Dear Quinies,

The following is a DD on the company BioCryst Pharmaceuticals.

BioCryst is a commercial stage biotech company. Its focus is on drug discovery and development. Specifically, BioCryst does research for quite rare and severe diseases (orphan diseases). Unfortunately, they have not yet been able to find a cure for the arrogance of @leveragegrinding or the chronic underperformance of @getquin when investing (kappa, just kidding <3).

𝐄𝐢𝐧 𝐩𝐚𝐚𝐫 𝐄𝐜𝐤𝐝𝐚𝐭𝐞𝐧 𝐳𝐮𝐫 𝐅𝐢𝐫𝐦𝐚:

- Headquarters: Durham, North Carolina (USA).

- Founded: 1986 / IPO 1994

- Structure-guided drug design -> molecular-level research.

𝐏𝐫𝐨𝐝𝐮𝐤𝐭𝐞

BioCryst currently owns two FDA-approved drugs (we'll omit a third, since it's only approved in Japan (1))

- Berotralstat (trade name Orladeyo) - for prophylaxis in hereditary angioedema (random swelling of body parts).

- Peramivir (trade name Rapivab) - for the treatment of influenza.

Hereditary angioedema (HAE) affects 1 in 40,000-50,000 people worldwide. Affected individuals suffer from severe, random, sometimes painful swellings all over the body. The swellings can take on life-threatening exceptions as soon as they affect respiratory tracts, for example. (2)

This is where BioCryst's drug Orladeyo comes in: It was approved by the FDA for prophylaxis in December 2020. Unfortunately, acute therapy does not work for some patients, which is why they have to resort to (long-term) prophylactic measures. Or generally as a supplement.

𝐎𝐫𝐥𝐚𝐝𝐞𝐲𝐨

- Is one of the plasma kallikrein inhibitors, just like the competitor product Takhzyro -> inhibits the activity of an enzyme

- Horny USP: oral ingestion (as the only prophylactic, non-steroidal product! Let that sink in).

- Prophylactic competitor products currently rather irrelevant, as in an early clinical trial stage -> free ride for Orladeyo

- Plasma kallikrein inhibitors possibly also applicable in other diseases, studies are ongoing (3)

𝐑𝐚𝐩𝐢𝐯𝐚𝐛

So, now we're talking about the flu. Typically, flu patients have two popular options for treatment or prevention: flu vaccination as prophylaxis or treatment with a neuraminidase inhibitor. This brings us to BioCryst's second approved product, Rapivab. Rapivab, or peramivir, has a virostatic effect and differs from competing products Relenza and Tamiflu in that it is administered intravenously, not orally or by inhalation. It also requires only a single dose. Rapivab has now been approved by the FDA and also by the EMA since 2018. It is marketed in other countries under the names Rapiacta or Peramiflu (4). The problem: It has not been shown to be effective in more severe cases requiring hospitalization (5). The only bright spot: It could be that Rapivab's active ingredient is actually fundamentally more effective than those of its competitors. However, the study density here is also still quite low (6).

Neuraminidase inhibitors are a chapter in themselves anyway. In general, the study situation on the efficacy of neuraminidase inhibitors is quite contradictory, confused and often also manufacturer-funded. Independent? I doubt it. Covered up results? But hello. hotel? Trivago. Yes, I'm looking at you, Roche. (7).

I see the use of neuraminidase inhibitors as critical. Neuraminidase inhibitors may only be prescribed at the first signs of flu-like symptoms (within about 48h). In the later course - and usually we only go to the doctor then - they cannot be used. In addition, the treatment is quite expensive and not really well researched regarding efficacy, side effects and complications. (8)

