Minimizing the US cluster risk is currently a major topic for investors. It is perhaps even THE topic since the second Trump administration has been throwing tariffs and isolationist positions around.

As part of an incipient reallocation in the portfolio $DFEN (+0,5%) and $ASWC (-1,07%) recently, but was bothered by the high proportion of US shares and the heavy weighting of Blackbox $PLTR (+4,99%) among others.

Today I stumbled across the recently launched ETF from WisdomTree, which compiles purely European defense companies: $IE0002Y8CX98 (-3,47%)

Some quick raw data:

Listed for the first time on 3/4/2025

TER: 0.4% p.a.

Physical

Accumulating

WKN: A40Y9K

IE0002Y8CX98

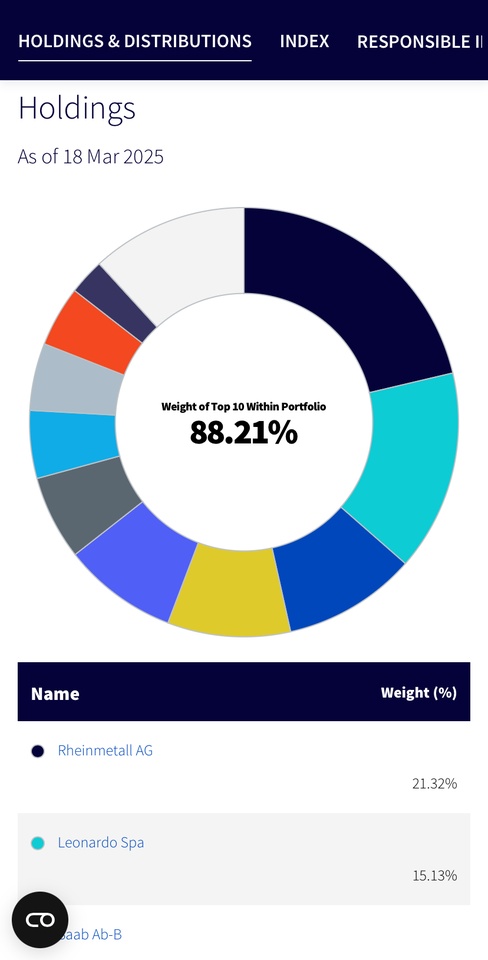

Largest positions:

Rheinmetall (approx. 20%) $RHM (-5,52%) 🇩🇪

Leonardo (approx. 15%) $LDO (-2,88%) 🇮🇹

Saab (approx. 10%) $SAAB B (-7,04%) 🇸🇪

BAE (approx. 10%) $BAE (+0%) 🇬🇧

Thales (approx. 9%) $THALES (-0,43%) 🇫🇷

This investor will reallocate a little. He is not giving investment advice, but rather enjoying the diversity of Europe. 🇪🇺

Sources:

https://www.wisdomtree.eu/en-gb/etfs/thematic/wdef---wisdomtree-europe-defence-ucits-etf---eur-acc

https://www.wisdomtree.eu/en-gb/strategies/european-defence

https://www.justetf.com/de/etf-profile.html?isin=IE0002Y8CX98#chart