Do you invest in the defense sector?

If so, which companies do you have?

At the moment I am LONG in $LMT (+3,53%) and $LHX (+3,12%) .

Messaggi

9Do you invest in the defense sector?

If so, which companies do you have?

At the moment I am LONG in $LMT (+3,53%) and $LHX (+3,12%) .

Week in review 26.10.

New 52-week highs or all-time highs: Gold, Silver, Booz Allen Hamilton, Boyd Gaming, Carvana, Endeavour Silver, GE Vernova, Iron Mountain, L3Harris, Philip Morris, Reddit, SAP, Sea Ltd, Teledyne Netflix, Nvidia, Microstrategy, Palantir PayPal, SoFi, Wells Fargo, Welltower, Wyndham Hotels & Resorts

Palantir (+170%) points to 2024 Vistra (+231%) and Nvidia (+202%) the third-best performer in the S&P 500

Tesla +20% after good quarterly figures, best trading day in 11 years, cheaper new model coming in H1/2025, +9% since the beginning of the year

New Apple MacBooks with M4, Mac mini and iMac will be presented next Monday, Apple shares +26% since the beginning of the year

McDonald's E.coli - bacteria in burger meat, one dead and several injured, shares fall 8%, +1% since the beginning of the year

SAP with good quarterly figures, +61% since the beginning of the year

Deutsche Bank with good quarterly figures, +26% since the beginning of the year

Mercedes with poor quarterly figures due to weak business in China, -9% since the beginning of the year

Microsoft-shareholders want to vote on Bitcoin purchase for the balance sheet at the Annual General Meeting in December, Bitcoin +59% since the beginning of the year

Qualcomm and ARM are in a license dispute over the Nuvia takeover, ARM +112% since the beginning of the year, Qualcomm +23% since the beginning of the year

Lockheed Martin with good quarterly figures, +24% since the beginning of the year

L3Harris with good quarterly figures, +24% since the beginning of the year

RTX (Raytheon) with good quarterly figures, sales and profit forecasts raised, +48% since the beginning of the year

UPS with good quarterly figures, -9% since the beginning of the year

Texas Instruments with good quarterly figures, +25% since the beginning of the year

Coca Cola with good quarterly figures, +15% since the beginning of the year

IBM with strong profit growth but disappointed sales, +36% since the beginning of the year

Munich RE Profit warning due to major losses, +24% since the beginning of the year

Starbucks has suspended its forecast for the coming financial year as new CEO Brian Niccol seeks to restructure the company but increases dividend, +5% year-to-date

Kering with profit warning as Gucci weakens in China, -40% since the beginning of the year

Enphase Energy with poor figures, share falls -12%, -37% since the beginning of the year

Traffic light government decides exit tax on ETF assets from €500,000, savings and independent investing are penalized even more, prosperity and freedom are made more difficult and hindered

Loopholes in the rent control for furnished apartments remain

" If you want to read a review like this every week, leave a like & subscribe here.

$TSLA (+9,97%)

$NVDA (-0,03%)

$PLTR (+5,8%)

$VST (+5,85%)

$BTC (+0,21%)

$AAPL (+0,65%)

$MCD (+2,19%)

$SAP (-0,4%)

$DBK (-2,66%)

$MBG (-3,33%)

$QCOM (-0,3%)

$ARM (-1,08%)

$MSFT (+0,15%)

$MSTR (+1,77%)

$RTX (+3,63%)

$LMT (+3,53%)

$LHX (+3,12%)

$UPS (-0,58%)

$DBK (-2,66%)

$SAP (-0,4%)

$TXN (+2,43%)

$KO (+1,1%)

$IBM (+1,17%)

$MUV2 (-0,5%)

$SBUX (+2,49%)

$KER (-5,61%)

$E2NP34

#steuern

#steuernsindraub

#rückblick

#palantir

#bitcoin

#krypto

#crypto

#aktien

#meme

#memes

#pltrgang

Defence stocks seem to be slowing down quite a bit.

I believe that European companies like $BA. (+0,48%) BAE Systems and, for example, $LDO (+3,07%) Leonardo or $HO (+0,39%) Thales are broadly positioned. They could be interesting for the areas of defence, space tech, drones, propulsion technology and cyber security.

Where do you see European and non-European defence stocks heading in the near future?

$ITA (+4,54%)

$BA. (+0,48%)

$BA (+1,21%)

$LHX (+3,12%)

$NOC (+1,36%)

$RR. (+0,81%)

$LMT (+3,53%)

$RHM (+1,63%)

$HAG (+2,31%)

$QQ. (-0,45%)

Which companies do you think have the most growth potential?