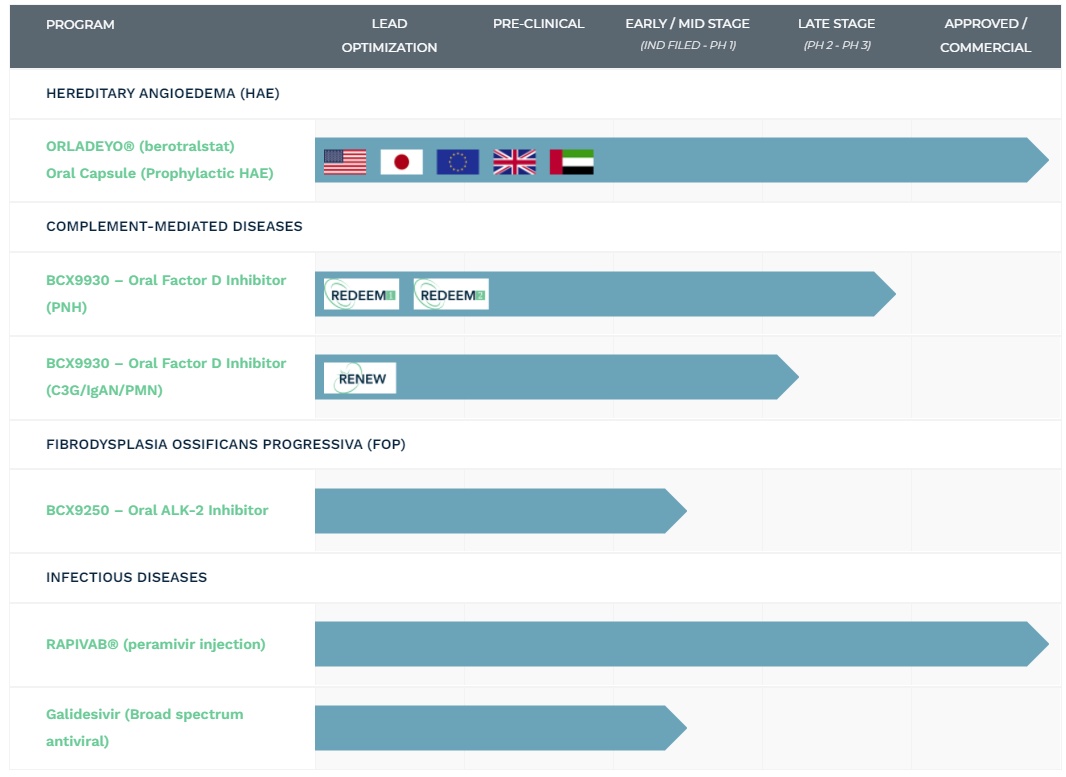

𝐏𝐢𝐩𝐞𝐥𝐢𝐧𝐞

BioCryst is up to quite a bit in the near future. They should, after all, their success is based on exactly two FDA-approved products.

BioCryst's research can be broadly divided into four different disease categories: HAE, complement-mediated diseases, FOP, and infectious diseases. Since Orladeyo is already very successful for HAE, we will focus on the other three areas.

𝟏. 𝐊𝐨𝐦𝐩𝐥𝐞𝐦𝐞𝐧𝐭𝐯𝐞𝐫𝐦𝐢𝐭𝐭𝐞𝐥𝐭𝐞 𝐄𝐫𝐤𝐫𝐚𝐧𝐤𝐮𝐧𝐠𝐞𝐧: 𝐁𝐂𝐗𝟗𝟗𝟑𝟎 (𝐰𝐢𝐫 𝐧𝐞𝐧𝐧𝐞𝐧 𝐞𝐬 𝐣𝐞𝐭𝐳𝐭 𝐔𝐥𝐥𝐢, 𝐰𝐞𝐢𝐥 @𝐊𝐚𝐩𝐫𝐢𝐨𝐥𝐞𝐧𝐒𝐨𝐧𝐧𝐞 𝐤𝐚𝐧𝐧 𝐧𝐢𝐜𝐡𝐭 𝐠𝐮𝐭 𝐦𝐢𝐭 𝐙𝐚𝐡𝐥𝐞𝐧)

- Novel oral factor D inhibitor for the treatment of PNH (life-threatening inherited disease).

