Unfortunately, with the purchase the end of this reliable dividend payer.

STORE Capital Azione Forum

AzioneAzioneDiscussione su STORn

Messaggi

24Time to say goodbye 😢👋🏻

You have had a single stock on your watch list for months and want to get in every now and then, and then it is simply taken off the public exchanges.

... once again too late.

getquin Daily Summary 15.09.2022

Hello getquin,

Today we start with a question that fits perfectly to Thursday! Where have you had your best kebab so far? Feel free to write in the comments. You can read my kebab secret tip tomorrow. But now back to the stock market news of the day!

Europe🌍:

1. Shell CEO Ben van Beurden resigns

The oil giant announced Thursday that CEO Ben van Beurden will step down after nearly a decade at the helm. Taking over will be Wael Sawan, currently director of integrated gas, renewables and energy solutions. The change will take place on January 1, 2023. Will this be the starting signal for a change in the Group and a focus on more sustainability?

Read more: https://cnb.cx/3BgEwXf

🟥 $SHEL (-1,61%) 26,65€ (🔽 -1,33%)

2. Siemens starts up production facilities for green hydrogen

The plant in Wunsiedel, Upper Franconia, will initially produce up to 1350 metric tons of hydrogen per year using solar and wind power. When the electricity used in the process comes from a renewable source such as wind or solar power, some refer to it as "green" or "renewable" hydrogen.

Read more: https://cnb.cx/3DslYpD

🟥 $ENR (+2,43%) 13,30€ (🔽 -1,99%)

America🌏:

3rd Adobe makes offer to buy Figma

US software maker Adobe has announced its acquisition of Figma. Figma is a collaborative web design platform and was previously seen as more of a competitor to Adobe. The purchase price is approximately $20 billion and a portion will be settled in stock. Figma's shareholders still have to approve the deal and the antitrust authorities in the USA also have to agree.

Read more: https://bit.ly/3dhSNLq

🟥 $ADBE (-0,7%) 323,50€ (🔽 -13,13%)

Special: Founder of Patagonia donates his entire company

The company's nearly $3 billion worth of non-voting stock is held by a trust that will use any profits not reinvested in the company to fight climate change. The company expects to contribute about $100 million a year, depending on the health of the business.

Read more: https://cnb.cx/3BmCKDU

Stocks of the day:

🟩 TOP $STOR 22,92€ (🔼 +20,96%)

👍 Store Capital is being bought out and is to be delisted.

🟥 FLOP $ADBE (-0,7%) 323,50€ (🔽 -13,13%)

👎 The acquisition of Figma is apparently not well received.

🟩 Most searched $TSLA (+9,97%) , 305,38€ (🔼 +0,61%)

🟥 Most traded $UN01 , 3,92€ (🔽 -2,39%)

🟥 S&P500, 3,930.84 (🔽 -0.38%)

🟩 DAX, 13,032.74 (🔼 +0.04%)

🟥 bitcoin ₿, 19,992.06€ (🔽 -1.34%)

Time: 17:00 CEST

Interesting Fact:

The name Patagonia

came to founder Yvon Chouinard after a trip through the Patagonia region of South America.

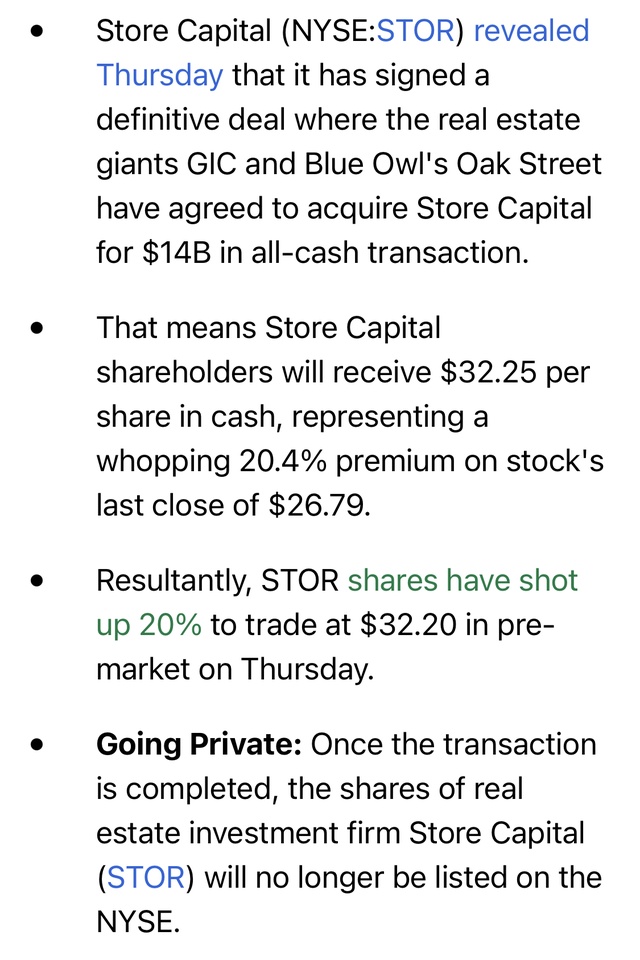

Today it was announced that Store Capital from GIC and Oak Street is to be taken over.

For me personally, this is a great pity, as I appreciated the business model very much and was able to buy the company cheaply at the time. Here I promised myself long-term dividend growth over the next 15 (and more) years.

If I were a major shareholder with a stake >1% I would actively oppose the acquisition as I think the price is too low. My expectations of Store are higher, so I will also vote against the acquisition with my comparatively small position.

How do you guys see it? Would you just sell or vote against the acquisition as well?

GIC - global investment company established in 1981 to secure Singapore's financial future. GIC is the manager of Singapore's foreign exchange reserves and invests in diverse asset classes.

Worldwide >1,900 employees 11 financial cities and investments in >40 countries.

Oak Street - is part of Blue Owl (global alternative asset manager with $119 billion in assets under management). Oak Street itself is a real estate investment firm that focuses on acquiring properties leased to creditworthy tenants.

Assets under management of $16.6 billion.

Titoli di tendenza

I migliori creatori della settimana