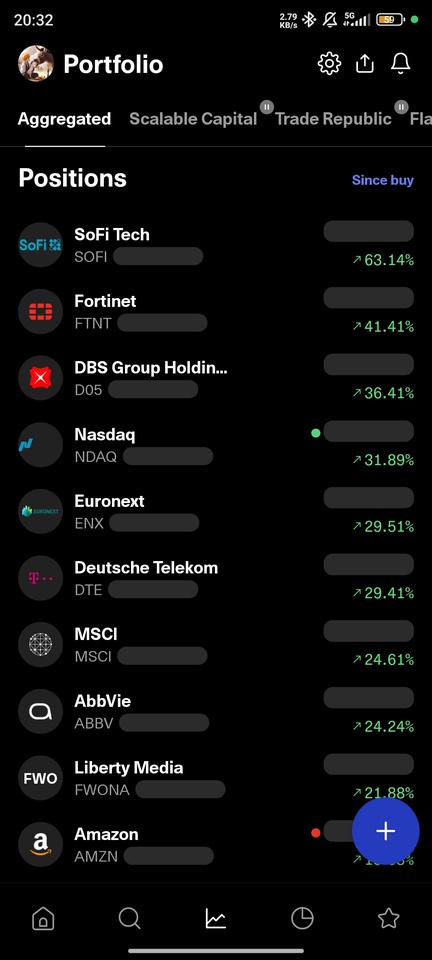

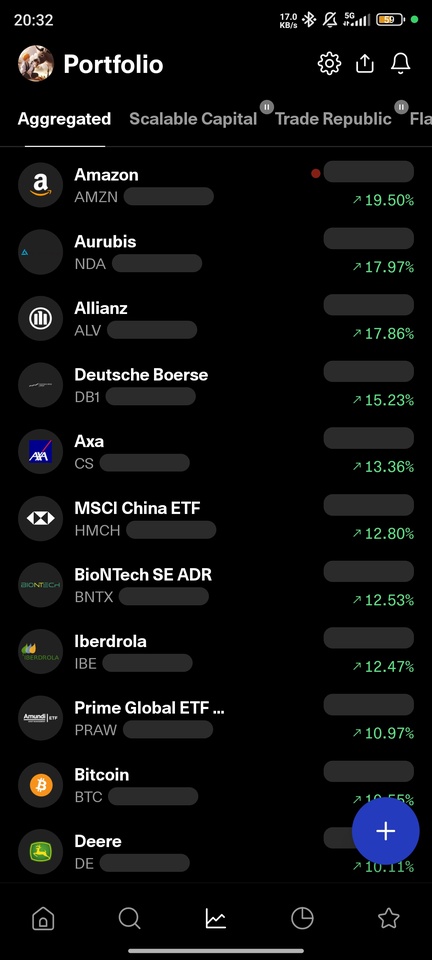

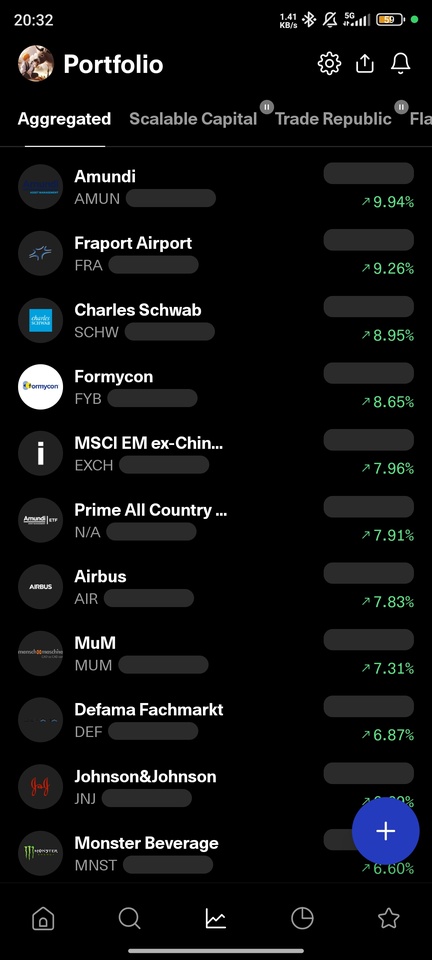

Another depot update. Values are not quite correct but the reference value is. The crypto values are completely wrong but I have no idea where the entry price is (made kind of annoying at Coinbase). The best positions at the moment are $SOFI (+9,03%)

$FTNT (+17,41%)

$D05 (+1,29%) . The interesting values for me are $BNTX (+3,76%)

$FYB (-0,57%)

$SNOW (-1,55%)

Snowflake Azione Forum

AzioneAzioneDiscussione su SNOW

Messaggi

64

+ 2

New addition to my portfolio $SNOW (-1,55%)

Snowflake was a mega IPO in 2020 and is a damn exciting company. Many of the big players such as Blackrock, Vanguard etc. are heavily invested in Snowflake and are constantly buying more shares because some of them are down 50%. So positions are being expanded because the story is right in the long term.

