1) Executive Summary

Embraer is not just another aircraft manufacturer – it’s a global leader in regional and business jets, with a portfolio stretching across commercial, executive, defense, and even urban air mobility. Backlogs are filled and at an all-time high of nearly $30 billion, growing quarter after quarter, providing multi-year visibility and opportunities for strategic planning. The company is increasingly seen as the “third force” in global aerospace – smaller than Airbus and Boeing, but faster-growing, more diversified, and dominant in its niches.

In commercial jets, the manufacturer benefits from an oligopolistic market where Airbus and Boeing are swamped with narrow-body demand, leaving airlines eager for Embraer’s efficient E2 family. In executive aviation, the Phenom and Praetor families continue to outpace peers, with the Phenom 300 holding its crown as the best-selling light jet. Defense is becoming a real growth engine as the C-390 gains traction among NATO members. And looking further ahead, Eve gives the Brazilian group a credible stake in urban air mobility, with an order book rivaling much larger peers.

The core strengths remain clear: diversification, execution, and a backlog that underwrites growth into the next decade.

2) Macro Environment

Embraer operates in a booming global environment on multiple layers:

- Regional aviation demand: Airlines are expanding their fleets globally, with rising passenger counts, and the company capitalizes on these trends. The manufacturer forecasts demand for ~10,500 sub-150 seat jets and turboprops over the next two decades, which, if true, would boost sales even more, as the leader in that space.

- Emerging markets penetration: Embraer led a strong push into India and other emerging economies across commercial, business and defense sectors through talks with Air India and IndiGo. Many regions, especially in Southeast Asia, are expanding their aircraft fleets massively due to the increased level of wealth within these countries and the corresponding demand for travel. The group is at the forefront of this growth. Countless regional airlines in developing regions are banking on smaller jets and efficient delivery. Both are major catalysts for Embraer.

