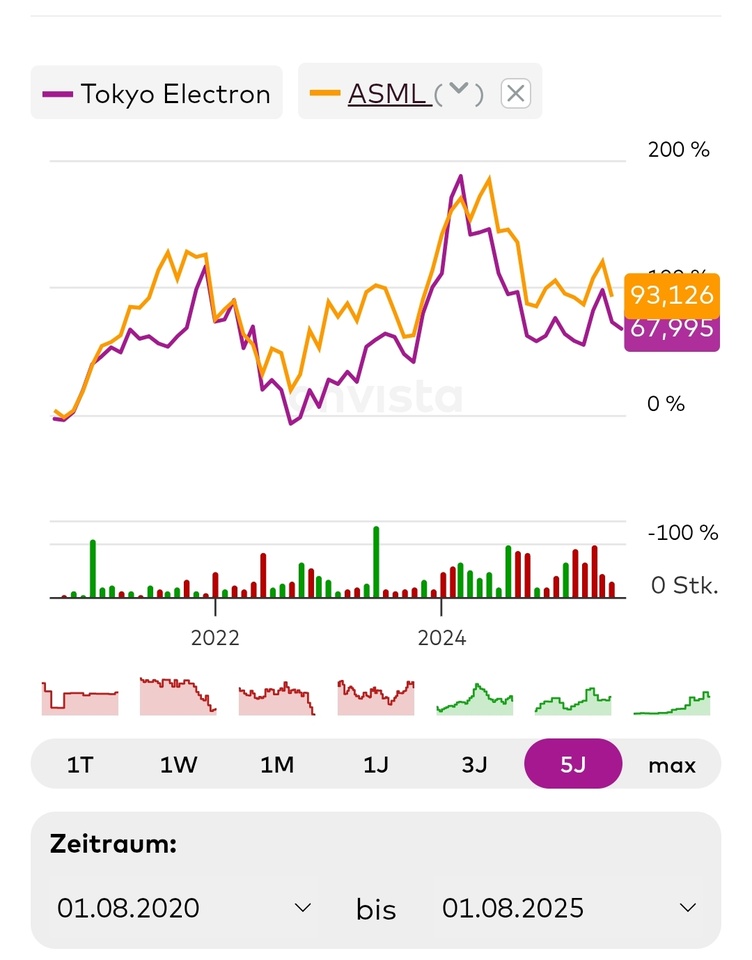

It's the same with ASML and Tokyo Electron.

That's why it was almost clear to me that after the mini crash at ASML there would also be a crash at Tokyo Electron after the figures.

(I have compared the companies for you in the annual and 5-year charts).

Now my question would be to the short experts.

My dears,

aren't there good opportunities here, and wouldn't it have made sense to go short on Tokyo Electron before the figures?

@Dividendenopi

@Multibagger

@Epi