Earnings next week (11.11 - 15.11)

JD.Com ADR Representing 2 Azione Forum

AzioneAzioneDiscussione su JD

Messaggi

56Hello everyone,

do you think the $JD (-6,23%) will return to its former strength (60-70 €) or whether this is just a flash in the pan due to the massive financial injection into the markets?

I am really undecided whether I should hold the position or take the profit

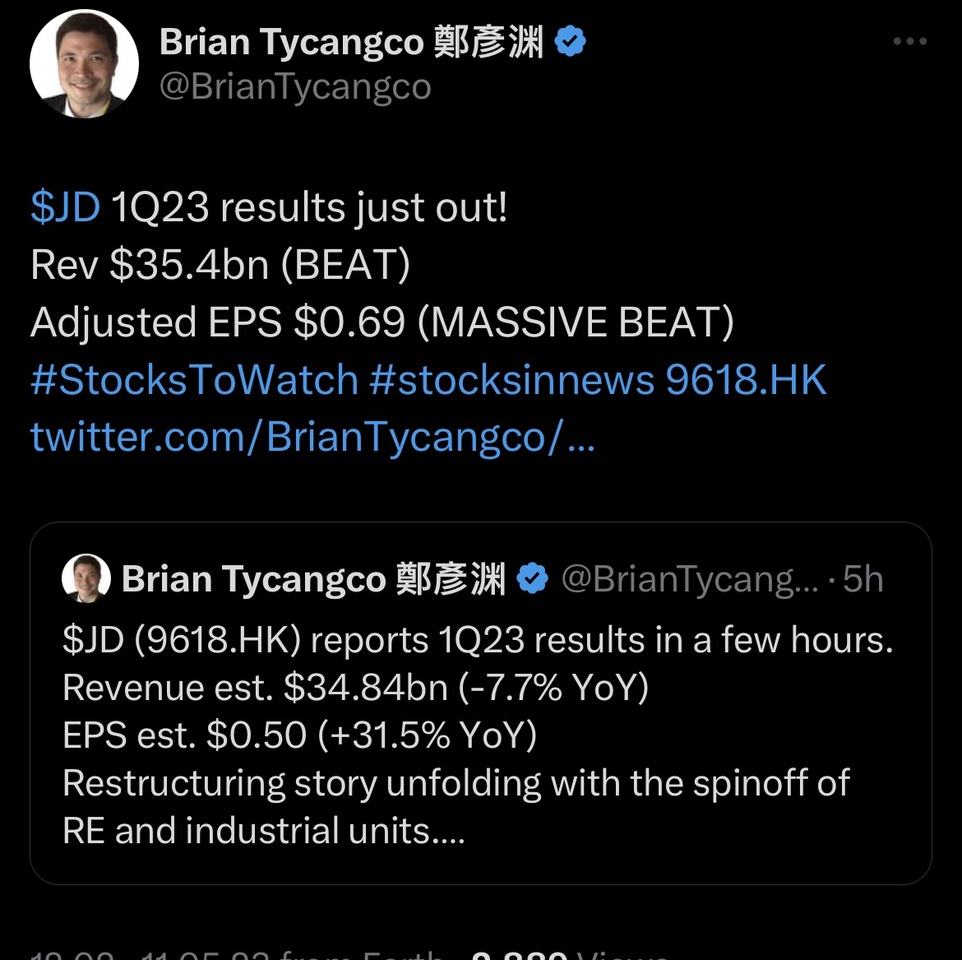

$JD (-6,23%)

$JD (-6,23%)

$BABA (-5,18%) my second chinese stock, price target $45-$50 by the end of the year!

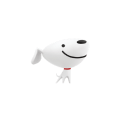

In Q4-2023 #HowardMarks - Oaktree Capital Management closed many positions and increased the stake in some securities in its portfolio, including $JD (-6,23%). Furthermore we have a new entry: $BABA (-5,18%) direct competitor of JD. Did he want to diversify?

#tradinggame

- A beautiful idea! 🥰

I have been very limited in the spread. Since you could also directly get the $VWRL (+0,46%) as a single position and let it run. 😅

My attempt with 5 positions, which I would probably never acquire privately under Buy&Hold, but since the time is very limited, it should work out.

$VBK (-2,98%) - A very beleaguered candidate of high grain prices. Chart-wise, with today's euphoria, the upside is now happening. One of my absolute favorite stocks, also in the private sector.

$JD (-6,23%) - A rather unpopular candidate due to its origin. The consumer slump is also persistent in China. But there are strong calls for an interest rate cut there, which should help Chinese stocks in particular.

$DB1 (+0,12%) - Safe haven for all time. As long as prices move, money will be printed.

$E4C (+0,37%) - A smallcap with massive potential. Business figures have always been strong and the business model is also robust. After a high dividend payment, the lower entry price should attract new investors again.

$BKHT (+1,05%) - Also a smallcap with huge potential. They acquire mid-market tech companies and sell them in the B2B space. The acting CEO has a golden hand, which he proves again and again.