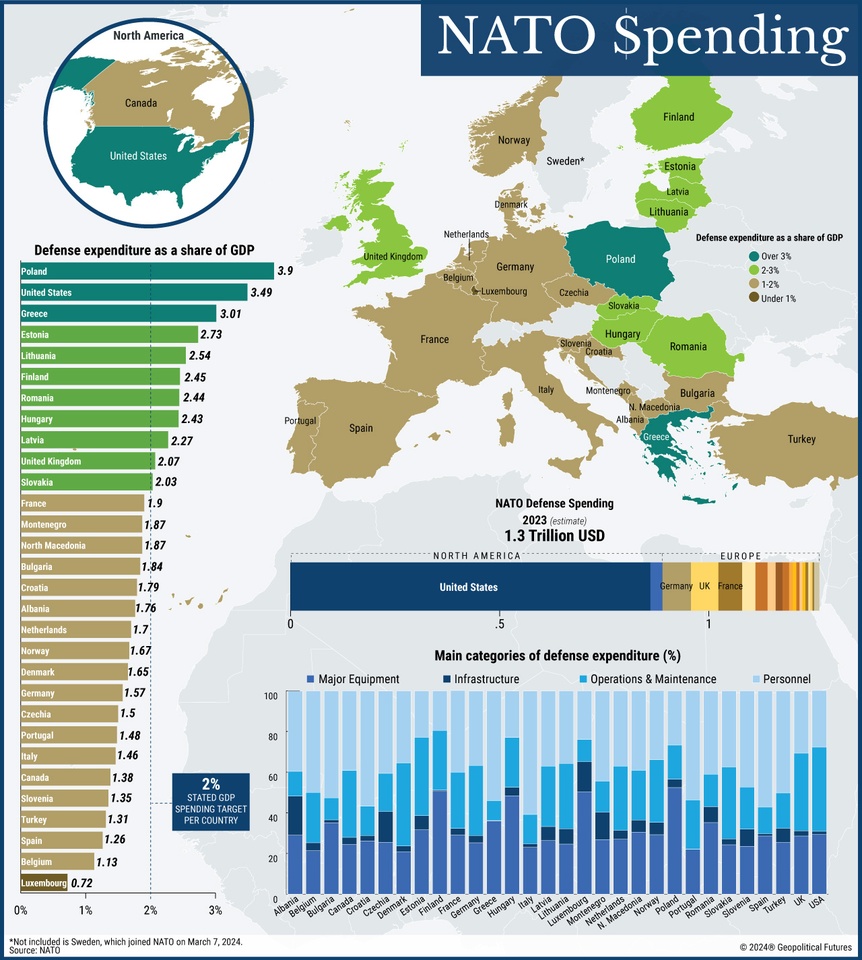

- Global increase in defense spending: With countless conflicts around the world and growing tension between the largest political actors, many countries decided to shift their priorities toward defense. Especially in Europe, where NATO members had to realize the hard way that conflicts still exist everywhere and can occur unexpectedly. Under President Trump, the U.S. pledged not to guarantee Europe’s defense perpetually if the continent does not conform to NATO defense spending goals (>2% of GDP). Following these events, many nations increased spending or even took loans for “emergency” packages to modernize and expand defense capabilities.

Decreased geopolitical and trade risk: After “Liberation Day” and the subsequent announcements, investors have become wary of Embraer’s North American prospects. However, these concerns vanished after the administration announced that aircraft deliveries will be exempt from scrutiny. Embraer reported no material tariff impact in Q2, which will continue, given that the situation stays constant.

3) Company Overview & Segmentation

Embraer is a diversified business with several categories. There are the core lines:

- Commercial Aviation: The backbone of the company is the E-Jet program. The newer E2 family (E175-E2, E190-E2, E195-E2) builds on the success of the original E-Jets, which still form a big part of the fleet worldwide. Embraer is the undisputed leader in regional jets (<150 seats). Airlines opting for something smaller than an A320 or 737 turn to Embraer instead. Demand is rising as carriers open up point-to-point routes and expand into secondary airports, particularly in emerging markets. The company also benefits from the largest installed base of regional jets in the world, with a proven track record for reliability and a vast operator network.

- Executive Aviation: The business jet arm centers on the Phenom (100EV, 300E) and the Praetor (500, 600). The Phenom 300 has held the top spot as the best-selling light jet for over 12 years, proving itself as a reliable market leader. The Praetor series marks Embraer’s strong entry into the midsize jet category, where it competes with models like Bombardier’s Challenger and Cessna’s Citation. Light and midsize jets are favored for their cost-efficient operations and dependable performance, making them a preferred choice for both corporate and private buyers.

- Defense & Security: Embraer’s key program is the C-390 Millennium (KC-390 for air-to-air refueling and cargo). It is seen as a modern, cost-effective alternative to Lockheed’s C-130 Hercules, favored especially by smaller European countries. The backlog is filled with orders from Austria, Portugal, Czechia, Hungary, the Netherlands, South Korea and Brazil. Other countries also confirmed intent to purchase, including Sweden, Slovakia, Lithuania, India, Poland, Turkey and Finland.

