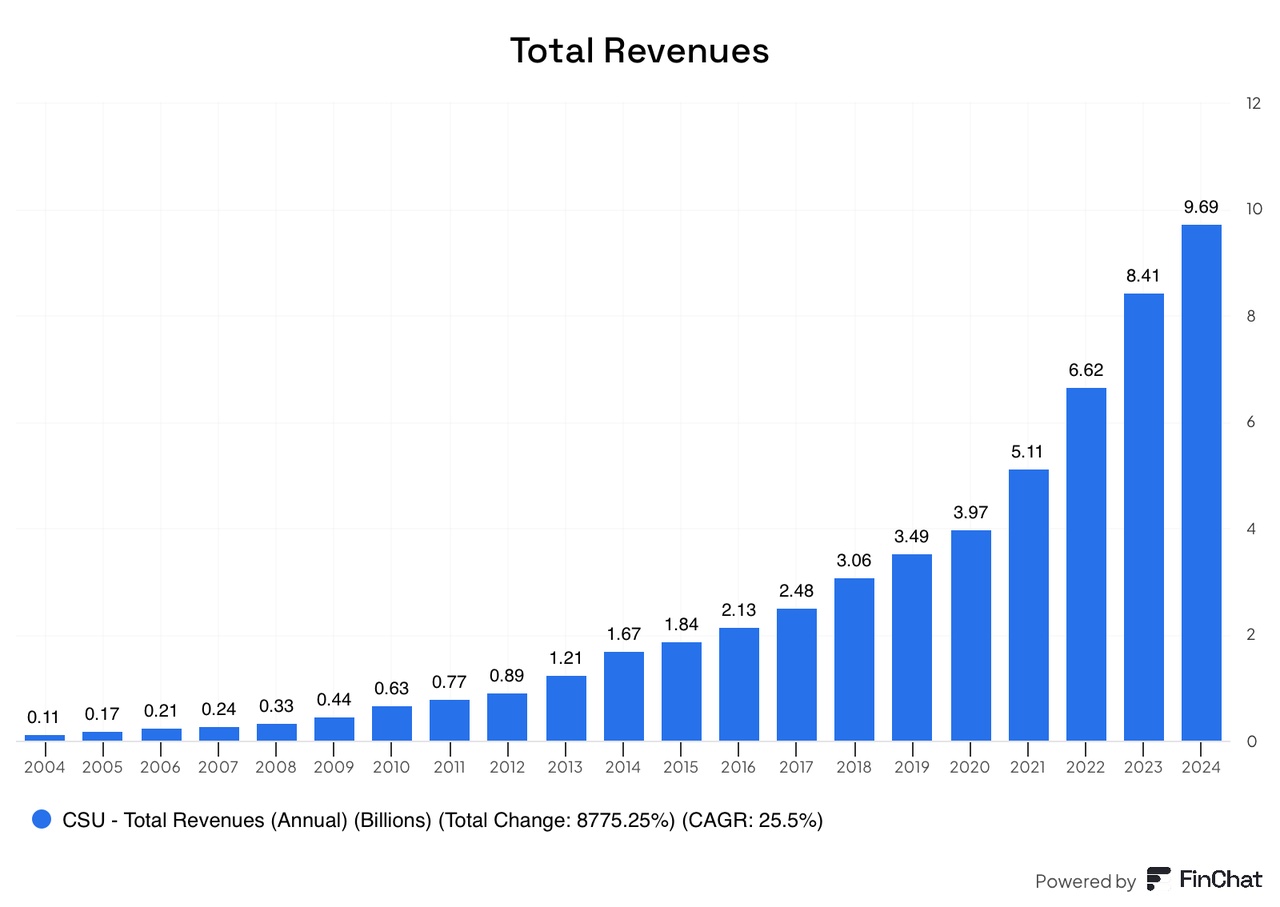

Constellation Software $CSU (-1,34%) is one of the top companies on my watch list with one of the best sales charts I have ever seen. Do you have the company on your radar?

Even Salesforce $CRM (-1,69%) , Shopify $SHOP (-0,21%) or Crowdstrike $CRWD (-0,29%) are sweating...