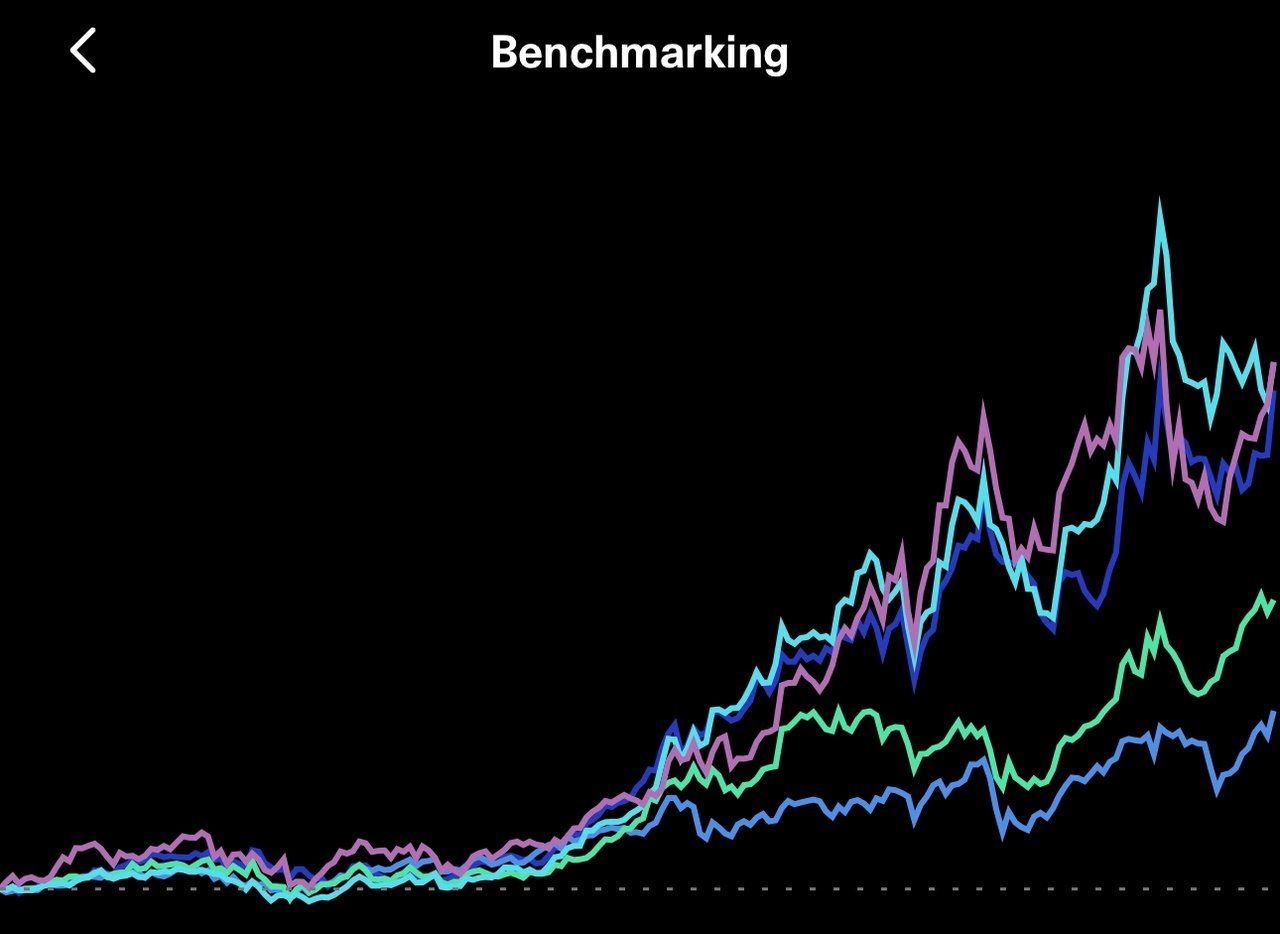

Armaments shares from 🇺🇸 in comparison, the last 20 years, you can see only after 10 years have the 🚀 ignited.

I only have a large position in Lockheed and a small one in RTX.

But I invest in all 5 via a savings plan 😊👍

Do you have one or two armor stocks in your portfolio?

$LMT (+3,53%)

$RTX (+3,63%)

$GD (+0,75%)

$NOC (+1,36%)

$LHX (+3,12%)

These are the current Upgrades🟩 for this Monday, the September 18, 2023.

