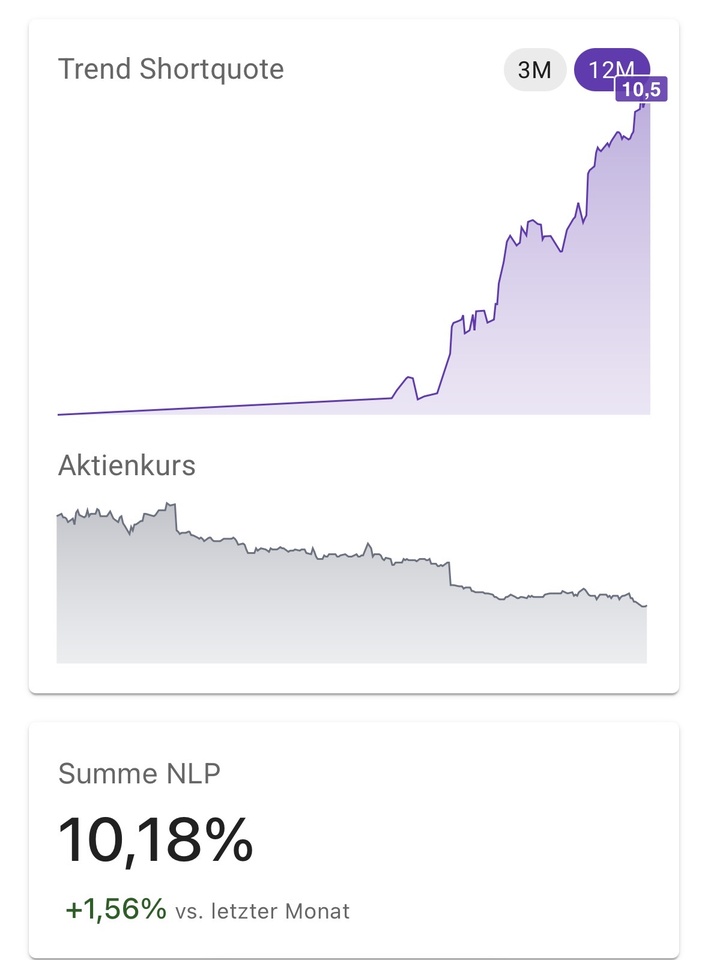

The $TMV (+0,54%) share, now the largest position in our portfolio, continues to fall. It is noticeable that short selling continues to increase.

The short selling ratio is now over 10% and the short sellers are continually adding to their positions. We are doing the same, only we are increasing our holdings further.

The most interesting thing is who is shorting the shares. It is mainly funds that only look at the chart and use trends to trade.

This makes the purchase by value investor Harris Associates all the more exciting. It now holds more than 3% of the shares and mainly buys shares that it believes are fundamentally undervalued.

It is clear that the trend points to a further fall in share prices. However, if you ignore the chart (in our view, the astrology of share trading), you will find a valuation that would only be justified if the company no longer generates any sales in 10 years at the latest. The company currently has a KCV of around 4, a forward P/E ratio in the 5 range and a dividend yield of 25% could be paid from the cash flow.

Even with years of 0% growth, we believe this is a valuation that perhaps logistics companies had for a short time during the coronavirus crisis.