Click here for the portfolio: https://getqu.in/7yH2y5/s9Dobr/

I hope for a fair and honest game!

If you are allowed to nominate here, as with every challenge normally, I wish the play along of @Der_Dividenden_Monteur , @Staatsmann and @FrauManu . 😅

#tradinggame - buy&hold just for fun from today until 29.07. 💥

How many getquin employees can you outperform? 😄

Today we started a stock market game internally at getquin (Fictitious

Investment amount 10.000 €, only with shares, ETFs and funds) which is why for the first time I have taken a closer look (without the numbers quite looking at the figures in detail 😅) with a portfolio composition of individual stocks.

Of course, the holding period of two months is exciting - the decision was not so easy, but I have now decided against an AI focus. I'm curious to see if I will regret this 😄 But can $NVDA (-0,03%) and Co. really go up more in the next two months? 😨

I wanted some risk, which is why a larger position $1211 (-3,83%) is and in equal parts I bet on $ENPH (-6,08%) (Supplier of solar and battery systems), a company I hardly read about here. Maybe someone would like to do a stock analysis?

I really enjoyed the compilation and I'm very excited about the result 😅💰💸

I would be totally interested in how you guys would do this. Join in and then we can compare the results 🤓

Share your portfolio link with absolute numbers here in the comments or in a new post with the reasoning behind your decision 📈📈

I nominate @California_Dreamin

@Lorena

@Goldmarie and @oliverplass 😄

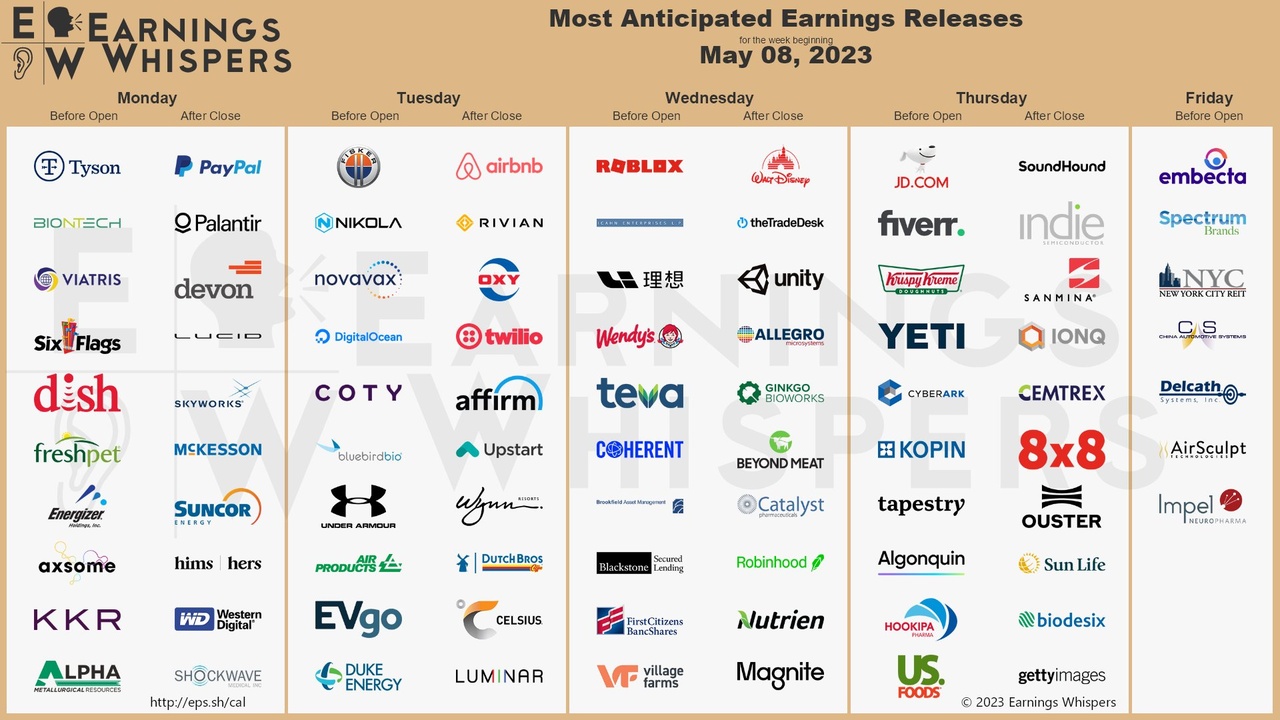

Where is the Earnings Dude of the last weeks, when you need him. Everything you have to do yourself 🥴

Next week it pops again really, there I know at least why the depot again completely depreciated 🥴

$PYPL (+3%)

$PLTR (+5,8%)

$ABNB (-6,51%)

$DOCN (+0,08%)

$ZIP (-4,77%)

$UPST (+25,91%)

$TTD (+3,69%)

$JD (-6,23%)

For whom it bangs next week again?

Titoli di tendenza

I migliori creatori della settimana