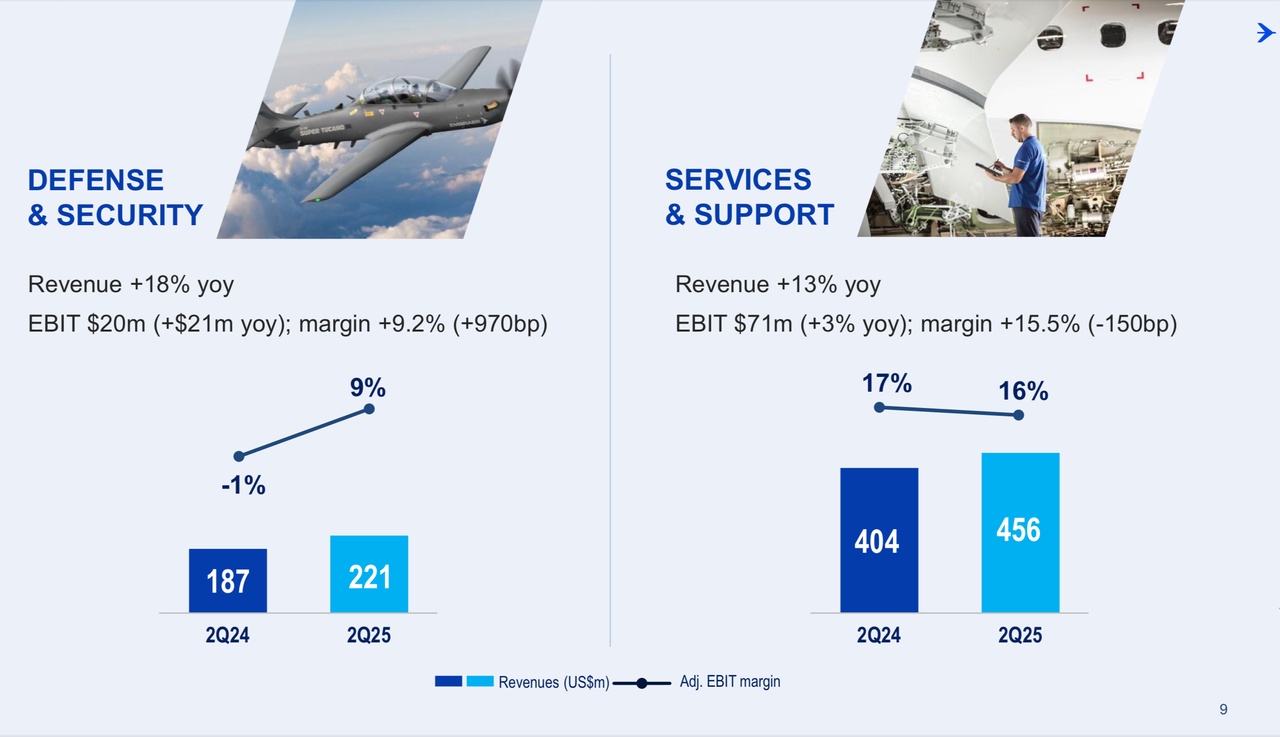

- Service & Support: This is Embraer’s recurring revenue base and serves as a margin stabilizer across economic cycles. Embraer has over 2,500 aircraft in service worldwide, generating demand for support services, including maintenance, repair & overhaul, parts supply, pilot training and fleet upgrades. Services backlog is growing rapidly, increasing predictive revenues.

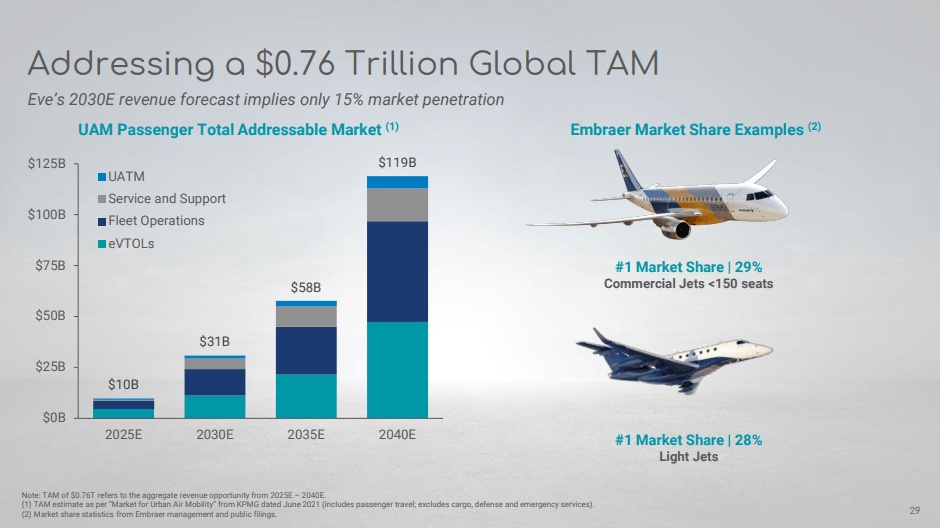

- Advanced Air Mobility: Eve is developing electric vertical take-off (eVTOL) and landing aircraft for urban air mobility. The order book is filled from airlines and ride-sharing platforms, however commercialization is still far away at the moment. Still, Eve is in a strategic position, backed by Embraer’s engineering and global service network – something many eVTOL startups lack.