In hindsight, the share was too expensive at the IPO. Well, tough luck. But the fundamental figures have actually developed extremely well in the meantime - only the share price is now around 50% below the issue price.

In total, the turnover since the IPO in 2020 exploded from USD 265 million to USD 2.81 billion.

The company has been consistently profitable since 2022 (non-GAAP).

The free cash flow has been positive for just as long and has since increased from USD 0.27 to USD 2.37 per share per share.

Anyone who likes risky stocks with a good risk/reward ratio should take a closer look at this share.

The turnaround will come - the only question is when it will be too late to get in. 😎🤞🏼

Podcast episode 58 "Buy High. Sell Low."

Subscribe to the podcast to see Bitcoin perform in Q4.

00:00:00 Iran & Israel, Buy The Dip

00:16:00 Portfolio performance, September review

00:36:00 Bitcoin, Crypto - ETFs

00:48:00 Hims & Hers

01:06:00 Novo Nordisk, Eli Lilly

01:13:30 Print dies

Spotify

https://open.spotify.com/episode/6qnlfoTcu6MYhqRWq7wJzH?si=5T-g9DHYSt6fFljTK2xjKA

YouTube

Apple Podcast

$LLY (+5,07%)

$NVO (+0,75%)

$HIMS (-0,18%)

$BTC (+0,47%)

$ETH (+0,7%)

$SOL (+1,48%)

$PLTR (+5,8%)

$SNOW (-1,55%)

$ABNB (-6,51%)

#gold

#silber

#palantir

$AMD (-0,12%)

$NU (+0,57%)

$P911 (-1,22%)

$GOOGL (-0,6%)

$SNOW (-1,55%) „annonce $2B private placement of convertible notes.“

https://x.com/stocksavvyshay/status/1838310970931941864?s=46&t=TOIEuQEHGd3wRmkNZdKndw

Snowflake $SNOW (-1,55%) recently announced the acquisition of Night Shift Development, a company specializing in data analytics for the US public sector. The purchase price was not disclosed. The acquisition is intended to help Snowflake expand its presence in the government sector and help decision-makers in various agencies use data more effectively.

Night Shift Development was founded by Tim Tutt (CEO) and Drew Hayes (COO), both of whom have extensive experience in data analysis and systems engineering. Their focus was strongly on working with US security agencies. Following the acquisition, Snowflake will establish a dedicated public sector unit to strengthen its collaboration with government organizations. Tim Tutt will remain part of the company and will now serve as Vice President of National Security at Snowflake.

This acquisition aligns with Snowflake's strategy to promote the use of data and artificial intelligence in government organizations and provide more secure and efficient data solutions. Both companies share the goal of making data analytics more democratic and expanding access to powerful data platforms.

Government institutions and companies in particular now have a problem with outsourcing highly sensitive data to the cloud and entrusting it to external companies.

This is why edge computing will return.

You should be well positioned here

Snowflake Inc.: Is ❄️ melting away or growing into an iceberg?

For the development (company figures), a better view and more, check out the free blog: https://topicswithhead.beehiiv.com/p/snowflake-inc-schmilzt-das-unternehmen-dahin-oder-w-chst-es-zum-eisberg-heran

Company Profile

Snowflake Inc. is a pioneer in cloud computing, specializing in data warehousing and analytics. Founded in 2012 and headquartered in Bozeman, Montana, the company provides a cloud-native platform that enables organizations to efficiently store, process and analyze data - all from a single source.

Historical development

Since its foundation $SNOW (-1,55%) has undergone a remarkable development. With its IPO in 2020, the company achieved the largest software IPO in history to date and consolidated its position as a leading provider of cloud-based data solutions. In the years that followed, Snowflake continued its dynamic growth and established itself as one of the key players in cloud data warehousing.

