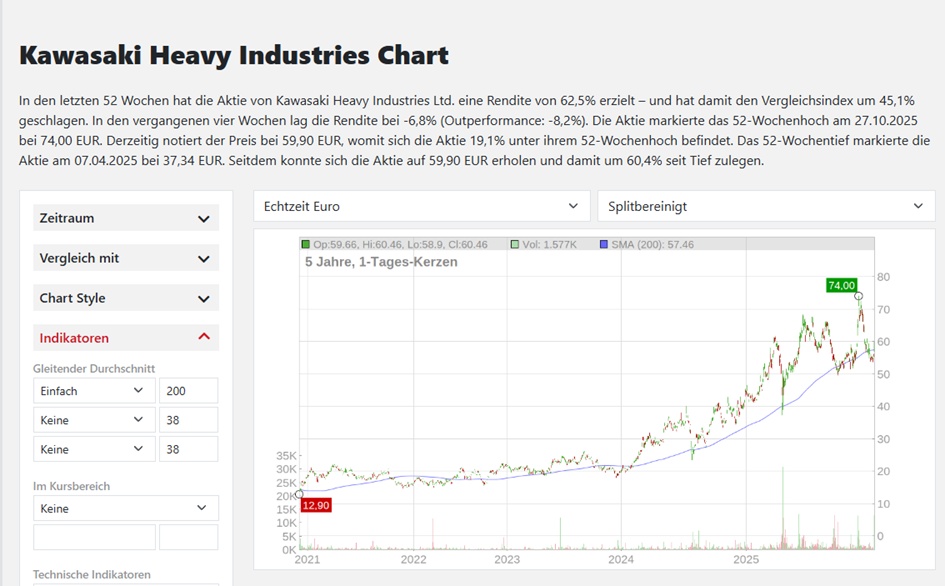

Investing in many growth sectors with one company is almost only possible in Japan.

Hello my dears,

Just before the end of the year is often the time to think about your portfolio.

To possibly carry out a rebalancing.

So I have come up with the idea of reducing a little in the semiconductor sector.

I see the biggest overlap in Tokyo Electron and ASML.

So my thought is to divest myself of Tokyo Electron.

However, as I would like to remain in Japan and in growth sectors, I have spent the last few days searching in Japan.

And I found a company that is active in several growth sectors.

Here I would also like to thank @EpsEra and @PikaPika0105 .