Embraer is not a one-product company: it combines commercial and executive aviation with other ventures and this strategy bears fruit. The company is gaining traction, driven by macro tailwinds and strong execution. The business model is as diversified as possible for an aircraft manufacturer.

4) Financial & Operational Performance

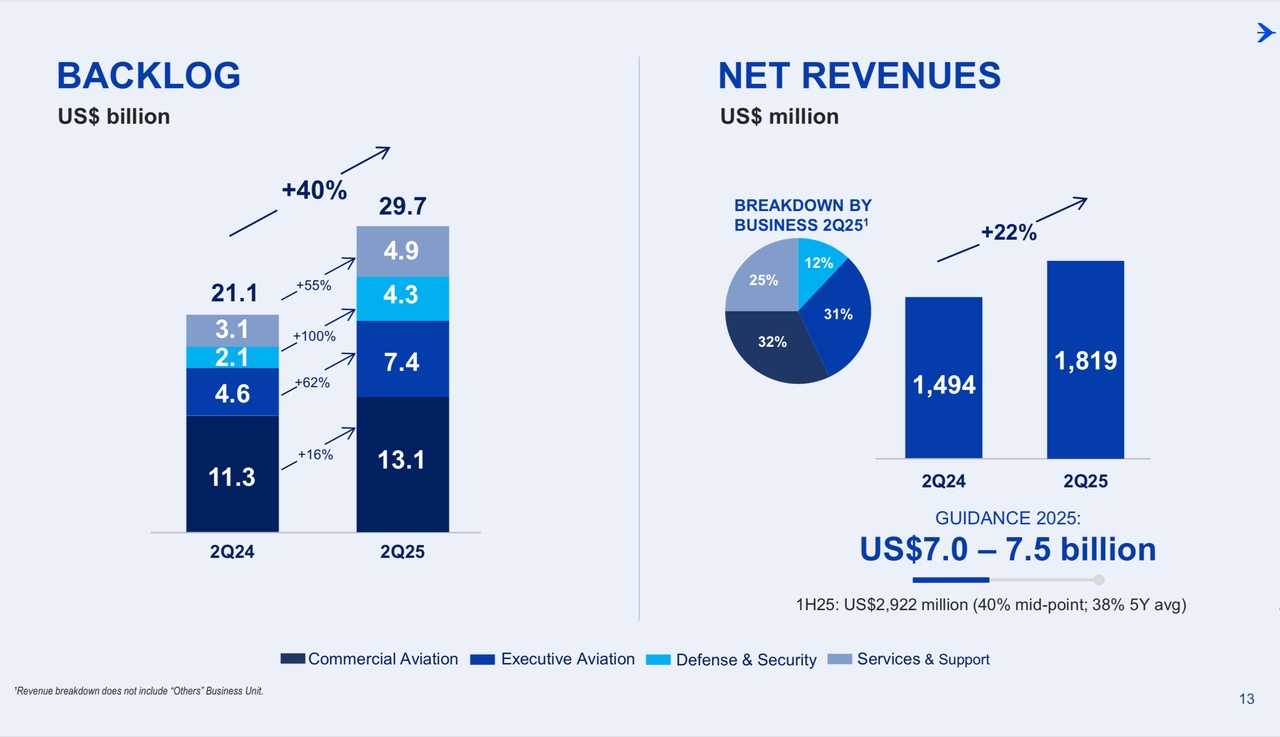

- Revenue (Q2 2025): $1.82 billion (+22% YoY, record second quarter)

- Adjusted EBIT: $191.8 million (10.5% margin, best in a decade)

- Adjusted Net Result: –$4.7 million (vs. $80 million profit in Q2 2024)

