Upstart Holdings ($UPST (-4,62%) ) is a company that uses artificial intelligence to revolutionize lending. After a rapid rise during the low-interest phase, the share price plummeted as interest rates rose. But with a possible interest rate cut in 2025, the tide could turn again. Is Upstart ready for a comeback? 🚀

Overview: What does Upstart do?

Upstart is an AI-powered FinTech company that evaluates loans differently than traditional banks:

✅ AI-supported lending: Instead of relying solely on credit scores, Upstart uses artificial intelligence and over 1,600 variables to better assess credit risks.

✅ Partnership with banks: Upstart does not grant loans itself, but brokers them to banks and credit institutions. As a result, the company does not bear any default risk of its own.

✅ Automated processes: Over 80 % of loans are approved fully automatically, saving banks time and money.

The business model is based on the fact that banks can grant more loans with Upstart technology without increasing the risk.

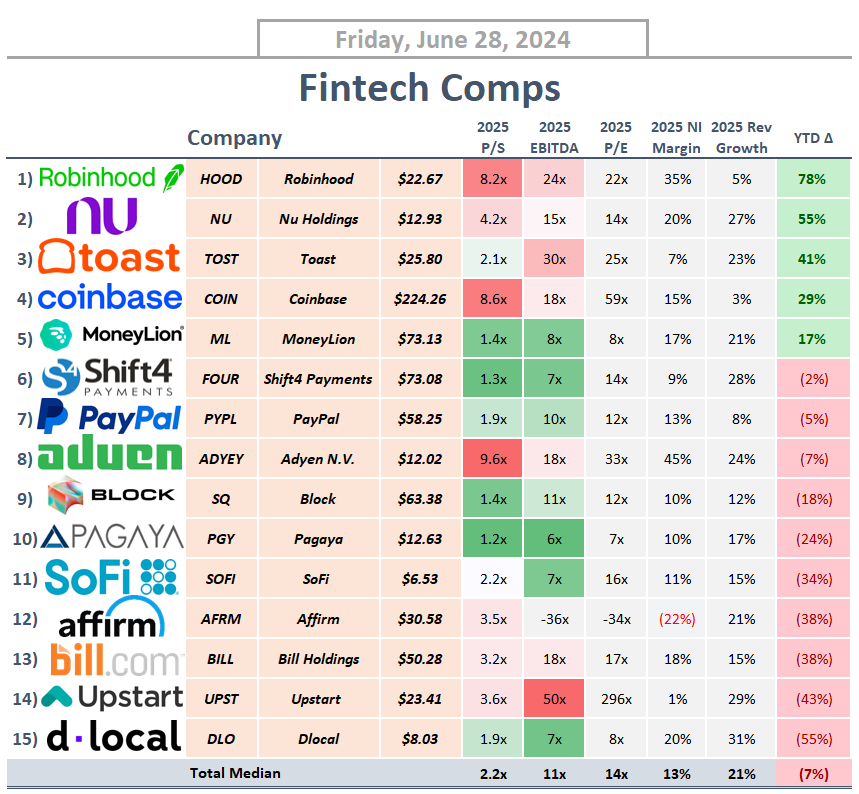

Competition: Who are the competitors?

🔸 SoFi Technologies ($SOFI (+0,43%)

SOFI) - Also a growing FinTech with a strong focus on loans and banking.

🔸 LendingClub ($LC (-2,27%)

) - Similar model, but with a stronger focus on peer-to-peer lending.

🔸 Affirm ($AFRM (-2,7%)

) - Competition in the "Buy Now, Pay Later" sector, offering real-time lending.

🔸 Traditional banks - Large banks such as JPMorgan or Wells Fargo offer their own lending solutions and could put Upstart under pressure in the long term.

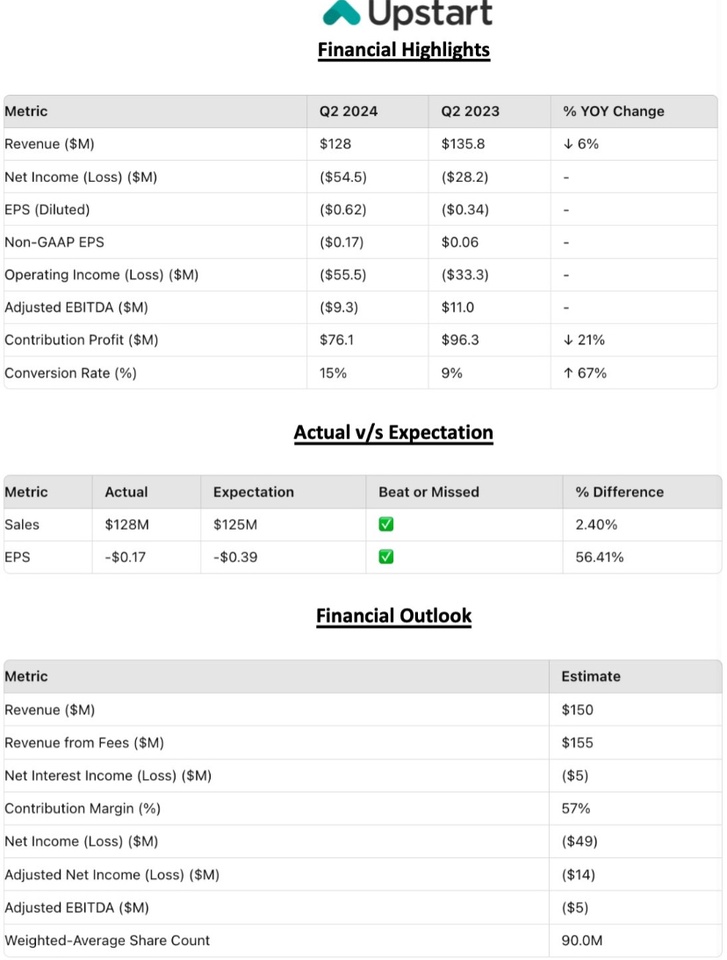

Opportunities: Why could Upstart take off again?

✅ Possible interest rate environment in 2025: Upstart has suffered greatly from high interest rates. If the US Federal Reserve lowers interest rates in 2025, demand for credit could rise again.

✅ AI advantage: Upstart's technology could help banks make more accurate lending decisions - especially in an environment where traditional credit ratings are often too rigid.

✅ Expansion into new lending areas: Upstart is expanding its model beyond traditional consumer loans to include car loans and mortgages. This could open up new growth opportunities.

✅ Partnerships with banks: Upstart already works with over 100 banks The more institutions use the platform, the larger the network becomes.

✅ Automation and efficiency: The company has cut costs significantly in recent quarters, which could improve profitability in the long term.

Risks: What could continue to weigh on Upstart?

⚠️ Interest rate risk: If interest rates remain high or continue to rise, demand for credit could remain weak.

⚠️ Regulatory risks: AI-supported lending is under scrutiny - new regulations could affect the business model.

⚠️ Confidence problem at banks: After recent weak quarters, some banks are reluctant to use Upstart loans. The company needs to prove its model again.

⚠️ Competitive pressure: Large banks and other FinTechs could develop their own AI models and take market share away from Upstart.

⚠️ High volatility: The share has shown strong fluctuations in the past. Investors must expect high volatility.

Conclusion: Turnaround or AI FinTech in crisis?

Upstart is an exciting company with an innovative idea that could revolutionize traditional lending. But after the massive fall in its share price, the company first has to prove itself again. If interest rates fall and banks start lending more again, Upstart could be one of the biggest winners.

What do you think? Is Upstart ready for a comeback or is it still a risky bet? 🚀