$ULTA (-1,32%) - Ulta Beauty brief introduction

Why am I convinced of the company and invested ?

Ulta Beauty is the leading cosmetics retailer in America and plans to expand to the rest of the world.

This dominant position proves that their products not only work, but are also favored by their target audience.

Biggest competitor: Sephora - $MC (-2,6%)

(Further $AMZN (-0,02%) , $TGT (-0,48%) , $WMT (+1,81%) )

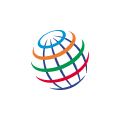

Ulta Beauty is continuously expanding its product offering with exclusive and new brands that appeal to a diverse customer demographic and drive sales growth.

They will continue to do so in the Americas to increase sales in existing stores.

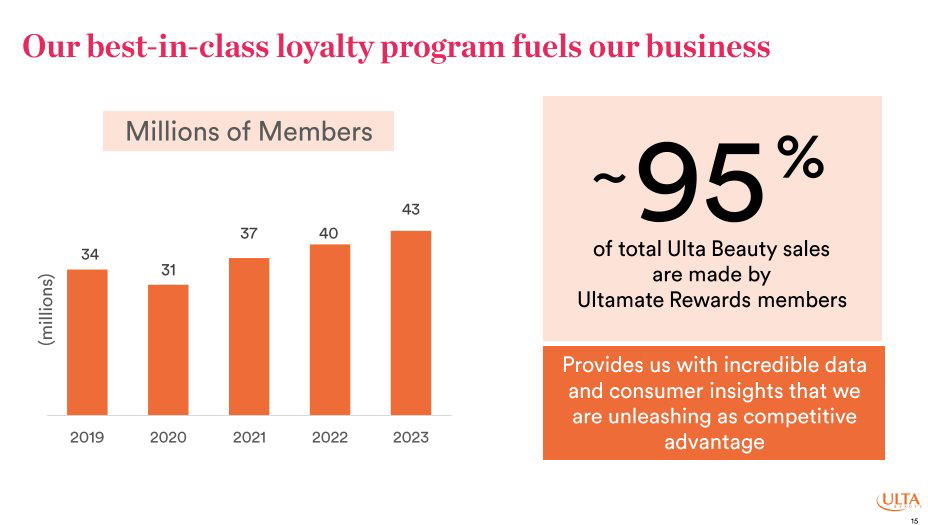

Ulta has a growing rewards program called Ultamate Rewards that has millions of members and continues to grow rapidly.

This will continue and strengthen customer loyalty in the Ulta ecosystem.

Ulta Beauty's strong omnichannel presence, combining e-commerce and physical stores, allows the company to meet the needs of its customers wherever they shop.

This increases overall sales and customer satisfaction as customers can visit Ulta online or in person.

Ulta can grow organically through volume and average price, but is also expanding internationally.

In 2025, they want to expand into Latin America and join forces with Grupo Axo. Grupo Axo is something like the "Target" (retailer and second largest discounter in the USA) of Latin America.

- Innovation and technology:

Ulta is investing heavily in technology and innovation, from beauty apps with augmented reality (AR) to AI-driven personalized recommendations that improve the customer experience and operational efficiency.

This also enables consumers to shop online with AR beauty apps.