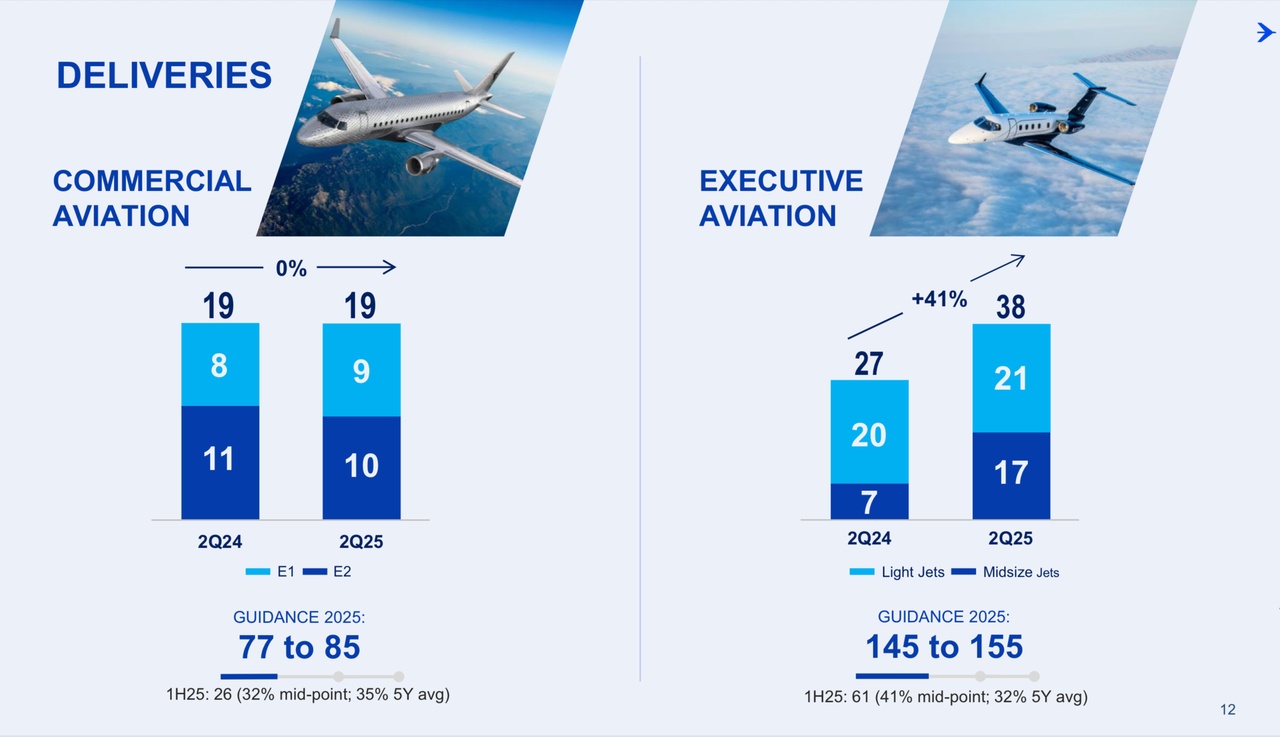

- Deliveries (H1 2025): 87 aircraft (61 executive, 26 commercial; +30% YoY)

- Backlog: $29.7 billion (record high; +40% YoY)

- Commercial Aviation: $13.1 billion (+16% YoY) – demand driven by E2 jets and strong regional fleet renewal

- Executive Aviation: $7.4 billion (+62% YoY) – Phenom 300 and Praetor families leading, business jet deliveries up sharply

- Defense & Security: $4.3 billion (doubled YoY) – C-390 export contracts expanding with NATO countries

- Services & Support: $4.9 billion (+49% YoY) – recurring revenue base growing rapidly

- Free Cash Flow (Q2 2025): –$162 million, explained through working capital required for increased production

- Leverage: Net debt/EBITDA around 0.5x after sharp deleveraging in 2024

- Guidance 2025: Revenue $7.0–7.5 billion, 77–85 commercial jets, 145–155 executive jets, EBIT margin 7.5–8.3%, FCF >$200 million

- Long-term growth: Management aims to nearly double revenue to ~$10 billion by 2030, driven by steady commercial demand, executive jet leadership, expanding KC-390 defense contracts, and early-stage growth in urban air mobility (Eve eVTOL).