- Could help with about 8 other diseases (diversification at its best, @Finanzfluss would be proud)

- Currently in phase 3 -> we are close to approval (or non-approval, haha)

- Competing products: Soliris and its further development Ultomiris. Advantage Ulli: Efficacy probably higher than competitor (measurement is based on hemoglobin level)

𝟐. 𝐅𝐎𝐏: 𝐁𝐂𝐗𝟗𝟐𝟓𝟎 (𝐮𝐧𝐝 𝐝𝐞𝐧 𝐡𝐢𝐞𝐫 𝐧𝐞𝐧𝐧𝐞𝐧 𝐰𝐢𝐫 𝐏𝐞𝐭𝐞𝐫)

- Oral ALK-2 inhibitor for the treatment of FOP (also a life-threatening inherited disease, only about 600 people are affected here worldwide).

- Early/Mid-Stage. No competition in sight, no single drug exists yet. However, it will be a long time before Peter is approved.

𝟑. 𝐈𝐧𝐟𝐞𝐤𝐭𝐢𝐨𝐧𝐬𝐤𝐫𝐚𝐧𝐤𝐡𝐞𝐢𝐭𝐞𝐧: 𝐑𝐚𝐩𝐢𝐯𝐚𝐛 (𝐍𝐞𝐮𝐫𝐚𝐦𝐢𝐧𝐢𝐝𝐚𝐬𝐞-𝐇𝐞𝐦𝐦𝐞𝐫) 𝐮𝐧𝐝 𝐆𝐚𝐥𝐢𝐝𝐞𝐬𝐢𝐯𝐢𝐫

- Galidesivir: antiviral drug designed to fight a variety of diseases (including SARS-CoV-2 Ebola, Marburg, yellow fever, and Zika.) Currently Phase 2.

- Strong competition, will be tough for BioCryst (9).

(𝐊𝐞𝐧𝐧)𝐳𝐚𝐡𝐥𝐞𝐧

P/E = best to leave that alone, the joint has been unprofitable so far.

Market capitalization: 2.8 billion USD

Current share price: 14.87 USD

Total revenues have increased significantly from 2020 to 2021. Although BioCryst was able to generate decent cash with the sale of Peramivir in 2020 (I could explain this with the boom during the Corona pandemic), in 2021 clearly Orladeyo was ahead in product sales and generated the most revenue of BioCryst's products (10),(11),(12),(13).

Specifically regarding Orladeyo, there was some very encouraging news recently:

BioCryst announced preliminary net sales for Orladeyo of $45.6 million for the fourth quarter of 2021. Total Orladeyo revenue for FY2021: $122 million. BioCryst expects revenue to more than double this year, to $250 million. Orladeyo's peak sales are expected to reach $1 billion, according to BioCryst. That could give them some really jaw-dropping revenue growth, and that's just from a single product that hasn't even been launched globally yet - stable. (14) Just as a point of comparison, competitor Takhzyro from Takeda (remember, also a plasma kallikrein inhibitor, intravenous administration) achieved sales of just under $800 million in FY2020 with an underlying annual sales growth of 30%. (15)

𝐂𝐡𝐚𝐧𝐜𝐞𝐧, 𝐑𝐢𝐬𝐢𝐤𝐞𝐧 & 𝐀𝐮𝐬𝐛𝐥𝐢𝐜𝐤

STONKS 📈

- Successful launch of Orladeyo in USA, Japan, and Germany, among others -> more countries pending.

- Competitive advantage and USP of Orladeyo in the field of HAE due to oral intake, definitely preferred by patients. In addition, less expensive than competing products and likely to be covered by many health insurers

- The market for HAE is currently about $3 billion and is expected to grow to about $4.5 billion by 2026. The undetected number of affected individuals is quite high. CAGR = 8.7% from 2022-2027. (16)

- Ulli offers promising study results

- Broad application area of galidesivir in many diseases

- Very fancy and creative logo, the color green has a relaxing effect -> absolutely bullish

NOT STONKS 📉

- The studies and approvals drag on. Enormous. Do you have staying power? (Ex: completion of REDEEM-1 / Ulli was set for 2023).

- Huge competition, highly competitive market, especially for galidesivir.