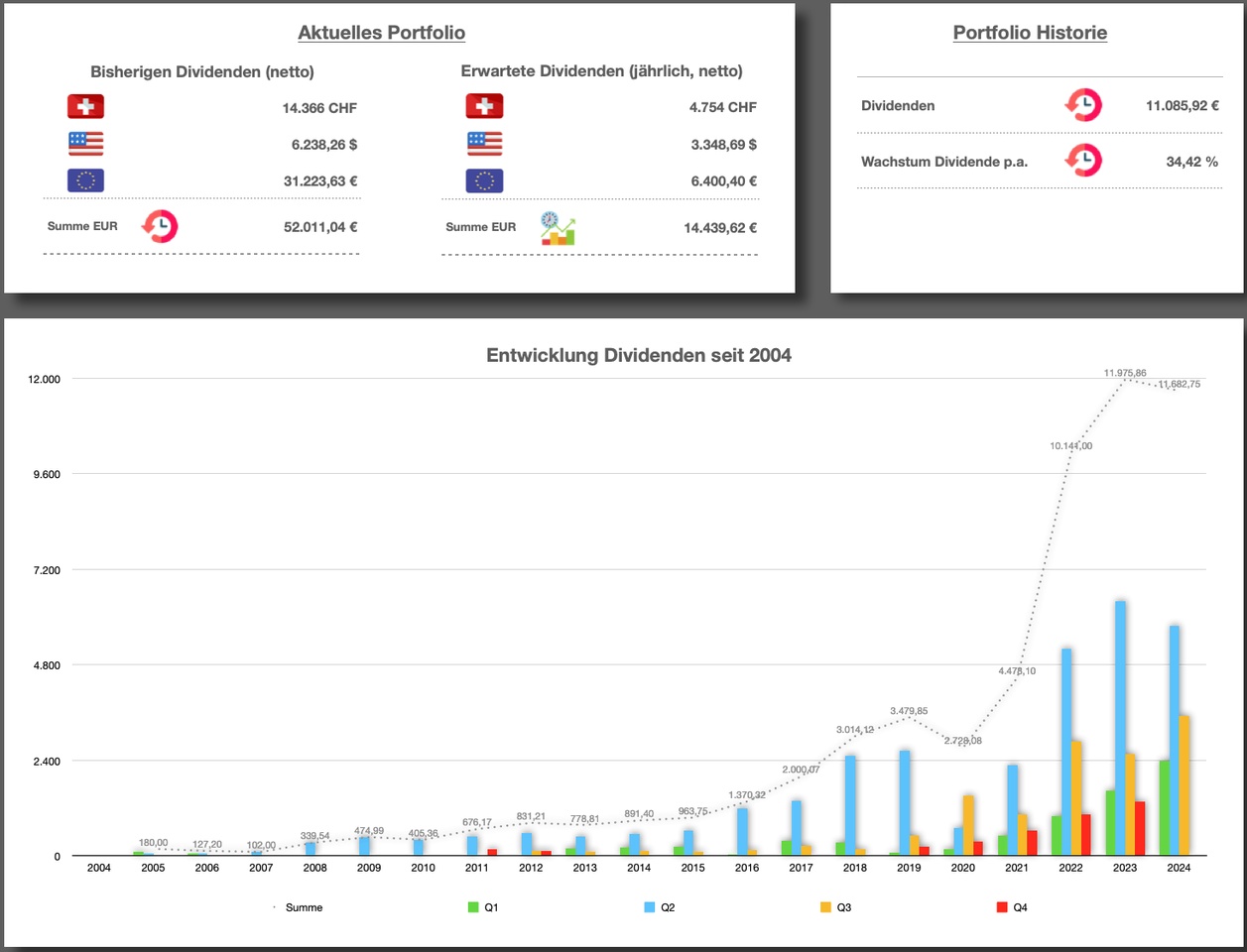

Shares - Buybacks:

Ulta will buy back shares en masse at these reduced prices. This will increase the value per share and all of the company's per share metrics.

They are set to buy back 5%+ of their market capitalization annually.

The beauty/cosmetics industry continues to grow and Ulta Beauty

is well positioned to capitalize on this trend through strategic store expansions and improvements to its digital capabilities.

As the dominant player, Ulta stands to benefit the most from this growth.

- Historically low P/E ratio:

Other key figures:

ROIC: 24.32% 5 years (return on invested capital)

Return on equity: 45.58 % 5 years

Gross margin: 42.74

Net margin: 12%

FCF margin: 8.09 % (free cash flow margin)

Sales growth 10 years: 14.96

FCF growth 10 years: 21.01 %