Embraer is aiming for another year of solid top-line growth, driven by strong execution and macro trends. Backlog strength across all four segments provides multi-year stability, with Executive and Defense posting the fastest growth, Commercial stabilizing as the core driver, and Services adding recurring resilience with impressive numbers.

5) Growth Drivers

- Backlog at record levels: Nearly $30 billion provides exceptional forward visibility and ensures production stability well into the next cycle.

- Regional jet demand: Airlines need smaller, fuel-efficient aircraft to run point-to-point routes and connect thinner markets. This is exactly the space the E2 family dominates.

- Executive jet momentum: Business aviation is holding up better than expected, with Embraer at the front of the pack. The Phenom 300 and Praetor are driving the strongest delivery volumes in years, outpacing most competitors and proving that demand for this class of jet is here to stay.

- C-390 adoption: More and more countries are lining up for the Millennium. Several NATO members already signed on, and others are in the pipeline. For mid-sized air forces that need a modern, versatile transport aircraft, it’s becoming the clear replacement for the aging C-130 built by Lockheed Martin. With production capacity expanding, Embraer can actually deliver these planes on time and work through its massive backlog – something rivals are often struggling with.

- Expansion into emerging markets: India, Southeast Asia, and Latin America are increasing fleet sizes – precisely the markets where Embraer’s regional aircraft fit best. The company maintains strong relationships with international carriers through its global network.

Urban air mobility optionality: Eve’s ~2,800 provisional orders represent a long-term bet on an entirely new industry, where Embraer brings engineering credibility and a service backbone no startup can replicate.