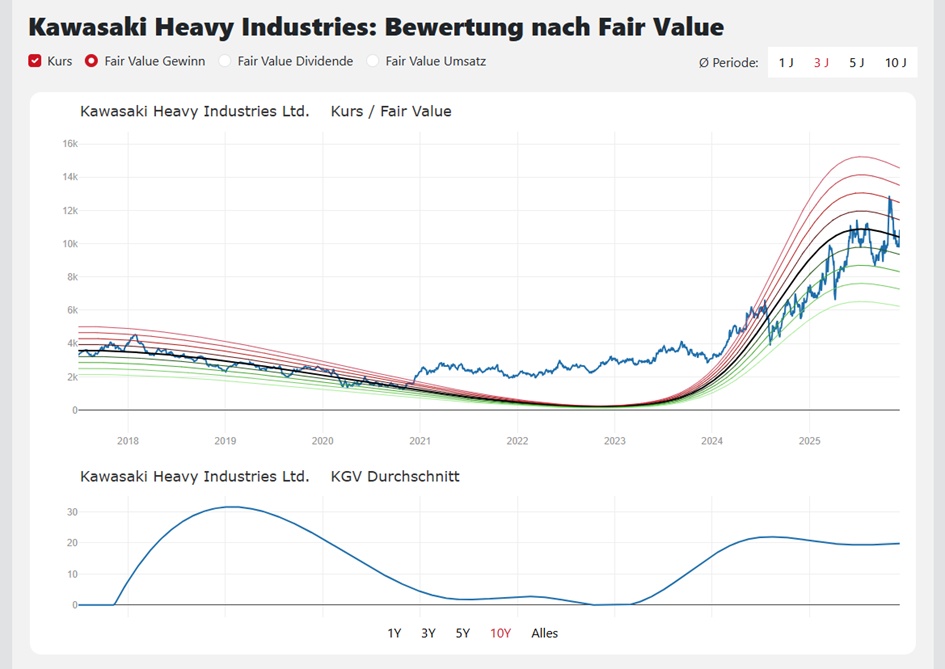

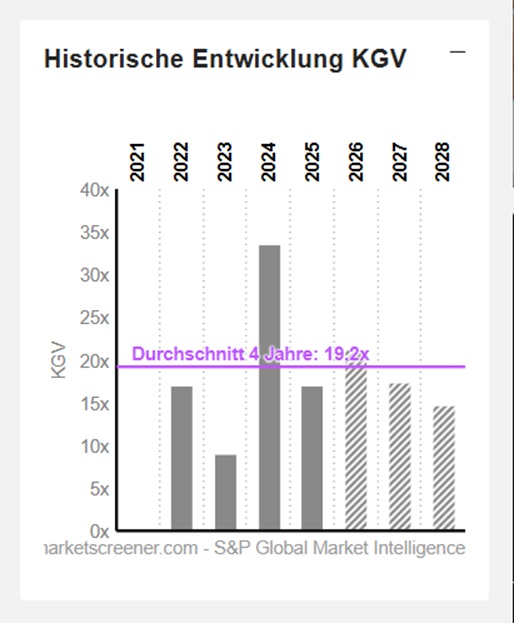

Those of you who have taken a close look at the key figures below. may now be wondering:

" What's wrong with the Tenbagger, he wants to invest in a company where next year's net result is declining, and the P/E RATIO is rising."

However, as earnings are set to rise again in double digits from 2027, I would assume that this effect will cause share prices to rise as early as next year.

Expectations instead of the present: Share prices reflect the sum of the expectations of all market participants. If investors believe that a company will grow in the future, the share price will rise today.

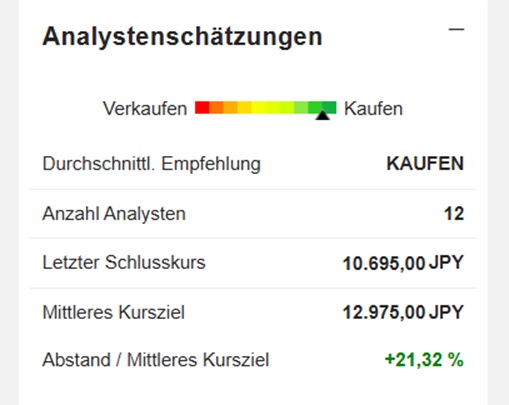

Dear all, do you think now is a good time to get in?

I look forward to plenty of comments.

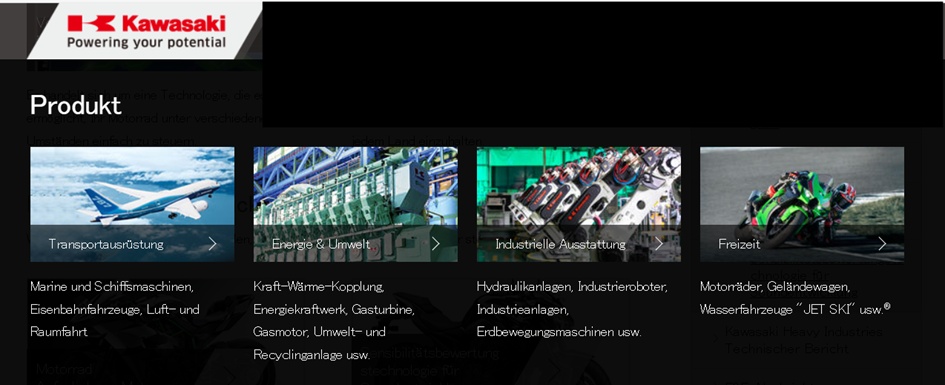

Kawasaki Heavy Industries, Ltd. specializes in the manufacture and sale of transportation and industrial machinery equipment. Net sales break down by activity as follows:

- Sales of motorcycles and engines (29.8%);