- High dependence of success on Orladeyo, low diversification

- Neuraminidase inhibitors rather controversial

General risks of pharma/biotech I would also like to mention:

o Regulations: Approvals take a long time and are not guaranteed

o Financing: assumption of costs by health insurance not guaranteed.

o Generics: after patent protection expires, cheaper imitation products may be produced -> loss of sales for the original. (17)

A possible target for BioCryst would be a buy-out by a large pharmaceutical giant. Until then, all hope is on Orladeyo, as the rest is simply still in the stars regarding approval. I believe that BioCryst is ahead of the competition because it is intravenously administered and Orladeyo has a strong competitive advantage that no one else can copy. Potential is there. However, as an as yet unprofitable growth company, I don't think BioCryst will have an easy time of it in times of interest rate hikes.

𝐅𝐚𝐳𝐢𝐭

It should be obvious to one, of course, that most biotech companies are volatile and somewhat risky investments. The chart here also shows that quite clearly. So anyone who goes all in on BioCryst now is going to get an abnormally juicy slap in the face from me. And whoever asks nicely, of course.

Edits:

On 8.4. BCRX published, studies bzgl.

𝐁𝐂𝐗𝟗𝟗𝟑𝟎 to be paused. The share then fell by more than 30%.

Good point by @ShovelStockswho knows better than me - like to check insider ownership in biotech stocks and consider it when weighing - also in this case :) - please read and apply his comment below the post.

NoDer. All information without guarantee & without rifle 🔫, am not a biotechnologist and also no BWLer. Greeting to @SharkAce, because this Mini-DD was lovingly handcrafted originally for him 😊

#stocks

--------------------------------------

𝐐𝐔𝐄𝐋𝐋𝐄𝐍

(1)https://lymphomahub.com/medical-information/mundesine-r-forodesine-hydrochloride-approved-by-japan-s-mhlw-for-relapsed-or-refractory-peripheral-t-cell-lymphoma

(2)https://www.awmf.org/uploads/tx_szleitlinien/061-029l_S1_Hereditaeres-Angiooedem-durch-C1-Inhibitor-Mangel_2019-01.pdf

(3)https://ir.biocryst.com/static-files/118b860e-2dea-4d71-85d8-7637d8f8874a

(4)https://www.fda.gov/drugs/information-drug-class/rapivab-peramivir-information

(5)https://www.drugs.com/newdrugs/fda-approves-rapivab-peramivir-influenza-infection-4134.html

(6)https://pubmed.ncbi.nlm.nih.gov/32677375/

(7)https://www.online-zfa.de/archiv/ausgabe/artikel/zfa-12-2019/49753-103238-zfa20190483-0488-neuraminidasehemmer-fuer-alle-patienten-mit-verdacht-auf-influenza/

(8)https://www.kvwl.de/arzt/verordnung/arzneimittel/info/wa/neuraminidasehemmer_wa.pdf

(9)https://ir.biocryst.com/node/23481/pdf

(10) https://ir.biocryst.com/static-files/118b860e-2dea-4d71-85d8-7637d8f8874a

(11) https://ir.biocryst.com/static-files/f8eade06-de8a-493b-8d04-fa92a36513a8 (quarterly figures 2021)

(12) https://ir.biocryst.com/static-files/03d1da32-f7a0-4fc0-9d76-ec584b23e9a3 (Quarterly figures 2021)

(13) https://ir.biocryst.com/static-files/c65f44b1-3cbd-4671-b4e9-f66473c776a9 (Quarterly figures 2021)

(14) https://ir.biocryst.com/node/23501/pdf

(15) https://www.takeda.com/newsroom/newsreleases/2021/takeda-delivers-resilient-fy2020-results-with-strong-margins--robust-cashflow-underlying-revenue-growth-expected-to-accelerate-in-fy2021/

(16) https://www.expertmarketresearch.com/reports/hereditary-angioedema-therapeutic-market

(17) https://www.finanzen.net/ratgeber/wertpapiere/biotech-pharma-aktien-kaufen