6) Valuation & Investor Sentiment

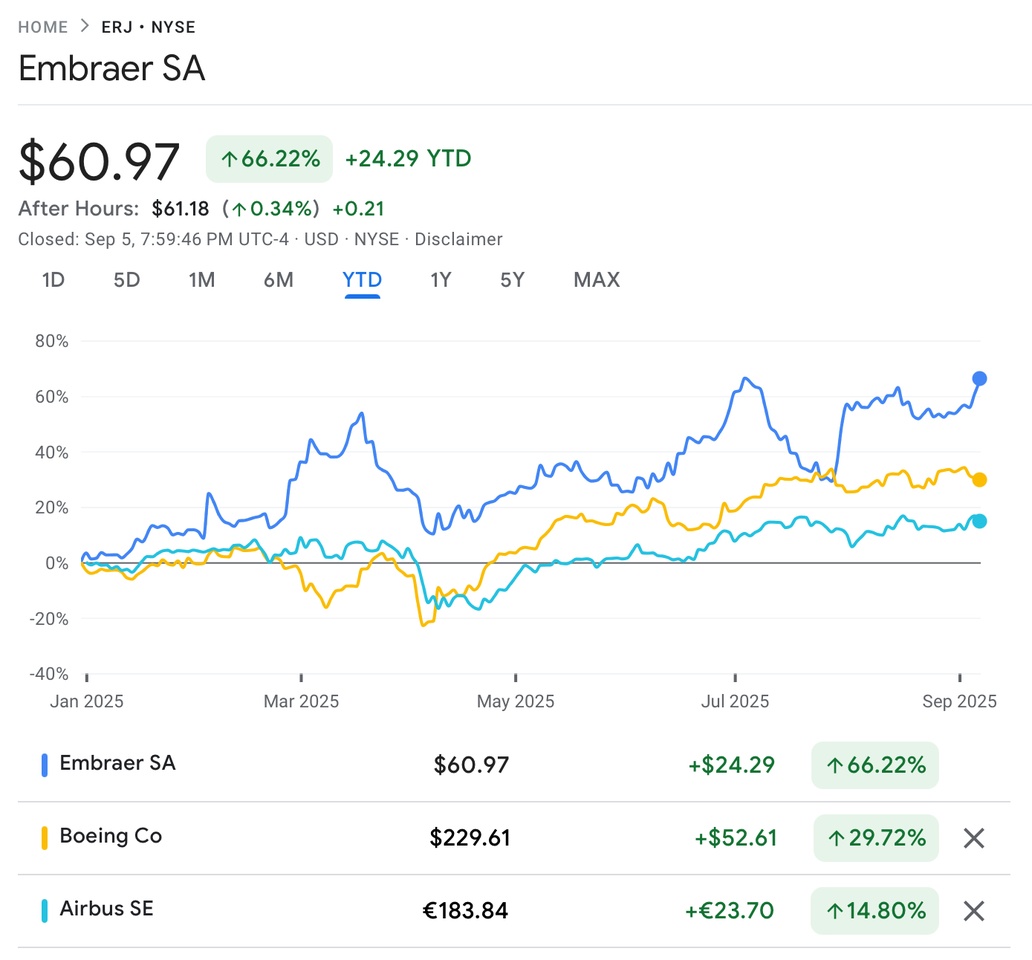

The stock has rallied a lot already this year, outperforming both Airbus and Boeing significantly. Investors recognize Embraer’s position and prospects, which led to this upward trend. However, with the company’s massive backlog, >15% revenue growth, and a strong pipeline, there is no reason to suggest a slowdown. Embraer is in a prime spot to capitalize on macro trends, and still, the stock is trading at a very fair to cheap Forward P/E ratio of ~21 – lower than Airbus’ ~23.

7) Risks & Challenges

Nevertheless, the manufacturer also faces challenges, however many seem insignificant or short lived:

- Margins under pressure: Embraer reported a negative free cash flow in Q2, which seems bad on first glance. However, if the reason for this is massive demand, which requires major investment into production capabilities to facilitate all orders, it does not seem so negative anymore.

- Tariff uncertainty: While President Trump has backed down from putting additional taxes on Embraer’s deliveries, this could potentially change in the future and further damage profitability.

eVTOL market uncertainty: Eve is one of Embraer’s future projects and growth drivers. However, there is no clarity about commercialization, regulation, and adoption as of now. While the prospects of eVTOL are undeniable, the how and when is still unclear.

8) Catalysts & Timeline

Embraer has had several successful quarters behind it, but signs point to continual growth, underpinned by multiple potential factors:

- Delivery ramp-up in H2 2025: Embraer is poised to significantly boost production, which should drive improved margins and stronger cash flow. The company continues to enhance its operational efficiency each quarter, and with a robust backlog providing a solid revenue foundation, Embraer is well-positioned to strategically invest in expanding its production capabilities and advancing its development facilities.

- Geographic expansion: As mentioned earlier, Embraer heavily targets Emerging Markets. India, one of the key players, is expanding its fleets rapidly, primarily with regional jets – something Embraer can capitalize on. The company has shown progress in talks with Indian carriers, which could materialize in the form of announcements, agreements and orders in the future.

- Defense deals: C-390 export wins could materially boost backlog. As nations pledge higher spend on the military, Embraer profits, especially since competitors struggle to deliver past orders, let alone new ones. Notably smaller countries including Austria, the Netherlands and Portugal, rely on the Millennium as their prime military transport aircraft.

eVTOL launch: Eve commercialization likely happening over the next few years, although without a concrete timeline. However, this trend is noticeably gaining traction and could become a crucial part of Embraer’s structure in the future.

9) Conclusion

Embraer is highly impressive in multiple ways: record revenue and margins, towering backlog, geographic expansion, defense diversification, and a stake in the future with eVTOL. Its strategy to nearly double revenues by 2030 – anchored on its core, modern product line – is credible. The leadership does not throw around baseless projections, but rather build on a historically strong execution and increasing demand for Embraer’s products.

For a well-rounded aerospace exposure beyond the Airbus/Boeing duopoly, Embraer shines. Yes, the company sits in Latin America, which has proven to be volatile in the past, however the landscape is changing and the economy is stabilizing, further solidifying an investment case. Most importantly, the pipeline is incredible: Eve commercialization is likely to come soon, Defense spending grows exponentially, commercial aircraft demand is booming, while private jets are as prevalent as never before. Embraer is at the intersection of all that. The company is a diversified behemoth in the sector and has a very bright future.

$EMBR3

$ERJ (-7,33%)

$AIR (-2,51%)

$BA (+3,99%)

$BOMBF

$BDRXF

$TXT (-1,59%)