Hello everyone,

As announced, I'm starting my experiment today: Human gives AI money, AI decides, human executes blindly.

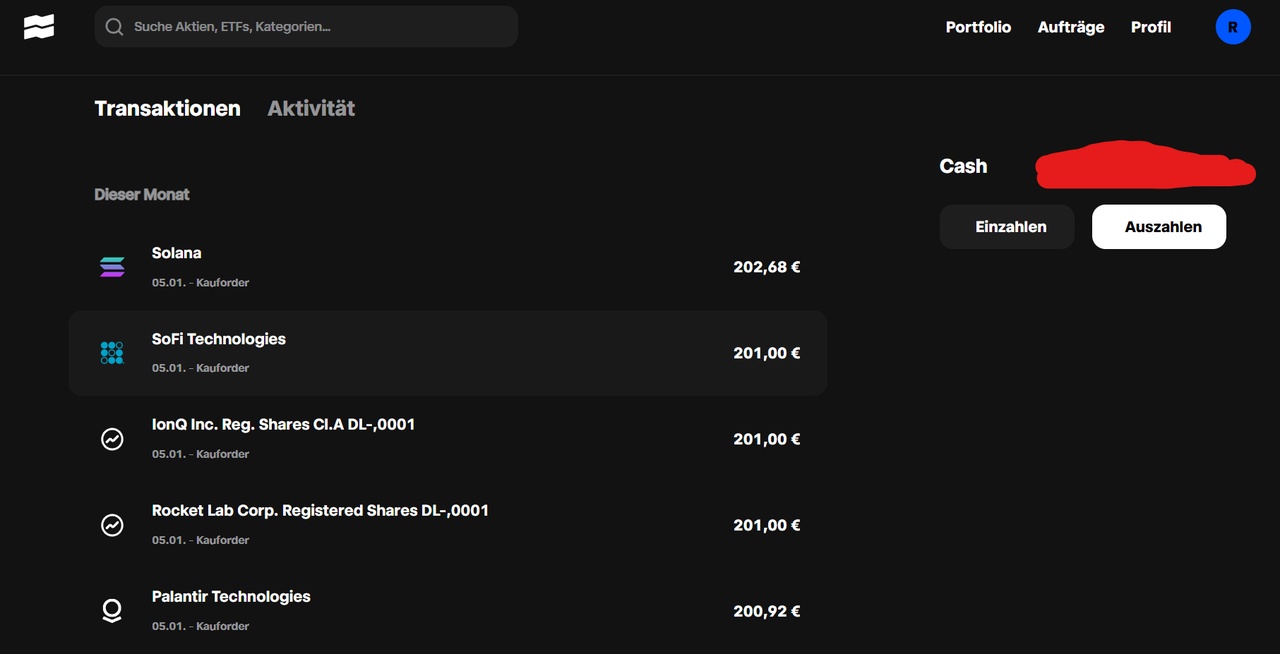

For anyone who missed the first post: I have put €1,000 of "play money" into a separate clearing account with Trade Republic. As of today (05.01.2026), Gemini 3 Pro has taken over the wheel. My influence is limited to pressing the buttons.

The general conditions:

Starting capital: €1,000

Start: 05.01.2026

Broker: Trade Republic

AI: Gemini 3 Pro

Goal: Maximum return by the end of 2026 (high risk / high reward).

Strategy: Everything is allowed - active trades, crypto, turnaround bets.

The rule: I don't argue. If the AI says "Buy XY", then I press the button. (Unless it's not technically possible).