Business model

Snowflake pursues a usage-based business model that focuses on flexibility and cost efficiency. The revenue streams are divided into the following main categories:

Subscriptions to the Cloud Data Platform

Professional Services

Marketplaces

Snowpark (a developer platform)

Strategic partnerships

This model enables customers to pay only for the resources they actually use and helps them to manage their costs effectively.

Core competencies

Snowflake has several key strengths:

Scalability: Thanks to its cloud-native architecture, the platform can scale compute and storage resources seamlessly and on demand.

Performance: Snowflake offers outstanding performance for complex queries and real-time analytics, clearly setting it apart from competitors.

Data integration: The platform facilitates the efficient integration of data from a wide variety of sources and systems.

Security: Snowflake sets high standards for data security and compliance and meets comprehensive data protection requirements.

Ease of use: The platform is designed for both technical and non-technical users, ensuring ease of use.

Future prospects and strategic initiatives

In the face of growing challenges, Snowflake looks forward to an exciting future:

Product innovation: The company is continually investing in the development of new features and services to secure and expand its market position.

Market expansion: Expansion into new sectors and geographical markets is the focus of strategic planning.

Partnerships: Snowflake is further expanding its ecosystem through targeted partnerships and strengthening its market position.

Focus on AI and machine learning: With the increasing integration of AI capabilities, Snowflake aims to meet the growing need for advanced analytics.

Cost optimization: In the face of rising marketing and personnel costs, the company is rigorously pursuing a strategy to control costs and increase efficiency.

Market position and competition

Snowflake operates in a highly competitive market and competes directly with cloud giants such as $AMZN (-0,02%) , $MSFT (+0,15%) and $GOOGL (-0,6%) , who each offer their own data warehousing solutions as integral parts of their comprehensive cloud ecosystems.

A particularly relevant competitor is Databricks, which - like Snowflake - focuses on modern, cloud-native data processing solutions. Although $DBRX not currently listed on the stock exchange, the company is considered a strong candidate for a future IPO and is attracting increasing attention in the industry.

Overall, the market for cloud data warehousing and analytics is extremely dynamic and highly competitive, characterized by a mix of listed tech giants, specialized companies and up-and-coming private firms. In this environment, Snowflake must assert itself through continuous innovation, differentiated product offerings and effective market strategies.

Total Addressable Market (TAM)

Snowflake's Total Addressable Market (TAM) is expected to more than double from USD 152 billion in 2023 to USD 342 billion in 2028. This development reflects the expected dynamic expansion of the market for data and cloud services in the coming years. The forecasts are based on the growing importance of data management and analysis in an increasingly data-driven economy and the ongoing migration of companies to the cloud.

Share Performance

Snowflake made its stock market debut on September 16, 2020 at an initial price of USD 120 per share. The share price rose sharply on the very first day of trading and opened at USD 245, almost double the issue price. Since then, however, Snowflake's share price has been extremely volatile. From its high, it has recorded an overall performance of -57.58% to date.

In summary, it can be said that after the initial hype and rapid price gains, the share has undergone a significant correction.

The Consumption Model

Snowflake relies on a consumption-based model in which the majority of revenue is recognized according to the extent to which customers use the platform. This model offers various advantages, but also some aspects that need to be considered:

Revenue generation

- Pros: Revenue grows faster as it is closely linked to actual customer consumption.

- To consider: Revenue is variable and depends heavily on customer usage behavior.

Pricing model based on consumption

- Pros: The model is aligned with customers' value-based costs as they only pay for actual usage.

- To consider: Improvements in platform performance may reduce customers' costs, which could impact revenue.

Contract terms for billing

- Typically in advance: Most contracts include upfront payments.

- Pros: This practice encourages faster growth.

- Pro: Bookings reflect a contractual minimum.

- Pro: A variable consumption model can provide additional revenue during the renewal cycle.

- To consider: Payment terms are dynamic and can evolve.

Further considerations

- Pros: Customers don't have to pay for unused software (known as "shelfware").

- To consider: Since the model is based on a usage-based approach, there is a possibility that revenue will fluctuate depending on customer usage.

For the development (company figures), a better view and more, check out the free blog : https://topicswithhead.beehiiv.com/p/snowflake-inc-schmilzt-das-unternehmen-dahin-oder-w-chst-es-zum-eisberg-heran

Opinion/Conclusion

Now that you have only heard negative things, the question arises as to why you should even think about the share. Let me give you a few reasons:

What was positive for the company and previous investors now makes the share price look completely crashed. The share was simply floated far too high and was completely overhyped. But the long-term trend is still behind the share.