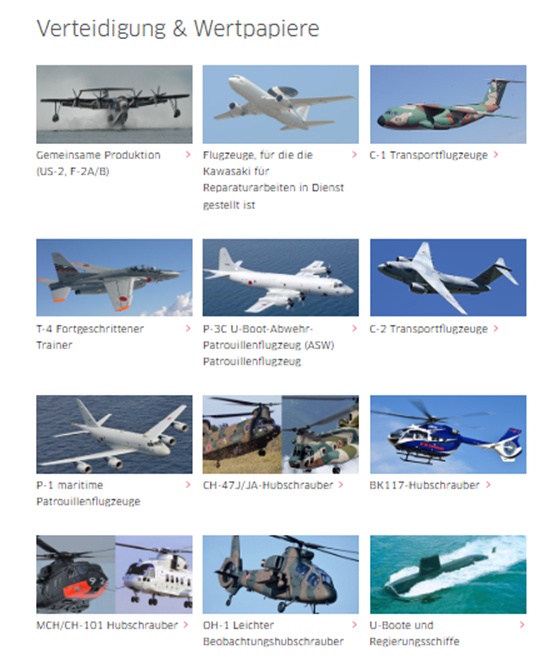

- Sales of aerospace equipment (19.9%): Aircraft, helicopters, missiles, electronic equipment, monorails, etc.;

- Sale of gas turbines (19.8%): Turbines for marine, naval and industrial applications, generators, propulsion systems, etc. The Group also develops shipbuilding (construction of ships, submarines, bulk carriers, oil tankers, etc.);

- Sales of precision machinery (16.8%): mainly hydraulic machinery. The Group is also developing an activity in the manufacture of industrial machinery (tunnel boring machines, curling machines, grinding machines, etc.);

- Sale of railroad equipment (8.4%): Train wagons, electric and diesel locomotives, monorails, etc.;

- Other (5.3%).

Number of employees: 40,640

The Kawasaki Heavy Industries Group has established the Group Vision 2030 "Responding to Trust ~Trustworthy Solutions for the Future~" as its vision for the future in 2030. The Group aims to transform its business structure into one that can grow even further with the areas it will focus on in the future: "safe and secure long-distance society", "mobility in the near future", and "energy and environmental solutions".

Hydrogen road

"The ultimate clean energy" We will open up a new future created by hydrogen, a hydrogen society.

Kawasaki Heavy Industries (KHI) is strongly committed to the hydrogen economy, particularly in transportation (e.g. Suiso Frontier liquid hydrogen tanker), power generation (hydrogen-capable gas turbines with partners such as RWE in Lingen) and logistics (partnership with Daimler Truck and HHLA for an LH2 supply chain in Europe), as well as in the development of hydrogen-powered vehicles, including a motorcycle with an H2 combustion engine and the four-legged robot Corleo. The projects aim to create a comprehensive hydrogen value chain and promote the use of hydrogen as a sustainable energy carrier.

Key projects and partnerships:

European logistics: together with Daimler Truck and HHLA, KHI is planning a European supply chain for green liquid hydrogen (LH2) via the Port of Hamburg to enable imports.

Hydrogen gas turbines: KHI is developing hydrogen-capable turbines, including a 34 MW plant for RWE in Lingen for the reconversion of green hydrogen into electricity, as well as a 1.8 MW turbine that can burn 100% H2.

Liquid hydrogen transportation: KHI built the world's first large liquid hydrogen tanker, the Suiso Frontier, which successfully shuttled between Australia and Japan.

Vehicle technology:

Motorcycle: prototypes with H2 combustion engines are based on the Ninja H2 platform and use direct injection.

Robot: The four-legged robot Corleo demonstrates bio-inspired locomotion with hydrogen propulsion.

Japanese projects: KHI is part of consortia (e.g. HySTRA, HEA) conducting hydrogen demonstrations in Japan and Australia to test the entire chain from production to utilization.

Goals:

Circular economy: create a global, sustainable hydrogen value chain.

Industrial application: Integration of hydrogen technologies into power plants and industrial processes.

Transportation: Development of hydrogen-powered vehicles for a CO2-neutral future.

Robotics

The company is one of the five largest producers of industrial robots. The largest car manufacturer Toyota relies on Kawasaki's robot roads. Cleanroom robots are also part of the product portfolio.

Kawasaki Heavy Industries Ltd. is one of the prime stocks in the robotics investment trend

Kawasaki Heavy Industries and NTT Docomo Business have signed a memorandum of understanding on strategic cooperation to create a new company through network links in the fields of robotics, mobility and social infrastructure.