Hey Hey, here I count you times on what is in my dividend portfolio in it, gladly feedback on it 🤍

$O (+2,65%)$DIS (+0,84%)$LTC (+2,37%)

$LHX (+3,12%)

$ORCL (+2,18%)

$CVX (+0,94%)

$N/A $RTX (+3,63%)

$HOT (-1,48%)

$MSFT (+0,15%)

𝗠𝗮𝗿𝗸𝗲𝘁 𝗡𝗲𝘄𝘀 🗞️

𝗖𝗵𝗶𝗽-𝗔𝘂𝗳𝘀𝗰𝗵𝘄𝘂𝗻𝗴 / 𝗦𝘁𝗮𝗵𝗹𝗵𝗮𝗿𝘁𝗲𝘀 𝗕𝘂𝘀𝗶𝗻𝗲𝘀𝘀 / 𝗛𝗼𝗱𝗹 / 𝗣𝗲𝗿𝘂'𝘀 𝗖𝗕𝗗𝗖

𝗘𝘅-𝗗𝗮𝘁𝗲𝘀 📅

As of today, among others, 3M ($MMM (+1,14%)), Cognizant ($COZ (-0,54%)), Cummins ($CUM (+1,28%)), Ford ($FMC1 (+0,87%)), GlaxoSmithKline ($GS7), Hershey Company ($HSY (+1,79%)), L3Harris Technologies ($HRS (+3,12%)), Microchip Technology ($MCP (-1%)), Otis Elevator Company ($4PG (+0,17%)), Raytheon Technologies ($5UR (+3,63%)), Sherwin-Williams ($SJ3 (+1,26%)) and Tyco Electronics ($TY1C) traded ex-dividend.

𝗤𝘂𝗮𝗿𝘁𝗮𝗹𝘀𝘇𝗮𝗵𝗹𝗲𝗻 📈

Today, among others, Alibaba Group ($2RR (-5,04%)), Applied Materials ($AP2 (-0,37%)), Farfetch ($F1F), Full Truck Alliance Co ($YMM (-3,01%)), Globant ($GLOB (-0,37%)), Intuit ($ITU (+2,04%)), JD.com ($013A (-6,23%)), National Grid ($NNGF (-0,42%)), Nuance Communications ($SC2), Palo Alto Networks ($5AP (+1,75%)), Ross Stores ($RSO (+0,91%)), Williams-Sonoma ($WM1 (-2,32%)) and Workday ($W7D (+0,04%)) presented their figures.

𝗠𝗮𝗿𝗸𝗲𝘁𝘀 🏛️

Nvidia ($NVD (-0,03%)) - In after-hours trading yesterday, NVIDIA shares were able to make strong gains, driven by high demand for chips for data centers and computer games. In the past quarter, NVIDIA reported an 84 percent increase in profits to $2.46 billion. Among other applications, NVIDIA's technology is used for artificial intelligence applications, graphics cards and data center chips. NVIDIA is considering plans to buy British chip designer Arm, whose technology is in almost all smartphones, despite concerns from competition authorities. Based on Arm's chip architecture, companies including Apple ($APC (+0,65%)), Samsung ($SSUN (+0,89%)) and Qualcomm ($QCI (-0,3%)) design their own processors for mobile devices.

thyssenkrupp ($TKA (-3,23%)) - Steel group thyssenkrupp beat expectations for the past fiscal year 2020/21 (ending September) with significant growth and benefited from the economic recovery. Adjusted earnings before interest and taxes came to 769 million euros. However, shareholders will again have to do without a dividend this year. The Group expects mid-single-digit percentage growth and around a doubling of adjusted EBIT to between 1.5 and 1.8 billion euros and net income of at least 1 billion euros for the recently launched new fiscal year.

𝗖𝗿𝘆𝗽𝘁𝗼 💎

Bitcoin ($BTC-EUR (+0,21%)) - Recent data shows that bitcoin holders who bought for $20,000 are refusing to sell BTC at all-time highs. Despite tempting triple gains, last November's buyers are determined to continue with the "hodl" strategy. BTC buyers hold their nerve and hold their coins despite various all-time highs.

Peru - The president of Peru's central bank (Julio Velarde) has announced that the country is working with India, Singapore and Hong Kong to develop a central bank digital currency (CBDC). According to the Atlantic Council, 87 countries (accounting for more than 90% of global GDP) are currently researching a CBDC, and seven have already launched their own. By comparison, only 35 countries have considered developing a CBDC in the 2020 mail.

Follow us for french content on @MarketNewsUpdateFR

I migliori creatori della settimana