With more and more data and the increasing migration to cloud services, Snowflake will continue to grow, especially internally. This means that sales will continue to rise steadily, and the only thing that really matters is customer migration. Proof of this is that if you take out S&G and still get revenue growth through the internal growth rate, you would immediately value the company positively. So you pay accordingly for future sales.

There are many competitors, but as is so often the case, you don't want to be dependent on the usual players. If you look at it this way, only Databricks and Snowflake remain as the main players.

The ratio of R&D to sales is just under 50%, which shows that Snowflake is determined to remain one of the market leaders and increasingly wants to offer more for its customers. The sales shortfall that this is currently creating will disappear later.

Snowflake believes this too:

"We have so many new product feature capabilities that we need to ensure the salespeople are equipped to be able to sell that. And a lot of that is sales enablement and training, and he's really deriving a lot of that. And it's very positive what I'm seeing coming out" (IR at the last meeting) or "And until we see revenue, we're not going to spend more on the COGS side. And we have a fixed amount in R&D, and that will not change. Got it. Got it. And I think Sreedhar has talked about seeing significant contribution from some of these emerging products maybe as early as next year. I mean, how should we sort of think about the pace in which these ramp up? Because on one hand, I mean, 2,500 customers is, I think, 30-40% of your install base or somewhat, which is a pretty good start considering these products are only out for a couple of quarters. Yep. So, you know, obviously, we wouldn't have built these products if we didn't think they could have a meaningful impact. And it's I'm not going to guide to it now. It's still too early to tell, but we'll definitely be talking about that in Q4 when we finish the year. Yeah. I think that's when we'll have more of an impact. Remember, a lot of these things with Cortex, there's 2 components to it. There's the GPU component to generate things, but then actually running the query is also driving a lot of data warehousing revenue as well, too, that has the higher margin. Right. And I think there's no contribution expected from these new products embedded in that. We don't have anything embedded in our guide for this year."

So we are dealing here with a fast-growing tech company that is investing heavily in the product and staff and is mainly being held back by the share price, as there is a revenue gap, an IPO that is too high and its competitor Databricks is doing very well. However, Snowflake has by no means lost touch.

I cannot predict whether the share price will continue to fall, but apart from a few minor issues, the company is doing very well and I will continue to hold on to it. This could be particularly interesting for savings plan shareholders, as you get more and more shares as the share price falls until the gaps disappear and you can concentrate on profitability.

Podcast episode 53: "Buy High. Sell Low."

Subscribe to the podcast to help Bitcoin break $100,000 in 2024.

00:00:00 Vonovia $VNA (+2,7%)

00:27:00 Weyerhaeuser $WY (+1,23%)

00:37:35 PayPal $PYPL (+3%)

00:47:00 Snowflake $SNOW (-1,55%)

01:12:00 FED money printers / interest rate cut

01:24:00 Dirt of the week: perma bears

01:31:00 Bitcoin seasonality Q4 2024 $BTC (+0,47%)

01:34:00 Tron with hype $TRX (+0,25%)

Spotify

https://open.spotify.com/episode/0rPsPlA35ZMGErSBDcyQln?si=lTebJn7qQtOezoRTcP4rcQ

YouTube

https://youtu.be/NC6Ts3dFuCw?si=GhCkyXYRi2z0BVky

Apple Podcast

"Subscribe to the podcast so that Bitcoin cracks $100,000 in 2024. "

If bitcoin doesn't crack 100k?

*joke ends*

HERE'S WHAT ANALYSTS HAVE TO SAY AFTER $SNOW (-1,55%) Q2 EARNINGS:

- Rosenblatt (Buy, PT: $180): "Snowflake reported Q2 product revenue growth of 30%, exceeding our expectations by 3%, with total revenue also beating consensus. Despite the better-than-expected consumption levels, the company's Q3 product revenue growth guidance remains in line with prior consensus. Snowflake is dealing with headwinds in the second half of the year from Iceberg table support, but we see the company as well-positioned for the longer term. While we have slightly lowered our revenue growth forecast for FY25, we maintain confidence in Snowflake's overall growth trajectory."