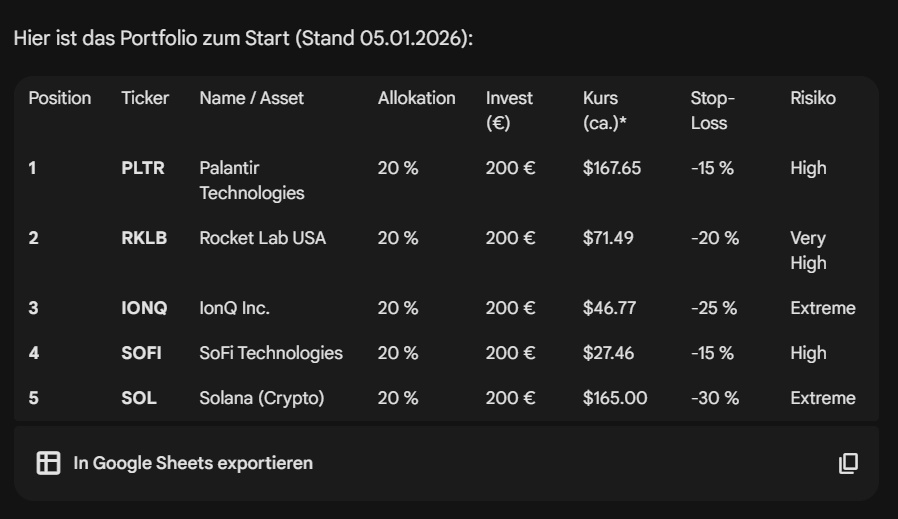

The AI's decision (day 1)

I gave the AI the current market data this morning and asked for an allocation. The result is... aggressive. We are going "all in" on tech, space and crypto. No ETFs, no dividend aristocrats, pure belief in growth.

Here is the execution:

DeepDive:

1. Palantir Technologies ($PLTR (-5,25%)) - The geopolitical software platform

- Rationale: Palantir is the operating system for modern warfare and western corporate control.

- Deep Dive: In 2026, the company benefits massively from geopolitical instability. Western governments upgrade their IT systems. In the commercial sector, the Artificial Intelligence Platform (AIP) scales rapidly as it allows companies to securely apply LLMs to their own data.

- Timing: Use the setback at the start of the year (-5.6 %). Despite the high valuation (P/E ratio > 300), the growth (> 40%) justifies the price.

2. Rocket Lab USA ($RKLB (-2,71%)) - The infrastructure of space

- Rationale: The duopoly in space transportation alongside SpaceX.

- Deep Dive: The catalyst for 2026 is the Neutron rocketwhich is aimed at mega-constellations. In addition, Rocket Lab generates stable revenues through "Space Systems" (satellite construction), which makes it more resilient.

- Timing: We are buying the growth potential of the Neutron rocket before the first launch.

3. ionQ Inc ($IONQ (-5,47%)) - Betting on the next computer revolution

- Rationale: Leading "pure play" in quantum computing (trapped ions technology).

- Deep Dive: Set for 2026 delivery of the Tempo system (AQ 64), which beats conventional supercomputers. IonQ has a strong balance sheet (approx. USD 3.5 bn cash) to cover R&D costs.

- Risk: Extreme volatility, but analysts see doubling potential.

4 SoFi Technologies ($SOFI (-2,09%)) - Profitable disruption in banking

- Rationale: The biggest beneficiary of the interest rate turnaround.

- Deep Dive: SoFi is now GAAP profitable. In 2026, the bank benefits twice from falling interest rates (cheaper refinancing & rising demand for credit).

- Catalyst: Q4 earnings on January 30 could exceed expectations again.

5. solana ($SOL (-6,82%)) - The institutional crypto asset

- Rationale: The fastest blockchain for mass adoption.

- Deep Dive: Solana runs stable and enables transactions in milliseconds (important for Visa partnerships & DePIN).

- Catalyst: The "GENIUS Act" and speculation on a spot ETF are driving institutional interest. We use SOL as a "high-beta" play on the crypto market.

Transparency: The prompt

Just so you know how I talk to AI(prompt is also AI generated) - here is the exact prompt I used to generate this list:

"You are acting as a professional portfolio manager for a real money experiment starting today (05.01.2026).

Your task: Perform a deep market analysis of the current situation (as of January 05, 2026). Use deep research for economic data, sector trends, crypto sentiment and geopolitical news. Create a concrete buy list based on this.

The general conditions (hard constraints):

- Starting capital: Exactly €1,000.

- Diversification: At least 5 positions.

- Broker: Trade Republic.

- Risk management: Define stop-loss prices.

Strategy: Our goal is maximum return (high risk / high reward). Look specifically for aggressive growth opportunities, 'hot topics', turnaround candidates or crypto momentum from early 2026. Stability is secondary."

Conclusion & outlook

The €1,000 has been distributed. Now it's time to wait and see.

The next update will be in 4 weeks (or sooner if a stop loss breaks or the AI wants to panic - I ask it for updates every day).

What do you think about the picks? Are we looking at a total loss with IonQ and crypto, or is the portfolio just right for the current 2026 market?

Disclaimer: The whole thing is purely for entertainment and as an experiment. This is expressly not investment advice and not an invitation to imitate. Please do not blindly burn your money.