Robotertechnologie & Forschung | Technologie | Kawasaki Heavy Industries Co., Ltd.

How Kawasaki robots are changing the pharmaceutical industry

Medical, pharmaceutical and biotechnology manufacturers are at the forefront of science and technology. While the potential for innovation is almost limitless, small and large companies alike face logistical, practical and regulatory hurdles. In order to keep pace and remain competitive in the long term, specially developed robots such as those from Kawasaki Robotics have become indispensable in the industry. These must meet the highest standards and certification criteria, but flexibility and reliability are playing an increasingly decisive role.

MC004V von Kawasaki Robotics - Wie Kawasaki-Roboter die Pharmaindustrie verändern - Automation.at

Ship and marine technology and research

Schiffs- und Meerestechnologie und Forschung | Technologie | Kawasaki Heavy Industries Co., Ltd.

Rail vehicle technology and research

Eisenbahnfahrzeugtechnologie und Forschung | Technologie | Kawasaki Heavy Industries Co., Ltd.

Aerospace and engine technology and research

Energy and power generation technology and research

Plant and environmental technology and research

Pflanzen- und Umwelttechnologie & Forschung | Technologie | Kawasaki Heavy Industries Co., Ltd.

Infrastructure technology and research

Technologie und Forschung zur Infrastruktur | Technologie | Kawasaki Heavy Industries Co., Ltd.

Hydraulic systems technology and research

Hydraulikgerätetechnologie & Forschung | Technologie | Kawasaki Heavy Industries Co., Ltd.

Power Sports & Engine Technology and Research

Power Sports & Motorentechnologie & Forschung | Technologie | Kawasaki Heavy Industries Co., Ltd.

Kawasaki Heavy Industries plans to test its Japanese Tomahawk SSM in 2027.

Kawasaki Heavy Industries will conduct a test launch of its new anti-ship missile, known as the "New SSM" (Surface-to-Surface Missile), in fiscal year 2027. This announcement was confirmed by a company representative at the Tokyo International Aerospace Exhibition on October 17, 2024, highlighting the ongoing progress in Japan's defense capabilities.

Kawasaki Heavy Industries plant, sein japanisches Tomahawk SSM im Jahr 2027 zu testen

Exclusive: Kawasaki in talks to develop Taurus rocket engines, sources say

- Summary

- The companies signed a memorandum of understanding (MoU) on a project earlier this year, sources say

- Latest agreement showing Japan's retreat from decades of pacifism.