- Goldman Sachs (Conviction Buy, PT: $220): "Snowflake’s Q2 results were solid, with product revenue growth and cRPO both beating expectations. Despite a lower revenue beat compared to previous quarters and concerns around the CEO transition, Snowflake’s performance in a constrained spending environment underscores its strength. We believe that if the company can stabilize or re-accelerate product revenue growth, it has significant upside potential."

- TD Cowen (Buy, PT: $180): "Snowflake's Q2 results were solid, with product revenue growth of 30%, slightly above the Street's 27% expectation but below what some on the buyside might have hoped for, leading to an 8% after-hours decline following a 20% rally over the last two weeks. However, the significance of the full-year guidance raise, more than double the Q2 beat, alongside positive comments on consumption stability, impacts from Iceberg, and plans to accelerate sales hiring, are the key takeaways. These factors are more important than the slight miss in expectations."

- Piper Sandler (Overweight, PT: $165): "Snowflake's Q2 results were better than feared, with a $22M beat in product revenue, stable optimization trends, and 30% y/y growth in cRPO. However, we remain cautious due to execution risks related to leadership changes, Iceberg Tables, macroeconomic headwinds, and competition. Despite these risks, the company's fundamentals remain strong, with significant long-term growth opportunities."

- Canaccord Genuity (Buy, PT: $190): "Snowflake's Q2 results were strong, with product revenue growing 30% y/y, beating guidance. However, investors are concerned about the slowing pace of revenue growth and the company's ability to stay ahead in the competitive AI race. While product gross margins were slightly down, the company managed to exceed expectations on profitability metrics, demonstrating resilience in a challenging market."

- Scotiabank (Sector Outperform, PT: $165): "Snowflake's Q2 results were unusual, with a modest product revenue beat but a decent full-year top-line raise, although without an increase in FCF margin guidance. Shares fell after hours as investors questioned whether recent data breaches or new table formats impacted performance. However, our checks suggest minimal impact from these events. We remain confident in Snowflake’s potential as an AI beneficiary and see upside potential in the latter half of FY25."

- Jefferies (Buy, PT: $145): "Snowflake's Q2 results were solid, with a 3% revenue beat, but the company's ongoing transition, including product investments and leadership changes, presents challenges. Although progress is being made, the valuation remains a question mark, and we believe it will take time for these initiatives to fully pay off. Nevertheless, Snowflake's long-term prospects remain strong."

- Baird (Outperform, PT: $152): "Snowflake reported solid Q2 results, with a 2.7% product revenue beat. The company also raised its full-year revenue guidance from 24% to 26%, and we remain positive on its near- and long-term growth potential. However, the stock experienced a modest drop after hours due to lighter-than-expected beats and in-line margin guidance. We continue to see value in Snowflake’s ability to capitalize on the shift to cloud data management and AI."

Needham (Buy, PT: $160): "Snowflake outperformed its guidance and sell-side estimates for Q2, but shares fell after hours as investors expected stronger revenue growth in the October quarter and a higher increase in operating margin guidance. We believe the company's decision to raise FY25 revenue guidance, despite a modest Q2 beat, reflects confidence in its long-term growth strategy. We remain positive on Snowflake's potential to exceed its updated guidance."

- Evercore ISI (Outperform, PT: $170): "Snowflake delivered solid Q2 results, with product revenue ahead of forecasts. While the beat was smaller than some hoped, the company’s core business remains healthy, and consumption patterns are normalizing. We believe the risk/reward skews to the upside, particularly with new AI products expected to drive growth in FY26."

- DA Davidson (Buy, PT: $175): "We maintain our positive view on Snowflake after the company reported solid Q2 numbers, beating expectations on both the top and bottom lines. Despite investor concerns, management reiterated that Snowflake was not affected by recent customer hacks, and the company is doubling down on investments for future growth. We believe this strategy will pay off in the long term, even at the expense of short-term margins."

$SNOW (-1,55%) - Q2 Earnings Highlights:

- Adjusted EPS: $0.19 (Est. $0.16) - Revenue: $868.82M (Est. $851.58M) ; UP +29% YoY

- Product Revenue: $829.3M (Est. $812.6M) ; UP +30% YoY

FY25 Guidance:

- Raised Product Revenue: $3.356B; UP +26% YoY

- Product Gross Profit Margin: 75%

- Operating Income Margin: 3%

- Adjusted Free Cash Flow Margin: 26%

Q3 Outlook:

- Product Revenue: $850M-$855M; UP +22% YoY

Titoli di tendenza

I migliori creatori della settimana