- Germany seeks parliamentary approval for Taurus modernization

- Ukraine has repeatedly requested Taurus for use in war

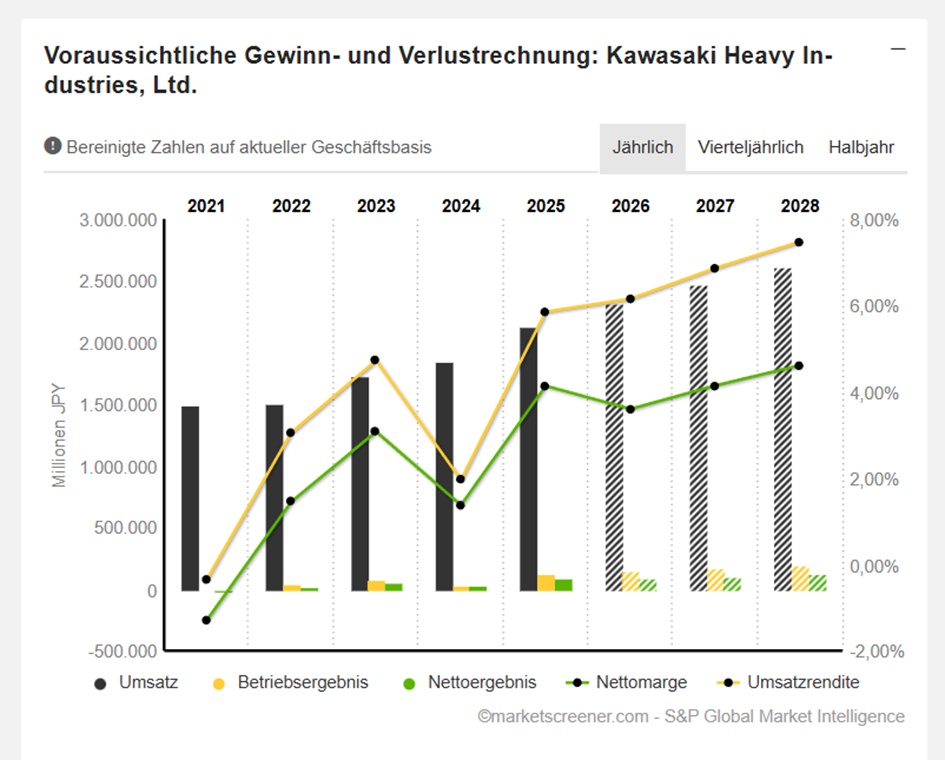

JPY in millions

estimates

Turnover

2025 2026 2027 2028

2.129.321 2.321.845 2.474.960 2.609.209

Change in

15,14 %

9,04 %

6,59 %

5,42 %

EBIT

124.574 142.772 169.767 194.956

Change in

244,19 %

14,61 %

18,91 %

14,84 %

Net result

88.001 83.545 102.474 120.291

Change in

246,77 %

-5,06 %

22,66 %

17,39 %

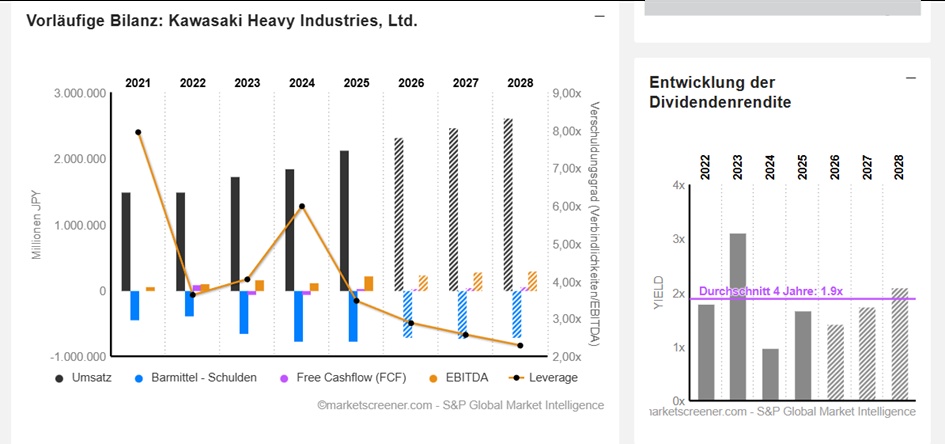

Net debt

756.734 708.461 716.592 702.120

Change in

-0,57 %

-6,38 %

1,15 %

-2,02 %

CAPEX

141.100 124.322 126.789 128.789

Change in

46,15 %

-11,89 %

1,98 %

1,58 %

Free cash flow

37.700 38.660 46.249 57.126

Change in

164,83 %

2,55 %

19,63 %

23,52 %

EBIT margin

5,85 % 6,15 % 6,86 % 7,47 %

ROE

13,2 % 10,99 % 12,56 % 13,42 %

Earnings per share

525,4 500,1 614,4 723,2

Change in

246,8 %

-4,83 %

22,85 %

17,72 %

P/E RATIO

17x 21.4x 17.4x 14.8x

PEG

0x -4.43x 0.8x 0.8x

Dividend per share

150 153,1 187 224,3

Yield

1,68 %

1,43 %

1,75 %

2,1 %

Market value JPY 1,495,616

Konsumgüterkonglomerate Change 3 Y P/E ratio (Y) Div. yield

KAWASAKI HEAVY INDUSTRI 266,27 % 21,39x 1,43 %

BERKSHIRE HATHAWAY INC. 62.59 % 17.87x

HITACHI, LTD 242.67 % 27.57x 0.98 %

HONEYWELL INTERNATIONA -10.25 % 19.33x 2.4 %

MITSUBISHI HEAVY INDUSTRI 675.65 % 49x 0.62 %

MITSUBISHI ELECTRIC CORP 232.19 % 25.02x 1.24 %